While Ethereum is trying to fend off sky-high gas fees, Bitcoin has been witnessing an opposite trend: a drop in transaction fees.

Arcane Research presented several reasons to explain the phenomenon and help investors make sense of the year’s happenings.

Keep it down, please!

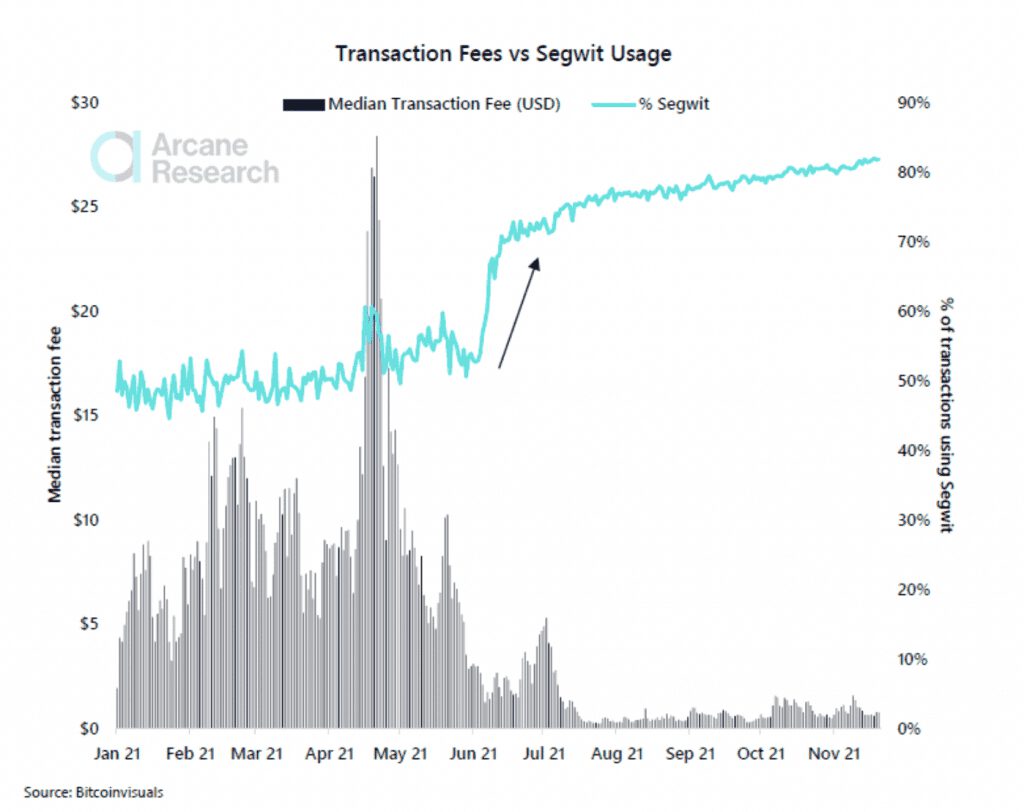

By how much have the Bitcoin transaction fees dropped this year? The median transaction fee during January was usually under $10, but this surged to nearly $30 between 21 April and 21 May. Following the May crypto crash, this number dropped, then saw smaller spikes during the summer. However, the last three to four months brought lows of below $1.

The report by Arcane Research noted that one factor responsible for this change could be a lower Bitcoin mempool size. A mempool refers to a pool of transactions which are yet to be confirmed by the network. Naturally, a congested mempool means more fees.

The taking of Bitcoin 1,2,3

Another significant factor to note is Segwit usage. This Bitcoin network upgrade helped increase the available block space and storage efficiency by taking off signature data from transactions. As the block limit is exceeded fewer and fewer times, the mempool is less crowded. This, again, means lower transactions.

Arcane Research’s report stated,

“In the $15 last six months, the Segwit adoption has seen a significant increase, rising from 50% in late May to 82% today. This could be a key explanation behind the declining fees.”

Source: Arcane Research

Apart from this development, the aforementioned report also pointed to the falling daily transaction count. This went from over 350,000 transactions per day in early 2021 to 270,000 – 280,000 transactions per day at the last count.

However, yet another factor highlighted in the report was transaction batching, applied by many large exchanges. This simply means that multiple requests are put in a single transaction batch, to save the Bitcoin network from being overloaded. Again, as it reduces mempool congestion and lowers the number of transactions per day, fees also come down.

Arcane Research’s report stated,

“On Jan 1st the 30-day average number of payments per transaction sat at 2.11 in contrast to today’s level of 2.41.”

Bitcoin blasting off

It’s essential to note that a drop in transactions per day doesn’t mean a drop in Bitcoin investors. In fact, data from Glassnode showed that Bitcoin addresses with more than 0 BTC had touched a new ATH of 38.76 million. For context, the last time the 38.7 million address mark was breached was before the crypto market crash in May.

The number of #Bitcoin addresses with a non-zero balance has reached a new all-time high of 38.76 million addresses.

The previous high of 38.7 million was set seven months ago on April 23rd, taking 213 days to fully recover.

Live chart: https://t.co/jbyYVmnwcH pic.twitter.com/Fxa9MMwhaW

— glassnode (@glassnode) November 23, 2021