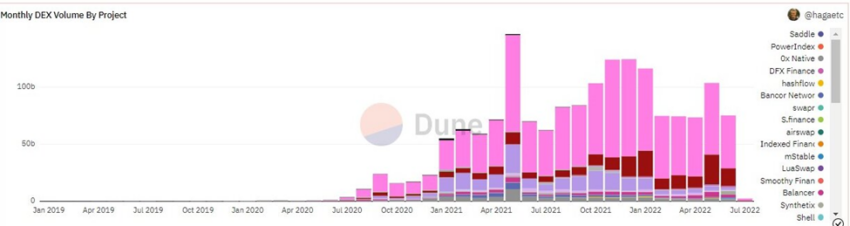

Uniswap saw a steep decline in trading volume during the month of June, the lowest the decentralized exchange (DEX) has recorded since July 2021.

June proved to be a difficult month for the entire crypto finance space, as DEXs saw a crash in volume. Uniswap recorded approximately $46.39 billion in volume during the last month of the second quarter of 2022, according to Be[In]Crypto Research.

While this statistic may seem high due to decreased investor interest as well as the relatively lower liquidity poured into other DEXs such as Balancer, Curve, SushiSwap and 1inch, the trading volume for Uniswap was down from May.

In May 2022, Uniswap trading volume was around $62.66 billion, a 25% decrease in 30 days.

Despite reaching a 10-month low, Uniswap saw a 4% increase year-over-year in trading volume from June 2021. In June of last year, Uniswap had a trading volume in the region of $44.4 billion.

Aside from that, Uniswap reached a yearly low in June after seeing a drop of $25.49 billion from Jan 2022’s $71.88 billion.

What caused Uniswap waning volume?

An overall bearish market that deepened in May and gained further ground in June has been largely credited for the waning volumes of Uniswap, DEXs, and centralized exchanges (CEXs) as a whole.

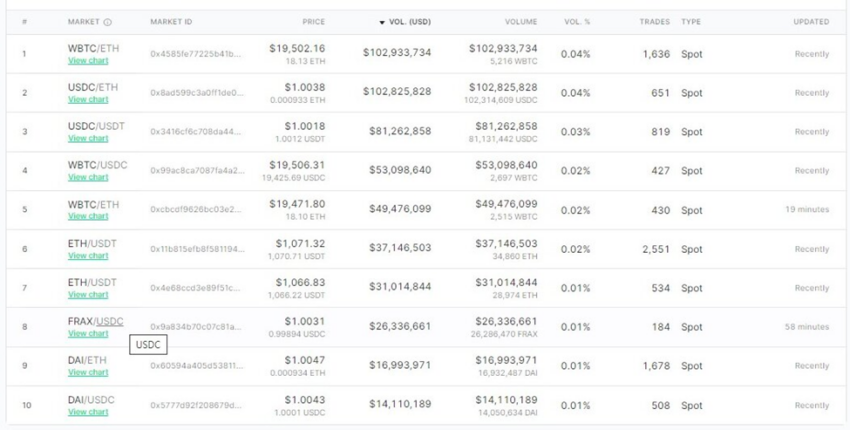

This was reflected in major coins on the exchange trading against stablecoins. The primary purpose of stablecoins is to maintain their peg to a fiat currency. In extremely bearish markets such as June, stablecoin pairings helped in reducing large percentage losses for traders and investors.

Out of the top 10 markets on the platform, seven were stablecoin pairings and they are USDC/ETH, ETH/USDT, USDC/USDT, WBTC/USDC, ETH/USDT, FRAX/USDC, and DAI/USDC.

UNI price reaction

UNI opened at $5.70 on June 1, reached a monthly high of $6 on June 26, tested a monthly low of $3.37 on June 18, and closed the sixth month of the year with a trading price of $4.98.

Overall, this equated to a 12% decrease in the opening and closing price of UNI in June.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.