Ukrainian citizens are fleeing to crypto as a result of the ongoing Russo-Ukrainian war, or what The Washington Post called “the world’s first crypto war”.

There is nothing more expensive than war. In terms of money, it can lead economies to crumble; and in terms of humanity, it can open deep cracks in history.

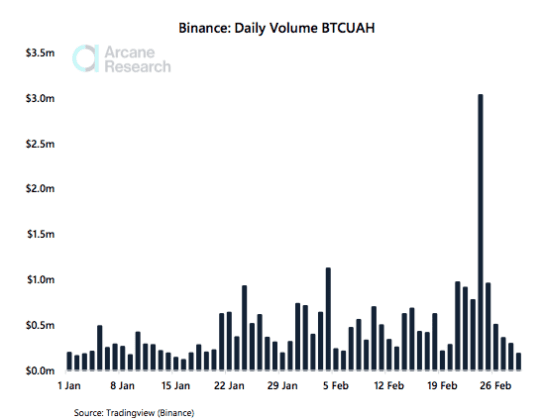

As Ukrainians expect a collapse of their banking system, many are turning to crypto as a safe haven for their savings and a financial tool when fleeing their country. A large increase in the country’s trading volume was recorded by Arcane Research data.

Huge Crypto Trading Volume

As per Arcane Research, the following charts show how the Ukranian Hyrvia pairs with USDT and Bitcoin (USDTUAH and BTCUAH respectively) have reported a significant increase in trading volume on the crypto exchange Binance.

After the government turned to crypto donations, Binance has been one of the crypto exchanges to join supporters of Ukraine. The platform sent a $10 million donation to the country’s efforts, destined to provide food, fuel, and supplies for refugees in border countries.

The exchange also launched an Emergency Relief Fund to support the people of Ukraine that has now recorded over 154.66 BTC ($6,8 million at today’s price) in donations.

Related Reading | Ukraine Thanks Crypto Community, Millions Donated to “Protect Freedom”

Besides donations, citicenz have found in crypto a powerful financial tool that allows them to turn their savings and wealth into digital assets (primarily bitcoin and tether), and manage to carry their money when moving across borders.

The reason why The Washington Post called this phenomenon “the world’s first crypto war” is because Russians have also found in crypto a needed safe haven as the liquidity providers may be trying to eliminate their ruble exposure, and Russians seek to prevent possible sanctions.

“Because there is no central controller who can impose their morals on its user, crypto can be used to crowdfund for the Ukrainian army or help Russia evade sanctions,” said Tom Robinson, chief scientist and co-founder at the crypto analytics firm Elliptic. “No one can really prevent it from being used in either way.”

Banking System To Collapse

The banking system of Ukraine had already been on the verge of collapse in 2014, then saw a recovery in 2018 but could cave in now amidst the war. Back in 2014, the Russo-Ukrainian war was also the reason why the Ukrainian economy shrank 6.8%, as a previous interest to merge and acquire the country’s banks stopped.

Wikipedia explains that “The National Bank declared more than 60 banks insolvent in 2014-2015 and withdraw from the market another 18 financial institutions in 2016.”

Then in 2016, the solvent Ukrainian banks reduced losses compared to 2015 by three times after the government nationalized PrivatBank, which holds over a third of individual bank deposits in the country. In 2018 Ukrainian banks made a profit of 21.7 billion Ukrainian hryvnias.

Now, following the declaration of Martial Law, The National Bank of Ukraine ordered to suspend the use of digital money, put a cap on cash withdrawals, and prohibited the issuance of foreign currency from retail bank accounts, CNBC reported.

As the banking system does not offer Ukrainians any relief, they are turning to crypto as a viable solution. This sends a signal to the rest of the world and could turn into a key step in the future of the crypto market.

Related Reading | Russian Politicians’ Crypto Wallets Targeted By Ukraine – Hefty Reward Up For Grabs