The Cardano ecosystem, over the years, distinguished itself from its competitors by taking a more rigorous approach to deploying new features. The #7 largest coin suffered a fresh 2% correction in the past 24 hours as it traded at the $1.04 mark. It is interesting to note that analysts and even some developers have started questioning Cardano’s roadmap.

‘I don’t expect nothing’

Chris Burniske, a partner at crypto-focused venture capital firm Placeholder was one of them. He addressed Cardano as a ‘vaporware’ in response to a question on why the price of ADA seems not to be appreciating. According to Chris, the project promised more than it could deliver.

Because $ADA is vaporware. https://t.co/SOwHDpxQDz

— Chris Burniske (@cburniske) February 8, 2022

Burniske has long been a critic of the Cardano blockchain. Last year, he cited Cardano as an example of a project that has been sustained by hype. Even though the criticism prevails, there are plenty of reasons to be optimistic about.

Back me up

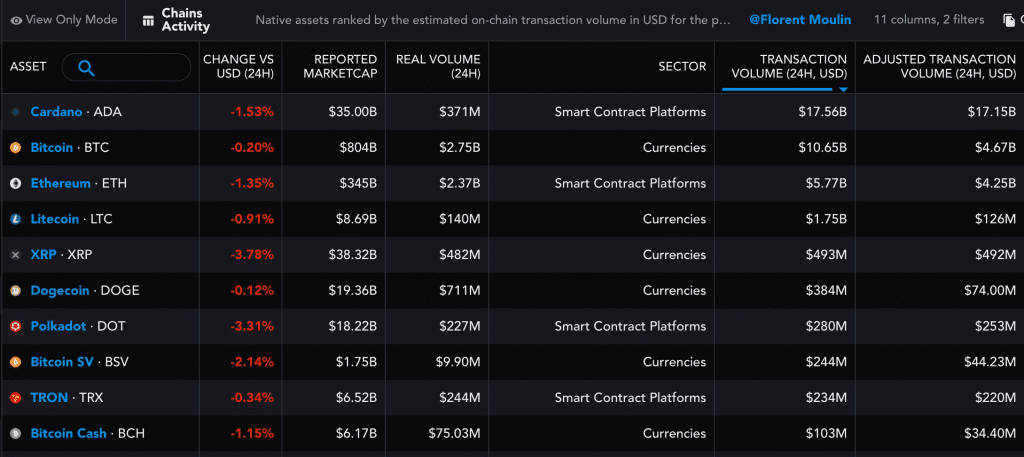

Crypto data aggregator Messari.io (Chains activity) showcased a positive sign for Cardano when compared to its rivals. According to the data, ADA outpaced Bitcoin and Ethereum for most transaction activity (adjusted transaction volume in the last 24 hours).

Source: Messari.io

According to the transaction behavior, ADA represented an adjusted transaction volume of $17.15 billion. Ergo, beating out BTC and ETH at $15.1 billion and $8.6 billion, respectively.

[Here, adjusted transaction volume offers more information about transaction volume. It describes a way to fairly compare UTXO style transactions and account-based transactions.]

Interestingly, this was the first time Cardano exceeded Bitcoin’s adjusted transaction volume. Thereby, signaling bullish projections. Other important indicators highlighted a similar picture.

Cardano users only paid $51,985.43 in transaction fees in the last 24 hours compared to $0.51 million and $19.39 million of Bitcoin and Ethereum, respectively. This marks a significant milestone.

#Cardano‘s in 1st place for most transaction activity (Adjusted Volume last 24 hrs) It overtook #BTC and #Ethereum. Adjusted transaction volume is a way to isolate only meaningful transactions and fairly compare utxo & account models. Look at the fees. 👀https://t.co/nm5fOb2L5O

— Ed n’ ₳ltcoins (@EdnStuff) February 13, 2022

Notably, the latest available data demonstrates an average transaction fee of $0.44, as of February 14. Meanwhile, transaction volumes on the network witnessed a rise after the Plutus script and Metadata transactions took over the blockchain.

Many even consider the flagship network as ‘undervalued‘ given its discounted price action. Nonetheless, the ecosystem saw immense growth over the years.