Twindex uses a fractional-algorithmic algorithm to make trading of synthetic assets pegged to real-world prices as simple as possible.

Dopple DeFi Ecosystem

Dopple Finance is a Binance Smart Chain Stablecoin DeFi ecosystem. Their core product is a decentralized stablecoin exchange that allows users to exchange stablecoins and pegged assets at the highest possible pricing.

Twindex is a decentralized exchange on the Binance Smart Chain that allows users to create and trade Synthetic Assets that are pegged to real-world pricing.

KUSD is the ecosystem’s native stablecoin using the “Fractional-Algorithmic” algorithm that is deployed on both Dopple Finance and Twindex. Their new synthetic assets on Twindex will be the first to apply a fractional-algorithmic algorithm (FAA) approach. As a result, tokens are backed in part by the KUSD stablecoin and in part by the utility token TWX. In addition to the capital gains generally generated by purchasing and selling assets, Twindex synthetic assets (tAssets) can be utilized in farming pools to produce dividend-like returns. They show many techniques to keep the tAssets pricing tied to the real-world price.

Twindex

Twindex is a decentralized exchange on the Binance Smart Chain that allows users to create and trade Synthetic Assets that are pegged to real-world pricing. Chainlink, the world’s leading decentralized Oracle network that feeds real-world data to blockchains, powers Twindex. The Dopple DeFi Ecosystem includes Twindex.

Stablecoin Swap

It should be as simple as swapping 1–1 between stablecoins and assets that are tied to the same value, such as 1 USD. Trading between various sorts of assets can be costly and inefficient, resulting in capital losses due to significant slippage and transaction fees.

Dopple uses a StableSwap algorithm that is specifically built for optimum switching between stablecoins, with minimum slippage and low transaction costs, to allow users to effectively swap stablecoins and pegged assets on the Binance Smart Chain. Dopple Finance charges a 0.045 % trading fee (vs. 0.25 % on PancakeSwap), which is divided down as follows:

0.018 % – Redistributed to liquidity providers.

0.027 % – Sent to the Dopple treasury. Dopple Finance currently supports the following stablecoins: BUSD, USDT, DAI, USDC, UST, TUSD, USDN, DOLLY, KUSD.

Minting and Redemption

Minting refers to the process of establishing new tAssets by supplying a portion of KUSD and TWX in accordance with the Collateral Ratio. The Oracle price at the time of minting will be worth the value of the assets that must be minted. TWX will be removed from the system, while the collateralized KUSD will be employed to produce value.

The process of obtaining KUSD and TWX by delivering tAssets to burn is known as redemption. The KUSD/TWX ratio varies depending on the Collateral Ratio, but the total worth is determined by the Oracle price.

As a result, you could say that minting tAssets requires the current real-world price of the asset, and redeeming tAssets returns the current real-world price. TWX will be re-minted from the system as a result of this operation. Minting and redemption are two procedures that help to keep the price of tAssets close to the peg by allowing arbitrageurs to profit from the gap between the market and the peg price.

อ

Providing Liquidity on Twindex

When a trader uses Twindex to do a swap, they pay a 0.3% charge, of which 83.33 % is split fairly among the liquidity providers of the swap routes and the rest goes to the platform.

