Circle, the parent company of USDC, which is the second largest stablecoin in terms of market capitalization, reduced its stablecoins supply by 10%. Will the reduction in the supply have a negative impact on USDT’s future. Or, would this act as a bump in the road for USDC’s race to the top?

A glance over data

From 15 September to 22 September, Circle issued a total of about $1.8 billion USDC. Post that, it ended up redeeming about $2.2 billion USDC. This led to reducing the circulating supply by about $500 million. At the time of writing, the USDC circulating supply stood at $50 billion and down by 10% from its peak.

It’s no surprise that USDC has been competing with USDT for the top spot in terms of market capitalization for quite some time. However, a loss of $500 million could very well get in the way of USDC claiming the top spot. Furthermore, the difference between each of the stablecoins market cap was about 17 billion. If USDC cannot improve upon the growth, it would not be able to surpass USDT.

It’s a race to the finish then

However, there are some factors that indicate that USDC isn’t tapping out just yet. USDC’s social presence, despite its current state, remained unscathed. Over the past month, USDC has shown impressive growth in terms of garnering social media attention.

Their social engagements have grown by 9.8% and their social mentions have grown by 16.8% over the past month. This development could prove to be fruitful for USDC in the long run.

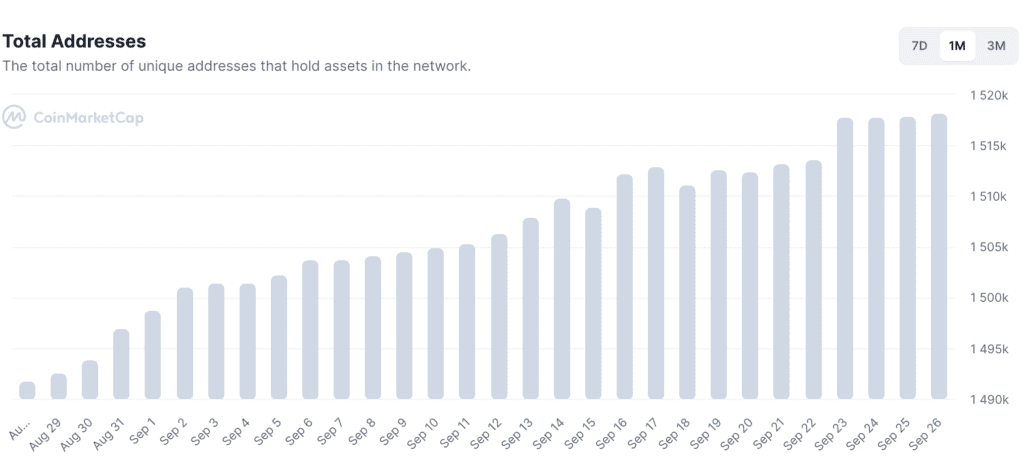

There are other positives for the token as well, the number of unique addresses holding the stablecoin increased over the past month. Additionally, big addresses, ones holding more than $1 and $10 million in assets, have also shown their interest in the stablecoin.

According to Messari, addresses holding more than $1 million have increased by 4.20% and addresses holding more than $10 million USDC have grown by 3.20% over the past seven days.

Although USDC managed to gather some positive factors in its corner, there were some negatives too that made their way. USDC’s exchange reserve has been going on a downturn since the past month, indicating that there is lower buying pressure at the moment.

According to CryptoQuant, there has been a decline in USDC’s transfer volume and the number of active addresses have gone down as well. USDC’s trading volume depreciated by 15% between 25 and 26 September, and the number of DeFi transactions witnessed a freefall of 20% as well.

These bearish indicators coupled with the fact that multiple exchanges such as Binance and WazirX have delisted the stablecoin from their platform, could negatively effect USDC’s future.