With the month so far marked by a bullish correction in the general cryptocurrency market, the big whales holding the UNI token have ramped up accumulation.

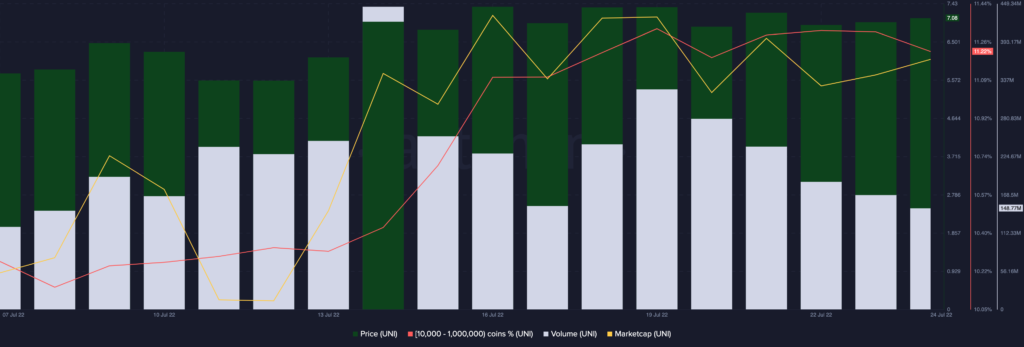

According to data from Santiment, Since 8 July, wallet addresses holding between 10,000 and one million UNI have collectively added 10.74 million more UNI tokens to their crypto holdings.

Valued in USD, this translates to over $74,643,000 worth of UNI added in the last 17 days.

Has this increased accumulation impacted the price of the token so far?

Journey of the last 17 days

On 8 July, when the key addresses holding between 10,000 and one million UNI increased trading activity, the price of UNI was pegged at $5.83.

As the rest of the cryptocurrency market went through bullish retracement, the token’s price embarked on an upward rally and rose to a high of $7.35 by 19 July.

Exchanging hands at $6.92 at the time of writing, UNI saw an 18% uptick in price in the past 17 days.

Within the same period, the token’s market capitalization also rose from $4.28 billion to $5.09 billion. As a result, UNI, at press time, was ranked #18 on CoinMarketCap’s ranking of cryptocurrencies with the largest market capitalization.

Furthermore, with the price rise, the index for the token’s trading volume grew daily within the period under review. The token’s trading volume went as high as 444.89 million on 14 July.

At 244.87 million at press time, the token’s trading volume grew by 40% in the last 17 days.

What after 14 July

According to data from Santiment, within the period under review, UNI’s network activity peaked on 14 July.

Since 14 July, key metrics deployed to track the growth on the network started to decline. For example, the number of addresses that traded UNI closed at a high of 1427 on 14 July. At 539 addresses at press time, a 62% decline has since been registered.

Also, on 14 July, the aggregate amount of UNI tokens across all transactions executed stood at 20.33 million. Steadily declining over the next few days, the index for the metric ticked its spot at 2.97 million at press time.

This represented a decline from $130.49 million to $19.7 million in transaction volume since 14 July.

As regards performance on a social front in the period under review, after touching a high of 2.07% in social dominance on 12 July, UNI proceeded to shed this by over 600%.

At press time, this metric stood at 0.29%. As for the token’s social volume, it was pegged at 54 at the time of writing, declining by 96% since the 1449 index of 11 July.