USD Coin (USDC) was one of the few digital currencies that was able to withstand the selling pressure that engulfed the market in May leading to a rise in one of the most used stablecoins.

The token remains a top five digital asset by market capitalization in June. According to Be[In]Crypto Research, USDC closed the fifth month of the year with a market capitalization in the region of $53.92 billion.

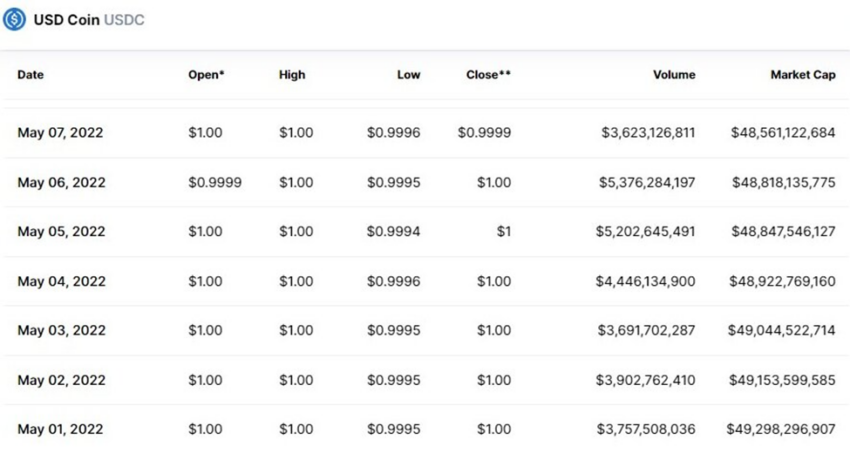

This marked an 8% increase from the opening day’s market value. On May 1, USDC saw a trading volume of $3.76 billion, which corresponded to a market capitalization of approximately $49.29 billion.

Why the soaring market capitalization?

The high demand for the stablecoin by crypto platforms and investors during the peak of the market crash in May can be attributed to the spike in the market capitalization of the token.

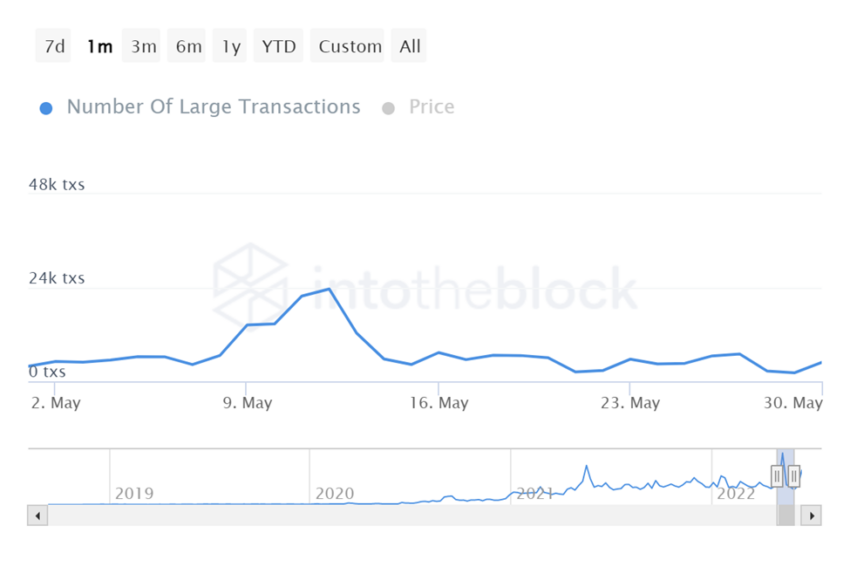

In May, the number of large transactions peaked in the week of May 9 to 15. During the week, the token was involved in 97,140 transactions. With that said, the number of large transactions reached a peak of 23,690 at a price of $0.966500 on May 12.

This corresponded with a transaction volume of 41.45 billion tokens at the same price.

The total transaction volume of 41.45 billion USDC multiplied by $0.966500 equals $40.06 billion.

On May 12, it opened at $1, reached an intraday high of $1.01, tested an intraday low of $0.9995, and closed the day at $1.

The trading volume for the day was $18.61 billion and this corresponded with a market capitalization of $49.59 billion, a 0.61% increase from the opening day’s market value.

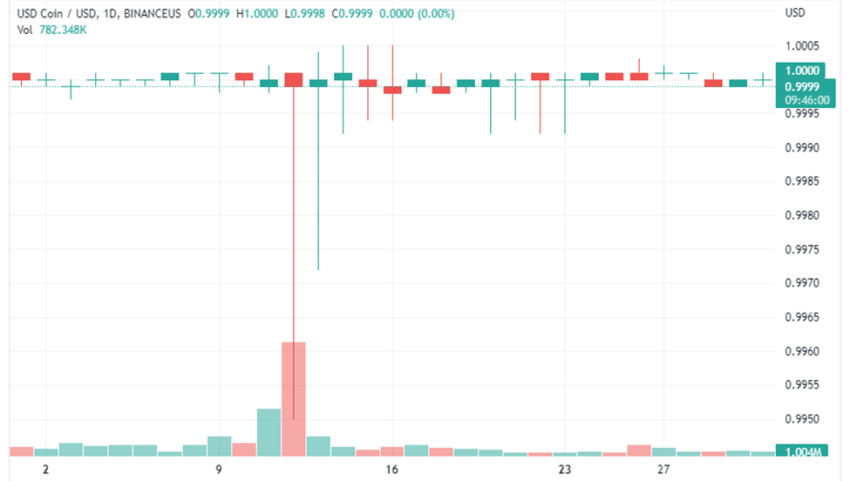

Due to increasing demand to prevent large percentage losses, the coin reclaimed its peg throughout the month.

USDC price reaction

USDC opened on May 1, at $1, reached a monthly high of $1.01 on May 12, tested a monthly low of $0.9993 on May 10, and closed the month at a trading price of $1. Overall, there was no change in the opening and closing price of the token in May.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.