Uniswap [UNI] is back in the news after the token resurged amid the ongoing market recovery. The largest DeFi exchange has signs of northern movement since the start of the week. It seems like UNI’s focus is to end June on a high note after looking at the price trajectory in the last few days. Furthermore, whale accumulation can also considered as a major factor in the increasing prices of the UNI token.

Onwards we march!

Uniswap is among those to relish the recent market resurgence after attempting a price revival recently. UNI has surged by 55% in the past week to $5.59 at press time and is further up by 2% in the past 24 hours. This is a big leap for the token after dropping to as low as $3.39 during the recent crash.

Uniswap has also been at the centre of whale accumulation. Per the following tweet, UNI just broke into the most purchased token among top 1,000 BSC whales in the past 24 hours.

JUST IN: $UNI @Uniswap now on top 10 purchased tokens among 1000 biggest #BSC whales in the last 24hrs 🐳

We’ve also got $SOD, $AXS & $Cake on the list 👀

Whale leaderboard: https://t.co/hABj9c9iFD#UNI #whalestats #babywhale #BBW pic.twitter.com/i9LRsiqENt

— WhaleStats – the top 1000 BSC richlist (@WhaleStatsBSC) June 25, 2022

As per additional data from Cryptofees, Uniswap transactions covered fees worth $4.87 million whereas Ethereum [ETH] accounted for $4.58 million between 15 and 21 June. Historically, this is result of high demand and increasing transactions on the Uniswap DeFi exchange. This further means that even in a bearish market, investors are not shy from using DeFi transactions.

Another reason for the high fees could be the acquisition of Genie. This will allow Uniswap to include both NFTs and ERC-20s on the exchange.

In other news, there has been surge in the Uniswap DeFi TVL of approximately 15%. However, at the existing $5.2 billion is still the lowest since March 2021. At current levels, the Uniswap DeFi has lost around 45% since the turn of the year.

A quick metric tour

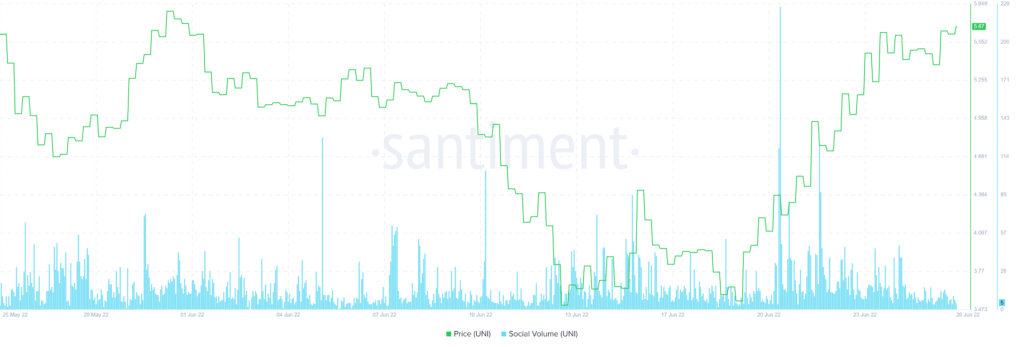

To further dive into Uniswap, the social volume metric can be taken into consideration. As per data from the chart below, it is inferred that there is limited discussion regarding the token on social media. It reached a monthly peak on 20 June, but fell down dramatically the following day.

Another metric being used here is the development activity on Uniswap. This metric took a nose dive at the end of May and has been down ever since. The largest DeFi exchange must show more intent and stir up conversations on social media to boost volume.

Despite the price surge, volume has fallen massively on Uniswap in the past 24 hours. It is currently down by 27% and with the social volume metric also stuttering, things are not looking for Uniswap right now. It seems the growing interest in DeFi and the NFT launches are the only factors driving Uniswap right now. And if the market was to go down again, Uniswap may be the first one in the list.