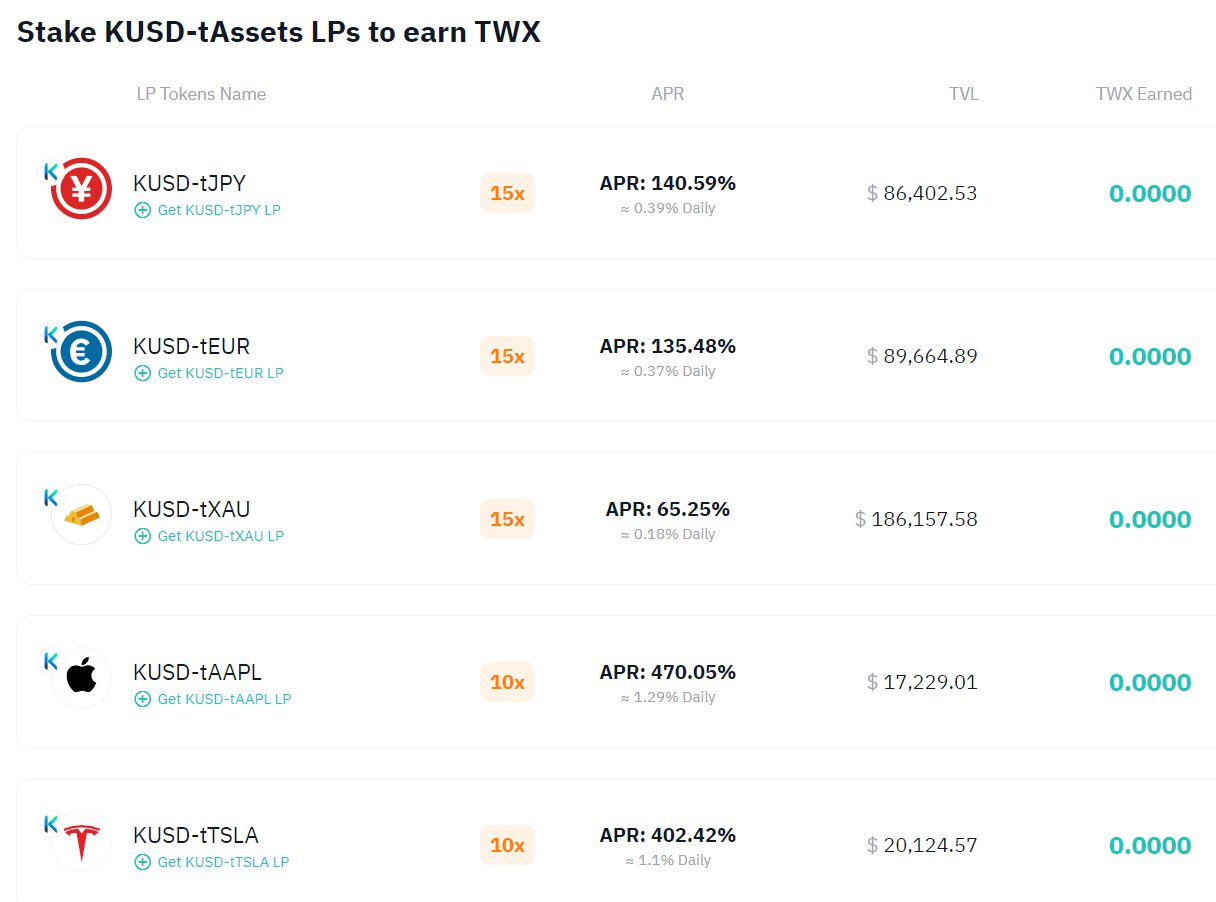

Available Liquidity Pools:

- KUSD-tJPP – APR: 140.59%

- KUSD-tEURO – APR: 135.48%

- KUSD-tXAU – APR: 65.25%

- KUSD-tAAPL – APR: 470.05%

- KUSD-tTSLA – APR: 402.42%

- KUSD-tARKK – APR: 403.64%

- KUSD-tBAC – APR: 398.58%

- KUSD-tCOIN – APR: 376.58%

- KUSD-tSPY – APR: 345.86%

- KUSD-tMRNA – APR: 323.37%

- KUSD-tTSM – APR: 412.7%

- KUSD-tFB – APR: 222.97%

- KUSD-tBRK.B – APR: 432.9%

- KUSD-tNVDA – APR: 470.82%

- KUSD-tBIDU – APR: 443.37%

- KUSD-tGBP – APR: 228.3%

You will earn Liquidity Pool (LP) tokens when you deposit your stablecoins into a liquidity pool. Staking KUSD-tAssets LPs to also earn TWX.

Staking at Twindex

Stake and provide liquidity to start earning at Twindex. Simply add and withdraw liquidity, stake and unstake, and get your rewards. Staking at Twindex allows you to earn TWX tokens as a reward while also receiving a portion of the charge from providing liquidity.

You will receive Liquidity Pool (LP) tokens when you contribute your stablecoins to a liquidity pool. These LP tokens can be used to generate a dividend on the TWX farms while also earning a trading fee for providing liquidity. LP tokens can be taken out at any time, but they must be staked in order to gain TWX.

What makes Twindex stand out in the industry

Twindex makes itself different in the industry by offering a variety of ways to profit from Twindex, even when the cryptocurrency market is in decline.

Better Dividend

Easy-to-follow yield farming can help you make more than 20% more money than standard trading dividends while also allowing you to benefit from capital gains.

Trade with Various Foreign Assets

Twindex allows users to trade a wide range of stock tokens from any country, including the United States, China, and Vietnam, from anywhere in the world.

No KYC, 24/7 Trading

There is no requirement for user authentication because of the Blockchain and DeFi concepts. Without waiting for the market to close, begin trading right now.

