The USDC issuer has started investing funds into its CRF (Circle Reserve Fund) to ensure that holders can redeem their coins when they want.

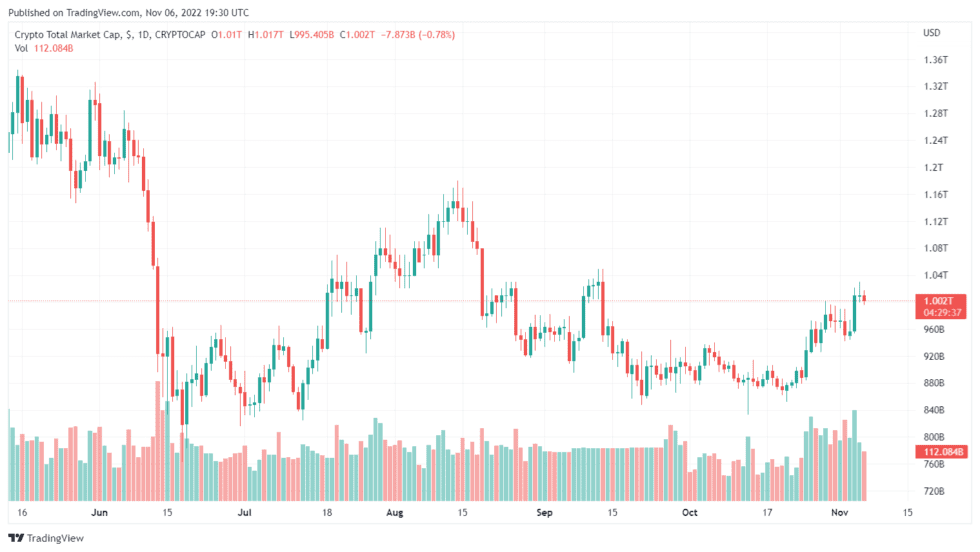

Many crypto firms faced issues this 2022 due to the market crash. Some downsized, while others filed for bankruptcy. Generally, the entire market felt the impact of the crypto winter, and investors lost billions of capital too.

As a result, those that survived the crash are taking measures to avoid such situations in the future. Also, most firms are aiming better to protect their customers’ funds in times of crisis. On this note, Circle has taken a bold step to prepare itself for such situations.

About Circle Reserve Fund

Circle partnered with BlackRock when creating the Fund. BlackRock is the largest asset manager in the world. It was established in 1988 and focused on managing its client’s assets and helping them minimize risks. The company is based in N.Y. city and has a total of $10 trillion in AUM (Assets Under Management).

The Fund which Circle established is already registered under Rule 2a-7 government money market fund under BlackRock. According to details, the Fund contains short-dated U.S Treasuries and cash.

The Fund will operate under an independent board’s control and release the portfolio holdings report daily. Also, it complies with the provisions of the 1940 Investment Company Act.

Only Circle can access the Fund and plans to buy new Treasury holdings with the proceeds. Also, the USDC issuer aims to store its Treasury holdings in the Fund that the Bank of New York Mellon controls. Circle has already started the process and plans to round it up by Q1 of 2023.

How Is USDC Performance So Far

In the stablecoin market, USDC is the second largest crypto in market capitalization after USDT. The stablecoin is pegged to the United States Dollar and has continued to grow in recognition and acceptance.

Circle has continued its effort to make USDC a widely adopted option. The firm plans to spread it on more networks, including Cosmos, Polkadot, Arbitrum, Optimism, and Near. USDC will enter the COSMOS blockchain by early 2023, while others will follow by the end of 2023.

Also, Circle will soon start issuing crypto in Singapore. It has already secured the approval to acquire a license to run a payment institution in the country. This license has empowered it to handle cross-border and domestic payments in Singapore. The firm received the approval in November 2022.

Circle aims to make USDC a go-to stablecoin amongst United States crypto investors. It is safe to say that the firm might soon accomplish the feat.

Coinbase recently revealed that the number of people who buy USDC with USD is higher than those who believe in other fiat currencies.

Featured Image From Pixabay, Charts From Tradingview