Uniswap price has set up a perfect bottom reversal setup that suggests a shift in trend favoring the bulls. This pattern comes at a time when BTC is consolidating, giving the possibility of a bullish breakout more chances.

Moreover, the on-chain metrics also support an optimistic outlook for the bottom reversal pattern.

Run it back

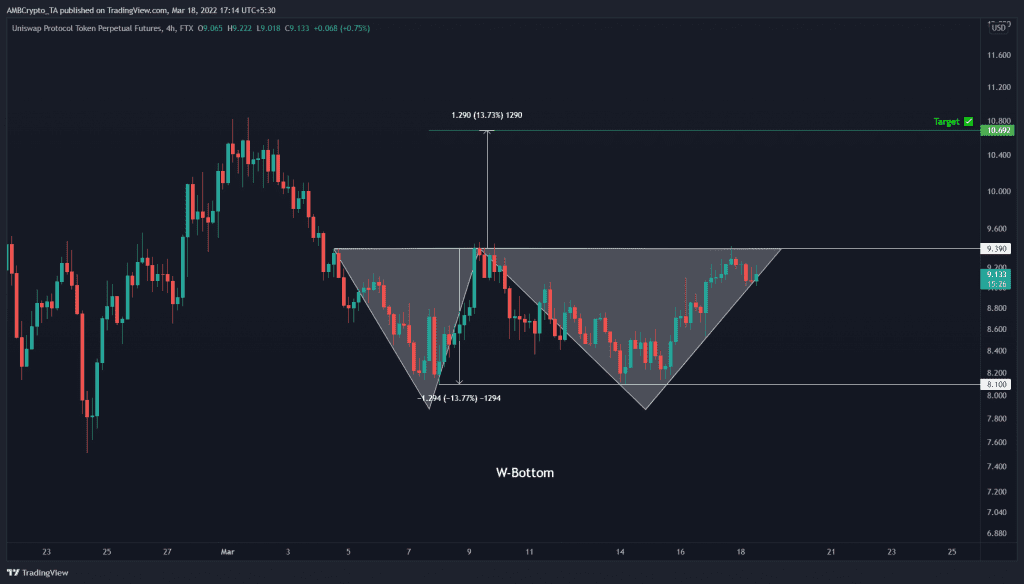

Uniswap price set up a swing high at $9.38 on 4 March and crashed roughly 13% to create a swing low at $8.1. This move was followed by a quick 16% run-up which exhausted around $9.38, solidifying its role as a resistance barrier.

UNI failed to flip the hurdle and retraced back to the $8.1 support level to create the second swing low, suggesting the potential for a bottom reversal pattern. Since then, Uniswap price has rallied 16% and is currently attempting to breach the $9.38 resistance level.

In total, the price action from 4 March to 17 March resulted in the formation of a W-bottom. A decisive four-hour candlestick close above this ceiling will signal a breakout and kick-start a run-up.

The target for this setup is obtained by measuring the distance between the highest peak and the lowest valley and adding it to the breakout point. For Uniswap, the W-bottom technical formation forecasts a 13% ascent to $10.69 if it manages to flip the $9.38 hurdle into a support level.

In some cases, this rally could extend to $11.85, bringing the total gain from 13% to 26%.

While the technical outlook suggests a bullish outlook, the 30-day Market Value to Realized Value (MVRV) model adds credence to the possibility of a bullish move from an on-chain perspective. This indicator is used to assess the average profit/loss of investors that purchased UNI tokens over the past month.

A negative value below -10% indicates that short-term holders are at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone.”

For Uniswap, the MVRV has moved from -10.5% to 0.85%, suggesting that the holders are accumulating. Considering the historical data, UNI has hit a local top at roughly 11.38%, suggesting that the 30-day MVRV has more room to move higher.

Interestingly, this uptick will occur if Uniswap price rallies as it would put the holders from underwater to profit. Therefore, this on-chain index adds a tailwind to the technical outlook that forecasts that UNI is ready for a quick run-up.