While the broader market continues to flash conflicting signals, Convex Finance rallied on 26 March on the back of its ecosystem-centric developments.

Convex Finance plays its cards

Primarily, Convex Finance was created with the intention of boosting staking into Curve Finance pools. However, it is now running a new incentive for veCRV holders through which the protocol will be providing CVX incentives.

The first pool to receive these rewards is the cvxCRV pool, which will be given about 12,000 CVX tokens every week. Furthermore, Convex Finance has also stated that this will further expand to other pools.

The rewards are expected to be visible by 31 March. Well, it’s quite natural for investors to become bullish about the token. And, this positive sentiment can be clearly seen in CVX’s ongoing price action.

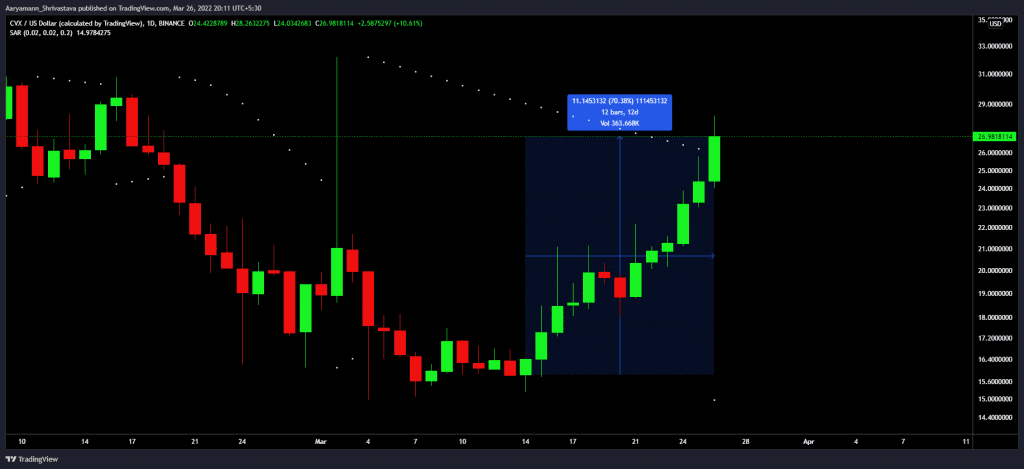

Leading the rally on 27 March, CVX was up by 13.04% over the last 24 hours. At press time, it was changing hands at $28.18. The rally is not unprecedented as CVX had been painting the charts green since 14 March.

In fact, just recently, CVX was listed on the crypto-exchange FTX – A move that spurred the alt’s price action even more.

Convex Finance price action | Source: TradingView – AMBCrypto

Simply put, over the course of the last fortnight, the altcoin has appreciated by 70.22% on the charts. This has also pushed CVX to its monthly high.

As expected, the overall bullishness has been driving investors towards more profit.

Happy investors, finally?

Before the rally began on 14 March, about 60% of all investors were in losses. Less than 3.3k addresses garnered profits. On the contrary, within the next 12 days, the tables turned. In fact, on 26 March, about 54.71% of all addresses found themselves in profit.

Convex Finance investors in profit | Source: Intotheblock – AMBCrypto

This can also be verified by the network-wide supply of CVX which registered a profit after two months. Ergo, the question – Can the rally serve to bring more investors on board?

Well, the network growth of Convex Finance was at its peak in December, during the rally when CVX hit its all-time high of $56.81. Since losing that level, the rate of growth hasn’t been particularly invigorating.

Convex Finance network growth | Source: Santiment – AMBCrypto

Even so, it’s worth arguing that the 12k CVX incentives can definitely spur the network’s wider growth.