The stablecoin market, like the rest of the cryptocurrency ecosystem, continues to see new updates every day. Things changed rapidly, especially after TerraUSD [UST] came into the picture only to crash and burn. Now, while some struggled to move on past the de-pegging event, others might have found a solid ground to stand on

Tether (USDT) has been the dominant force in stablecoins for a few years now. However, Tether’s closest rival, Circle’s USD Coin (USDC), might be the one making headlines today.

Circle of ‘stable’ life

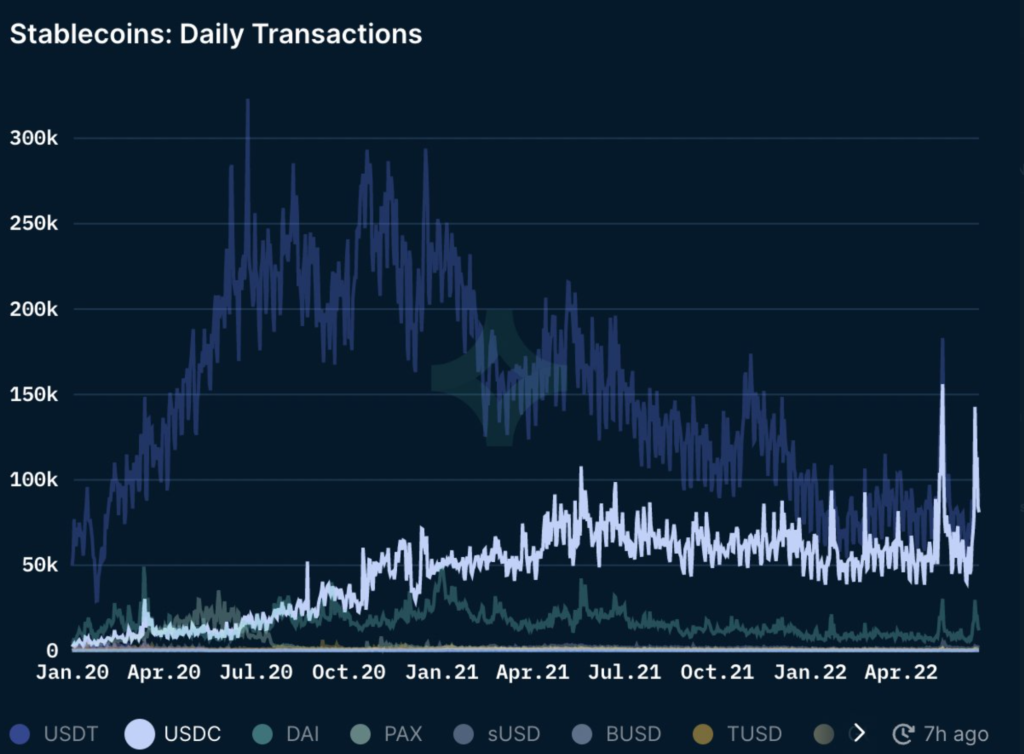

Around five months ago, USDC surpassed a milestone of 50 billion USDC in circulation. Despite the achievement, USDT maintained a significant gap over the rest of its competitors. Mostly on the front of market capitalization and the number of daily transactions on the Ethereum [ETH] blockchain. Now, this gap may have taken a big hit.

Circle’s USD Coin (USDC) stablecoin has FINALLY crossed Tether’s USDT by the number of daily transactions on the Ethereum blockchain. Alex Svanevik, CEO of on-chain data hub Nansen, shared this milestone on Twitter too.

Source: Nansen

Circle’s dollar-pegged stablecoin is yet to flip USDT by market cap. The two cryptocurrencies are currently valued at $67.8 billion and $55.5 billion, respectively. But, Tether might lose its footing or even the battle, given the headwinds. On the other hand, amidst this chaos, USDC found interest from investors in the market.

Terra’sUSD de-pegging and eventual collapse sent shockwaves across the crypto-market. Major stablecoins such as Tether [USDT] and USD Coin [USDC], and DAI saw major changes. USDT, in fact, still hasn’t achieved the $1-peg as it circled around the $0.99-mark at press time.

To make matters worse, Tether’s Chief Technical Officer Paolo Ardoino confirmed the incidence of a DDoS attack. Here, Tether received 8M reqs/5 minutes as opposed to the usual 2k reqs/5 min.

On the contrary, USDC, at press time, maintained its $1 peg on CoinMarketCap. In fact, USDC is the most-used stablecoin of all when it comes to transferring volume, holding a share of 51.5% on this front.

Tether and DAI only have shares of 25% and 11.4%, respectively.

This marks an unprecedented hike for USDC, despite the chaos within the market.

Game, Set, Match?

Well, not really. Tether (USDT) isn’t giving up just yet.USDT remains the top player in the stablecoin market. That being said, regulatory scars are a cause of alarm.

Tether has been at the receiving end of severe backlash because of its “backing.” It has faced several lawsuits over the past couple of years. As a result, the firm’s efforts to provide transparency have failed to derail the bad press surrounding it.

On the other hand, Circle, the regulated crypto-focused financial service firm behind the dollar-pegged stablecoin, hasn’t faced such regulatory hurdles. Only time will tell how this competition will go.