While the crypto economy has shed significant value, losing more than $2 trillion since the highs recorded at the end of 2021, a great deal of value was erased from smart contract platform tokens and decentralized finance (defi) protocols. One sector of the defi ecosystem that’s recorded heavy losses this year is the blockchain oracles space, as a great number of oracles secure a lot less value than they did seven months ago. While there are more than two dozen oracles today and there were only 17 at the beginning of the year, the total value secured by oracles has decreased by 61.74% since mid-February.

Today There’s a Lot More Blockchain Oracles but Less Value Secured by All of Them Since Mid-February

Blockchain oracles have seen significant growth since the inception of these protocols but in 2022, the protocols secure a lot less value than they did seven months ago. A blockchain oracle is essentially middleware that connects a blockchain network to external systems via smart contracts, and the medium provides data sources that are verifiable and shared in a decentralized fashion.

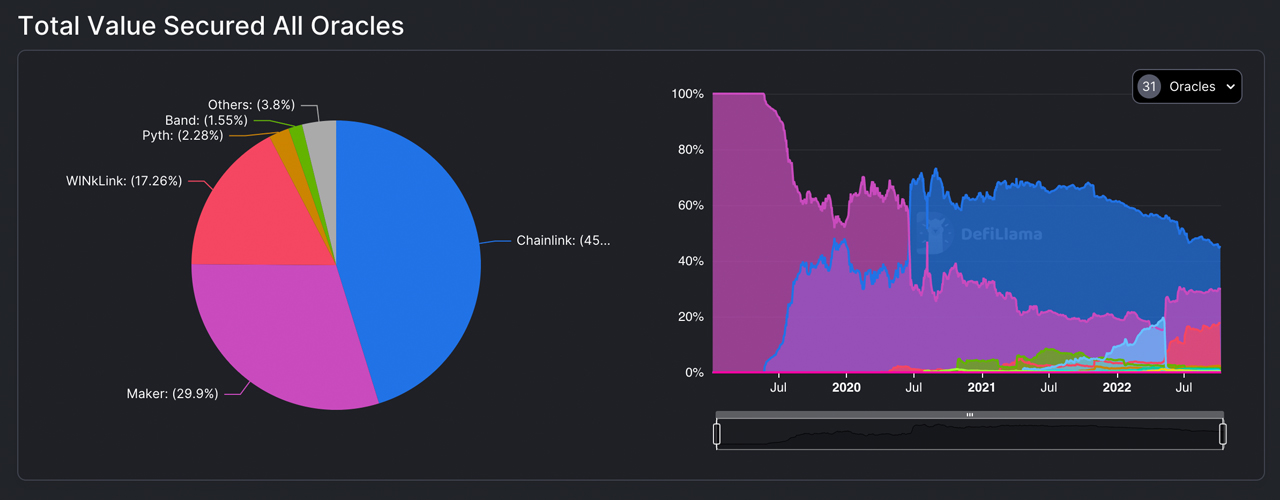

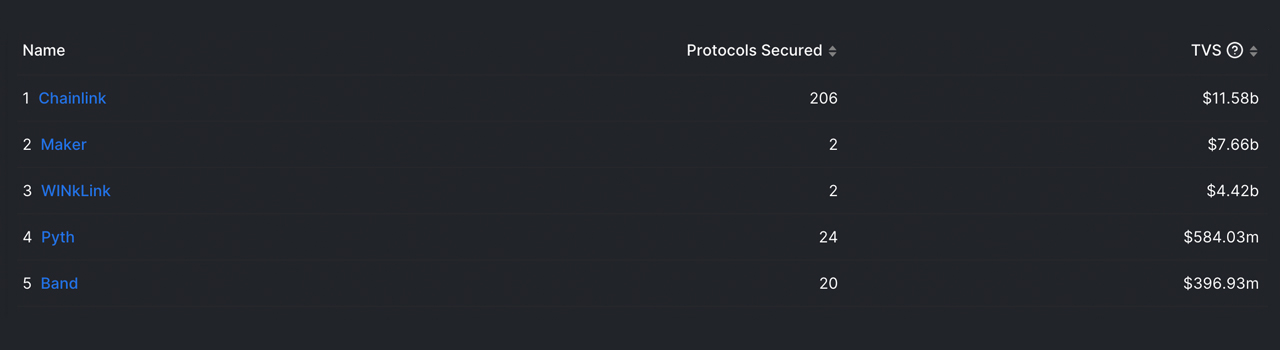

Data from defillama.com shows that Chainlink is the largest blockchain oracle in terms of total value secured by all oracles, and the Chainlink oracle secures 206 protocols. Chainlink commands roughly 45% of the $25.612 billion secured by 31 oracles today and the oracle is followed by projects such as Makerdao, Winklink, Pyth, and Band.

Maker commands $7.66 billion, while Winklink secures $4.42 billion and Pyth secures around $584.03 million. The fifth-largest oracle according to defillama.com metrics is Band, with around 1.55% of the total $25.61 billion secured, or around $396 million. While $25 billion is quite a bit of funds secured by decentralized blockchain oracles, it’s 61.74% less than the funds oracles secured on February 12, 2022.

