Over the years, U.K regulators raised several concerns over the significant usage of cryptocurrencies in the region. One of the reasons they aim to regulate it as soon as possible is to avoid any repercussions. In a 40-page report, the Bank of England Financial Policy Committee assessed the financial stability relating to crypto-assets and decentralized finance.

The Financial Conduct Authority, or FCA, and the Bank’s Prudential Regulation Authority, or PRA voiced their narrative.

Reality-check

The Bank of England’s Financial Policy Committee (FPC), on 24 March, published a report. It noted that crypto assets and DeFi posed a “limited” risk to the stability of the U.K financial system. Although, the said risk grew “as these assets become more interconnected with the wider financial system.”

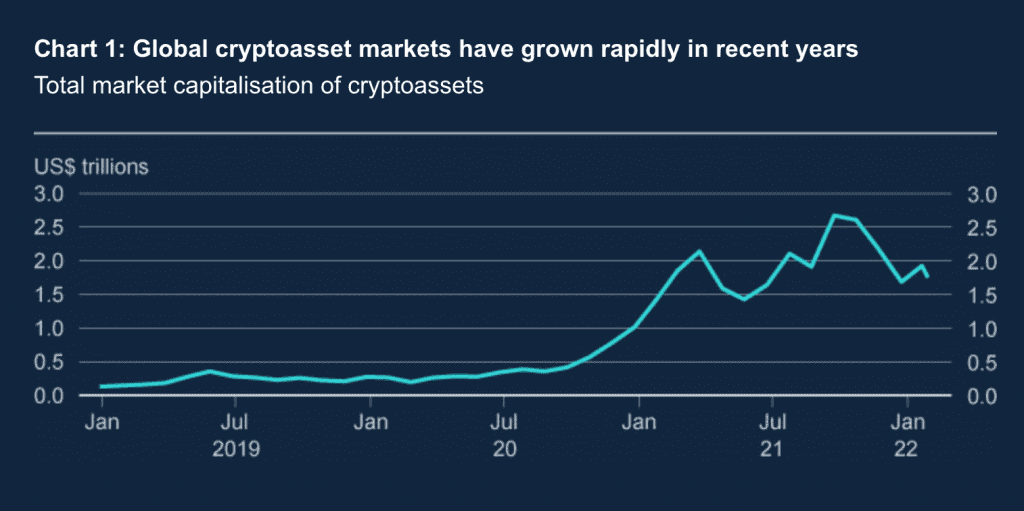

The outstanding value of crypto-assets grew around tenfold between early 2020 to November 2021, peaking at $2.9 trillion. Ergo, the report asserted:

“The FPC will continue to pay close attention to developments in crypto-assets and DeFi and seek to ensure that the U.K financial system is resilient to systemic risks.”

As such repercussions expanded, the FPC highlighted those risks and accordingly made recommendations. The existing regulatory framework would mitigate risks where crypto technology served the same purposes as traditional finance. Nevertheless, advised financial institutions to take an “especially cautious and prudent approach” to any adoption of such assets. Well, until a proper regulation got installed.

In addition, to help ensure a “prudent treatment”, the FPC welcomed the Treasury’s proposals for stablecoin regulation. It included the proposal to bring the Bank into the process. Further, expressed support for international efforts to regulate DeFi applications.

In that context, PRA Deputy Governor and CEO Sam Woods wrote a “Dear CEO” letter to banks, insurance companies, and designated investment firms with exposure to crypto-assets. The said letter shed light on the existing policies and regulatory frameworks. The letter further, encouraged organizations to record their current crypto exposure and plans for the year due 3 June.

Following this line

U.K’s financial regulatory body, the Financial Conduct Authority (FCA), reiterated a similar warning in another Twitter post.

We remind all regulated firms of their existing obligations when interacting with or exposed to #cryptoassets and related services #crypto https://t.co/XzXTEYNP5L

— Financial Conduct Authority (@TheFCA) March 24, 2022

On Thursday, the FCA released a new circular for regulated firms exposed to crypto-assets in the country.

“We are reminding all regulated firms of their existing obligations when interacting with or exposed to crypto-assets and related services,” the release stated.

Firms must register with the FCA by 31 March. If crypto companies failed to register with the financial watchdog by the deadline, they could be forced to close down their businesses. Further, it reminded regulated firms of their “existing obligations when interacting with or exposed to crypto-assets and related services.”