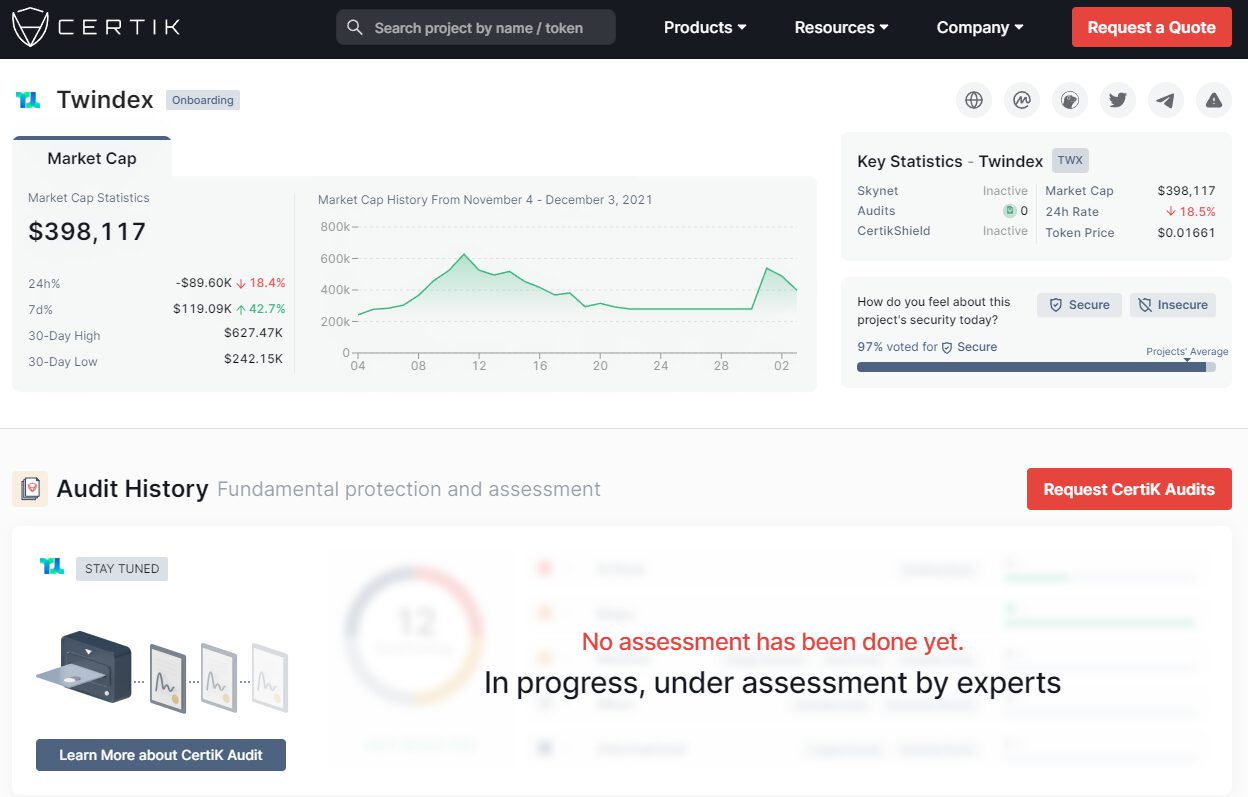

Security Audit from CerTik

CerTik’s security audit of Dopple Finance was completed successfully. All 32 findings have been resolved fully.

Twindex is still in review by CerTik. Stay tuned for updates once the audit completes.

CEO

Dopple Finance’s CEO is Kowit Charoenratchatabhan. Kowit Charoenratchatabhan also has a solid IT history, having worked as the Co-Founder and CTO at Cookly, Follovv, and Phoenix Studio for over 11 years.

Learn More

Twindex Twitter: https://twitter.com/twindexcom

Dopple Finance Twitter: https://twitter.com/dopplefi

Twindex Official Community Telegram Group: https://t.me/twindex

Dopple Finance Official Community Group: https://t.me/dopplefi

Twindex announcement channel: https://t.me/twindexAnn

Dopple announcement channel: https://t.me/dopplefiAnn

Documentation: https://docs.dopple.finance

Medium: https://dopple-ecosystem.medium.com

GitHub: https://github.com/DoppleFinance

Dopple Website: https://dopple.finance/

Twindex Website: https://www.twindex.com/

Documentation: https://docs.dopple.finance

Medium: https://dopple-ecosystem.medium.com

Security Audit: https://www.certik.org/projects/twindex

Dopple DeFi Ecosystem Linkedin: https://www.linkedin.com/company/dopple-finance

CEO Linkedin: https://www.linkedin.com/in/kowito/