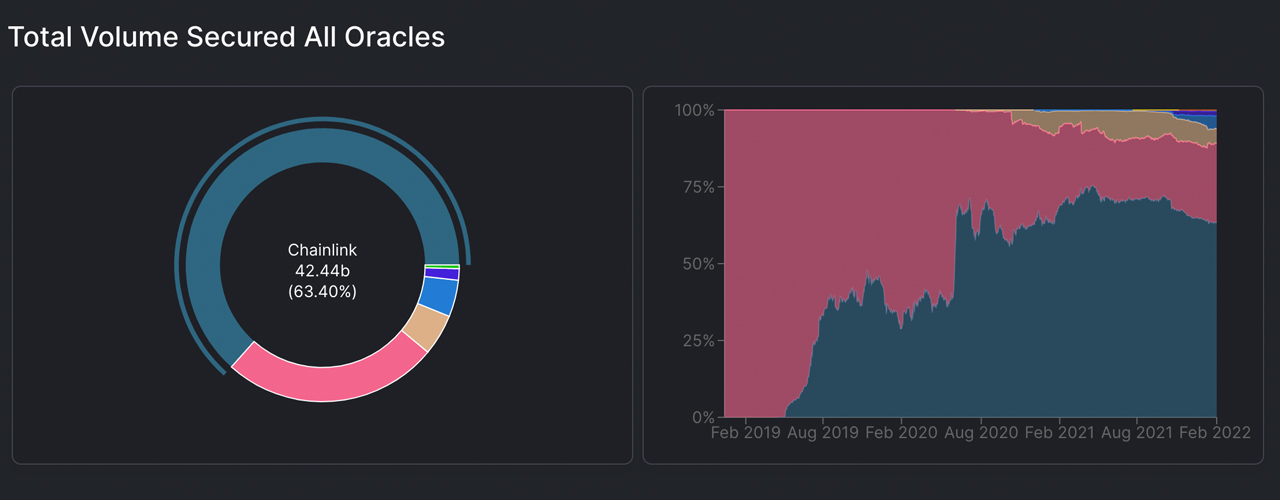

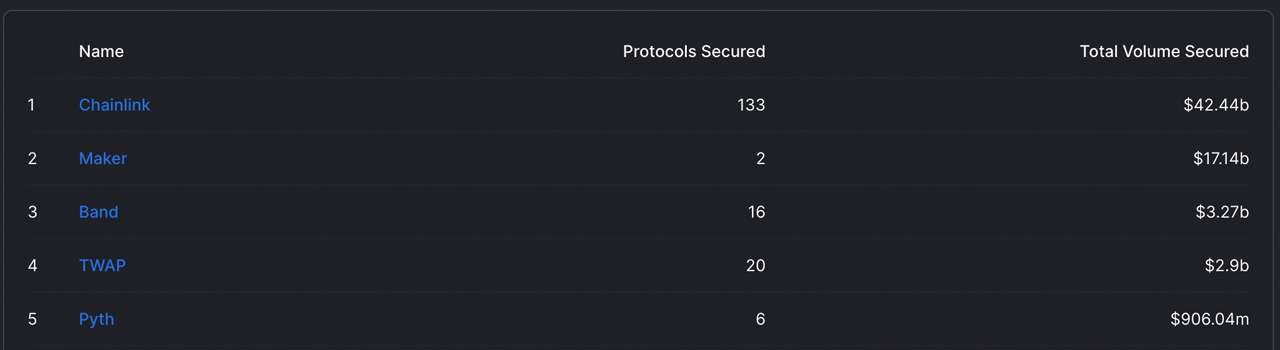

At that time over seven months ago, Chainlink’s total value was larger than the total value secured by 31 oracles today. On February 12, Chainlink secured $42.44 billion and Makerdao secured $17.14 billion on that day. 17 oracles were monitored by defillama.com at the time and collectively they secured $66.946 billion in value.

Seven months ago the top five oracles were Chainlink, Makerdao, Band, TWAP, and Pyth. Moreover, while Chainlink secures 206 protocols today, back then it only secured 133 protocols. Four of today’s top five oracles have native tokens as well, and the token values are down a great deal since their all-time highs (ATH).

Chainlink (LINK) is down 85% since the ATH recorded on May 10, 2021, and makerdao (MAKER) is down 84% from its ATH on May 3, 2021. Winklink (WIN) has shed 96% since April 5, 2021, and band protocol (BAND) is down 94.7% since the coin’s ATH recorded over a year ago on April 15, 2021. Despite the loss in value, native tokens are more valuable than they were at inception.

LINK, for instance, is up 5,053.1% higher during the last five years against the U.S. dollar since November 29, 2017. BAND is up 496% since its inception, WIN is up 168.4% during the last two years, and MAKER has gained 449.1% in two years as well.

Moreover, the total value secured by oracles is a whole lot larger than it was three years ago. Blockchain oracle proponents believe the technology will be able to disrupt a number of industries as they grow, as legacy oracles today provide data that is questionable at best.

What do you think about the total value secured by blockchain oracles losing 61.74% since mid-February? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer