Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Uptrend seems set to continue for Uniswap

- UNI at a wait-and-watch zone at press time

Uniswap posted remarkable gains since the drop to $5.4 in mid-October. It also flipped its lower timeframe market structure to bullish and retested $6 as support. With sentiment in the altcoin market somewhat bullish in the past few days, can UNI maintain its run of form and climb to $8-$8.2?

Here’s AMBCrypto’s Price Prediction for Uniswap [UNI] in 2022-23

Bitcoin was able to defend the $20k mark over the past week. Heading into the weekend, it approached a zone of resistance at $21.5k. If BTC can hold its ground above $20.8k, the chances of another rally for Uniswap can increase.

A breakout above a range for UNI but a buying opportunity would require patience

The $7.2 mark has been a strong level of resistance since mid-August. In this period, the price ranged from $7.2 to $5.8. At press time the price broke above the $7.2 range highs and was accompanied by a surge in buying pressure.

In the past two weeks, the On-Balance Volume (OBV) made a series of higher highs to show that buying volume has been strong. Hence, the rally from $6 has been in good demand. In the same period, the Relative Strength Index (RSI) formed a bearish divergence, but each pullback saw a hidden bullish divergence.

The higher timeframe market structure has also been bullish after the price broke above $6.8. Hence, traders can look to follow the trend and look for buying opportunities. At the time of writing, the price was nearly 6% above the $7.2 support but has resistance nearby around $8.2.

Therefore, traders can either wait for a move down to $7.2 to consider buying or buy a bullish retest of the $8-$8.2 region.

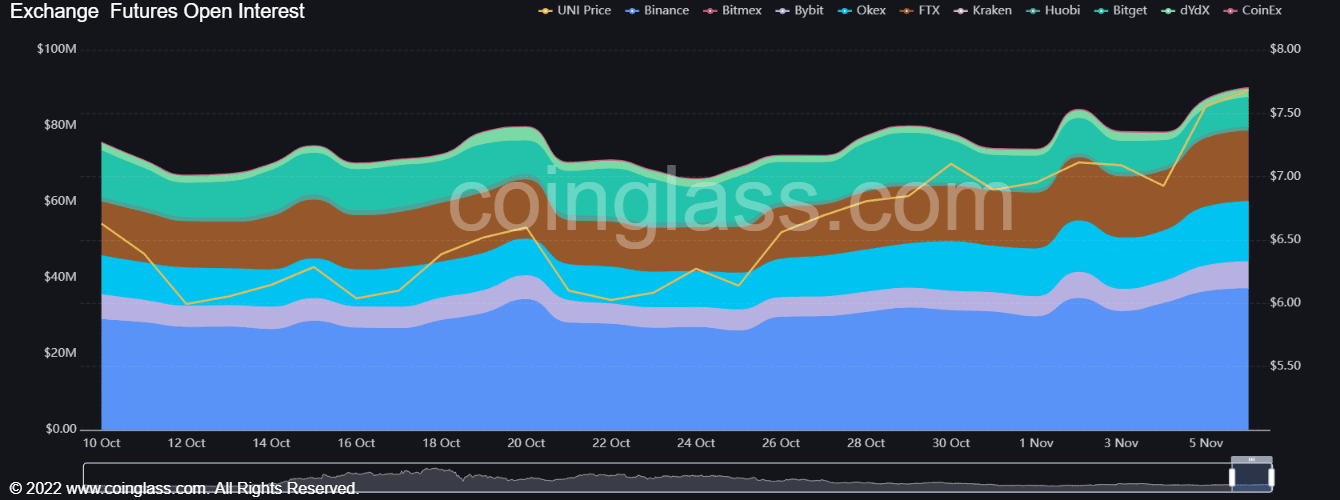

Open Interest steps up alongside the price, do speculators anticipate a move upward?

Source: Coinglass

The Open Interest slowly ascended since 24 October. During this time UNI rallied from $6 to $7.6, a move that measured nearly 26% from swing low to swing high.

The heightened Open Interest meant that futures market participants were interested in the Uniswap rally, and the buying pressure in the spot markets suggested many were positioned bullishly. The Long/Short ratio of the past 24 hours, however, was slightly bearishly skewed, with 50.4% in short positions.