United States Dollar Coin (USDC) has overtaken Ethereum (ETH) and United States Dollar Tether (USDT) as the most purchased cryptocurrency by the top 100 Ethereum wallet addresses.

USDC is one of the most used stablecoins today. It has seen an average of $3 billion in daily trading volume in May buoyed by the market crash on the weekend of May 13 to 15.

According to Be[In]Crypto Research, the coin has become the most-purchased digital asset with an average purchase amount of $3,636,201, and an average token quantity of 3,628,528.

Other digital assets such as the Tether, Binance United States Dollar (BUSD), WOO Network (WOO), USDP, Curve (CRV), Gala (GALA), Chainlink (LINK), and Enjin (ENJ) are among the most purchased cryptocurrencies by the top 100 wallet addresses.

USDC is a stablecoin that can be found on several of the world’s powerful blockchain networks.

New milestone reached

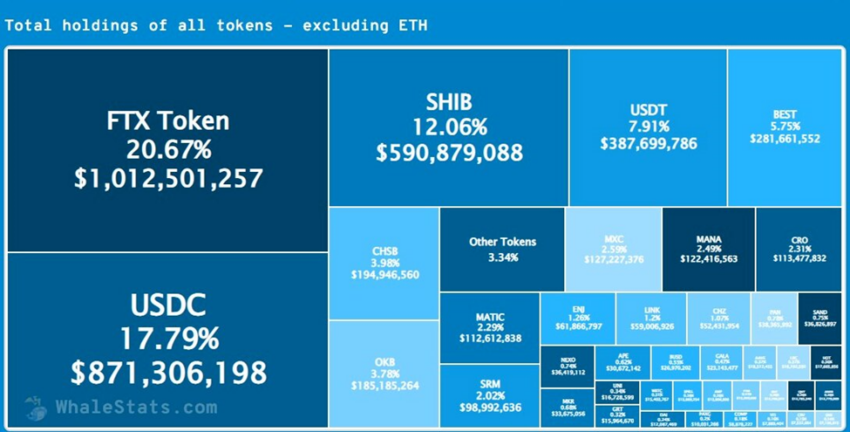

USDC has surpassed Shiba Inu (SHIB) and Tether to become the third-most held cryptocurrency after Ether (ETH) and FTX Token (FTT) by the top 100 Ethereum wallet addresses.

The average amount of the coin held was $8,713,062 and the average quantity was 8,699,484.

Aside from FTX Token and Ethereum, other major assets held by the top 100 wallet addresses include Shiba Inu, Tether, BEST, Decentraland (MANA), SwissBorg (CHSB), OKB, and MXC.

Overall, the total value of USDC held was around $871.31 million, which equates to 17% of all the coins held by the top 100 Ethereum wallet addresses.

Price reaction

USDC opened the year with a trading price of $1, reached a yearly low of $0.9973 on April 8, and had regained its peg to the dollar, as of writing.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.