Uniswap saw a plunge in trading volume during the month of March, the lowest the DEX has recorded since September 2021.

March proved to be a great month for cryptocurrencies but areas such as non-fungible tokens (NFTs) and decentralized exchanges (DEXs) took a massive hit in volume.

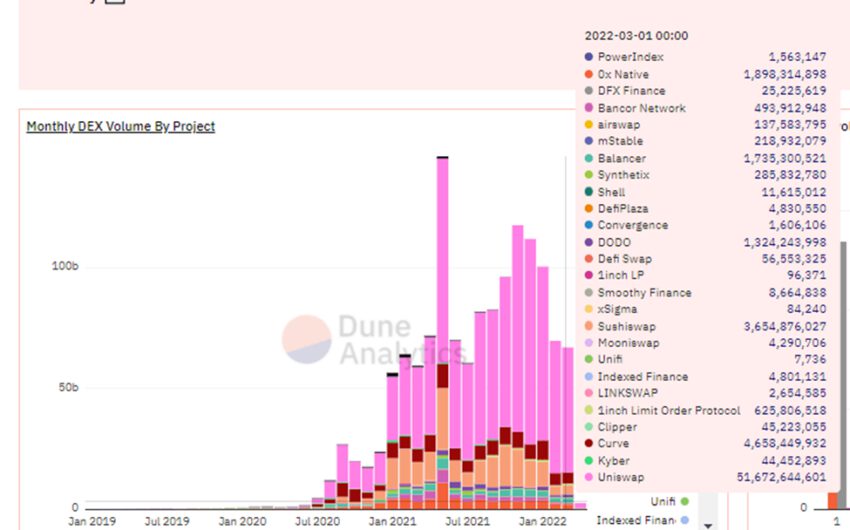

Uniswap recorded approximately $51 billion in trading volume during the last month of the 1st quarter of 2022, according to Be[In]Crypto Research.

Although this statistic seems high when you consider the trading volumes of SushiSwap (SUSHI), Curve (CRV), 1inch LP (1INCH), and Balancer (BAL) among others, the trading volume for Uniswap was down from February.

The trading volume recorded in February 2022 was around $54 billion, a 5% decrease in 31 days.

Uniswap monthly volumes in 2022 have not surpassed the highs of 2021

The waning trader interest in the top decentralized exchange by trading volume could have a detrimental effect on the fortunes of Uniswap.

This is because it competes with DEXs on Ethereum, Binance Smart Chain, Tron, Solana, and the growing ecosystem of Cardano. Inasmuch as Uniswap’s volume is up 54% since March 2021, which saw approximately $33 billion in volume recorded, the DEX still trades below the milestones attained in 2021.

At the peak of the market in May 2021 when Ethereum (ETH) crossed $4,000 for the first time, protocols on Ethereum saw a massive spike in user activity.

The total transaction counts on Ethereum as of May 31, 2021, was approximately 45 million. This resulted positively in one of the chain’s top-performing decentralized applications, Uniswap. The DEX recorded around $84.72 billion in May 2021.

With a decline of the market which led to a huge sell-off which brought forth a bearish engulfing, trading activity on Uniswap fell steeply.

As a result, May’s volume crashed by 33% to around $54.66 billion in August 2021, dwindled by 36% to approximately $53.44 billion in September 2021, and lessened by 26% to the region of $62.02 billion in October 2021.

Uniswap increased by 0.982% from May 2021’s high to a new all-time high of approximately $85.55 billion in November 2021. There was a slight decrease of 0.724% to close out December 2021 at $84.93 billion.

What caused the waning volume in Uniswap?

The consistent decrease in transaction counts in 2022 has been largely detrimental to the fortunes of the decentralized exchange.

In May 2021, total transaction counts stood at 200,733 with a single-day high of 12,857 recorded on May 5.

In November 2021, the total transaction counts recorded was 63,147 with a single-day high of 2,729 recorded on Nov. 10.

Total transaction counts have fallen below 40,000 for the entirety of 2022. January 2022 saw transactions of 38,849 with a single-day high of 1,932 recorded on Jan. 22.

This decreased by 17% to 31,765 in February 2022. There was a single-day high of 1,707 recorded on Feb. 27.

The total transaction count for March 2022 was 33,279 with a single-day high of 1,493 on March 31.

Although transactions in the third month of 2022 were higher than in the second month of this year, the average transaction value was relatively higher in February than in March. This is the reason why trading volume in February slightly surpassed March.

March 2022’s transaction count was 83% and 47% lower than May and November 2021 respectively.

What is the impact of declining volumes on UNI?

UNI is the novel token of the Uniswap protocol. UNI was among the beneficiary tokens that reached new all-time high prices of $44.97 on May 3, 2021.

Since then the token has shed more than 70% of its price after being hit hard by the bearish cycle of the market in 2022.

UNI opened on March 1, 2022, at $10.52, reached a monthly high of $12.43 on the last day of March, and eventually closed on March 31, 2022, at $11.27.

Overall, UNI has been trading in the price range of $8.14 and $12.43 in the last 30 days as of press time.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.