After the Federal Reserve increased interest rates by 75 basis points on Wednesday, the U.S. stock market increased, correcting earlier losses while also indicating that smaller rate increases may be next.

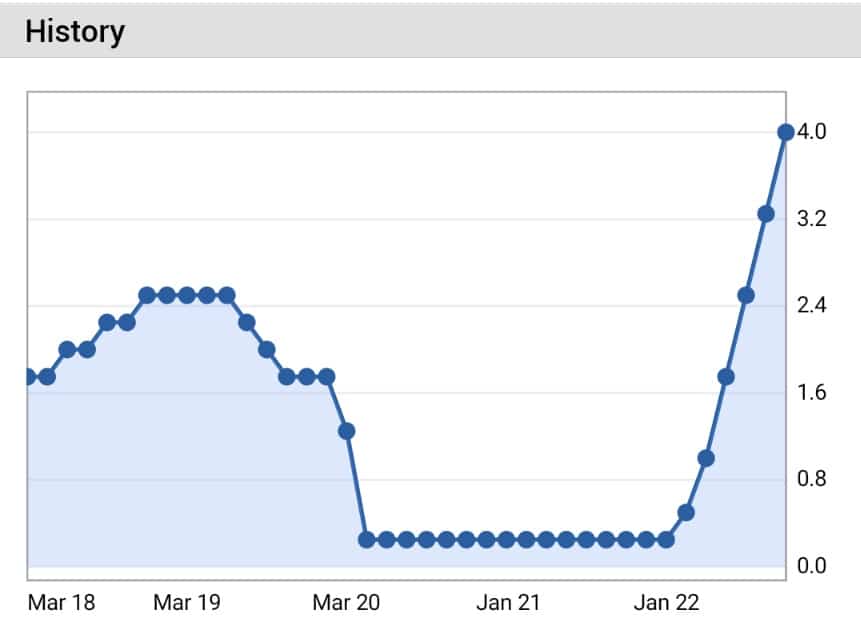

The Fed’s hike, the fourth consecutive one of that size as it seeks to lower inflation that has remained stubbornly high and set the target federal funds rate in a range between 3.75% and 4.00%, was moderated by new language that appeared to indicate the central bank was conscious of the impact its disproportionate rate hikes have had on the economy.

Investors had been hopeful that the Fed would indicate its willingness to scale back the rate hikes at its December meeting, but had instead been generally expected a 75-basis point rate increase.

Impact on US Stock Market

As of 2:30 PM Eastern, the S&P 500 was up 0.7%. The Nasdaq composite increased 0.7% and the Dow Jones Industrial Average gained 338 points, or 1%, to close at 33,004. Prior to the delivery of the Federal Reserve’s interest rate policy statement at 2 p.m. Eastern, all of the indices had been down for the majority of the day.

Trending Stories

With roughly 70% of S&P 500 businesses having reported their quarterly profits, growth expectations have risen marginally to 4.8% from 4.7% the day before and 4.5% at the beginning of October.

Following the fed statement, the majority of the s&p 500’s 11 sectors saw increases, with banks, health care providers, and technology stocks accounting for the majority of the gains.

Impact on US Bond Market

Treasury yields on long terms decreased. Shortly before the Fed made its announcement, the yield on the two-year Treasury, which frequently tracks market expectations of upcoming Fed action, decreased to 4.45% from 4.55%. Mortgage rates are influenced by the yield on the 10-year Treasury, which decreased from 4.03% to 3.98%.

Markets in Europe were mostly down while those in Asia were generally higher.

On the other hand, the crypto market pretty much maintained itself, with Bitcoin raising by 1.3% and Ethereum by 2% at the time of Fed announcement.