USD Coin (USDC) issued by Circle Inc is the second-largest stablecoin by market capitalization. It achieved significant milestones over the years. In fact, on 1 February, USDC market capitalization surpassed $50 billion. In all, Circle minted more than 100 billion USD Coins (USDC). Continuing the same trend, here’s the latest development.

SPAC merger

CIRCLE NEWS: Today, we announced a revised SPAC deal for Circle (“reSPAC”) which values the company at $9B, building on the extraordinary growth of USDC and everything we are building around it. (1/3) https://t.co/hHt1K5C8ox pic.twitter.com/gIU7qLfgAx

— Jeremy Allaire (@jerallaire) February 17, 2022

Circle, the issuer of USDC received a major financial boost post the 17 February announcement. The company announced that it terminated its existing business combination and agreed to a new deal with Concord Acquisition Corp. This gave Circle a $9 billion valuation, double the previous July 2021 agreement with Concord Acquisition.

USDC’s circulation had more than doubled since the original deal was announced, reaching $52.7 billion as of 17 February 2022. Speaking on this matter, Jeremy Allaire, Circle’s co-founder and CEO expressed his optimism following the partnership. He stated:

“Circle has made massive strides toward transforming the global economic system through the power of digital currencies and the open internet.”

Allaire aimed at public listing through the aforementioned merger with a special purpose acquisition company (SPAC). This would further strengthen trust and confidence in Circle. He added:

“This is a critical milestone as we continue our mission to build a more inclusive financial ecosystem. Making this journey with Concord under our new agreement is a strategic accelerator.”

The new agreement had an initial outside date of 8 December 2022 with the potential to extend to 31 January 2023, under certain circumstances. It would then be listed on the New York Stock Exchange under the stock ticker symbol ‘CRCL’.

The Board of Directors of both, Concord Acquisition Corp and Circle approved the new agreement. Concord Acquisition’s management team expressed similar positive sentiment regarding the deal. Bob Diamond, Chairman of Concord Acquisition Corp, asserted,

“We believe our new deal is attractive because it preserves the ability of Concord’s public stakeholders to participate in a transaction with this great company.”

Further details would be provided in a report on Form 8-K filed with the SEC and would be available at www.sec.gov.

Reciprocating the same

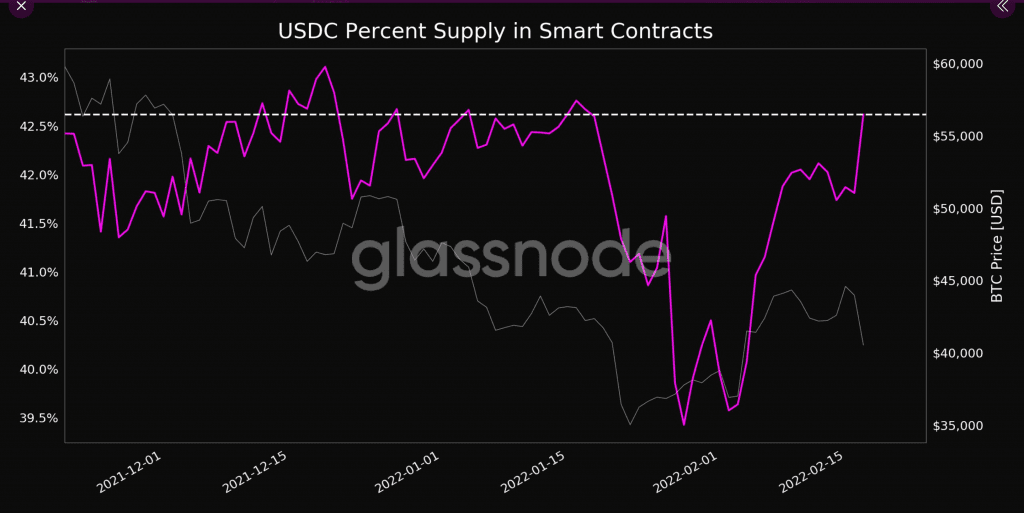

USDC, the world’s second-largest stablecoin by market capitalization did react in a positive manner post this development. According to Glassnode, USDC’s percentage of “Supply in Smart Contracts” reached a 1-month high of 42.617%.

Source: Glassnode

As per the plot above, the previous 1-month high of 42.192% was observed on 19 January 2022. Having said that, the bulls and bears still remain neutral (at 78) as per data from IntotheBlock.