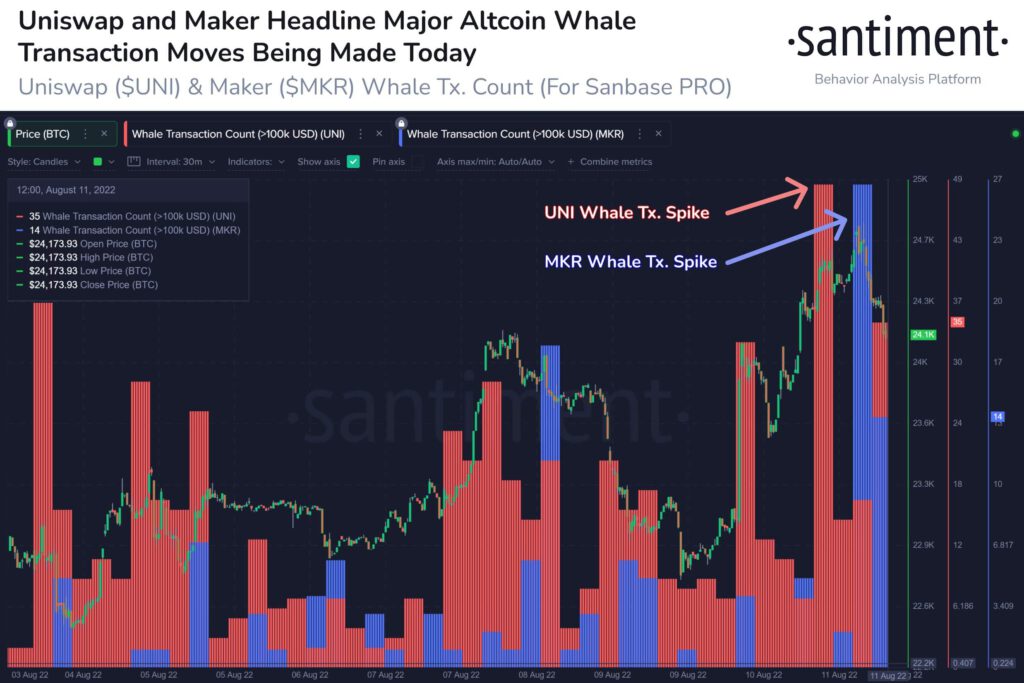

Uniswap’s UNI and MakerDAO’s MKR are the two leading altcoins that have seen a significant spike in whale transactions above $100,000 on their respective networks since the beginning of this month, data from Santiment revealed.

Interestingly, these spikes are usually followed by price reversals whenever the intensity in this category of whale transactions starts to wane.

During the trading session on 12 August, UNI logged a total of 140 whale transactions above $100,000, while MKR saw 64 similar transactions.

Two alts, almost the same performance

As of this writing, UNI traded at $9.02, a 6% price growth from its price level at the beginning of the month.

However, with a slowed growth in price in the past few weeks, trading activity on the network has declined.

With a total of 224.9 million in trading volume in the last 24 hours, trading activity has declined by 60% since 3 August.

On the other hand, the price of MKR has declined since the beginning of the month. After rallying to a high of $1,181 on 8 August, a bearish correction forced the token to trade at $1,077.62 as of this writing.

Unsurprisingly, trading activity on the network also dropped as the price of MKR fell. At press time, the trading volume was 116.7 million. It has declined by 93% since 3 August.

Here lies the divergence

While both tokens might have toed a similar path in whale transactions on their respective networks and posted declines in trading volumes since the beginning of the month, data from Santiment showed some disparity on both networks within the same period.

On the UNI network, the index for unique active addresses that traded the token has declined consistently since 3 August.

As of this writing, daily active addresses stood at 309, a 75% drop from the 1236 addresses logged on 3 August. New addresses created on the network have also dropped by 19% in the same period.

However, since August, network activity has rallied on MKR.

Daily active addresses on the network have grown by 93%. In addition, new addresses on the network have seen a 51% uptick.

On a 7-day moving average, the ratio of MKR tokens that have left exchanges exceeded the ratio of UNI tokens that have left exchanges.

Therefore, with its exchange outflow posting a negative value, a price dropdown is in the future for MKR.