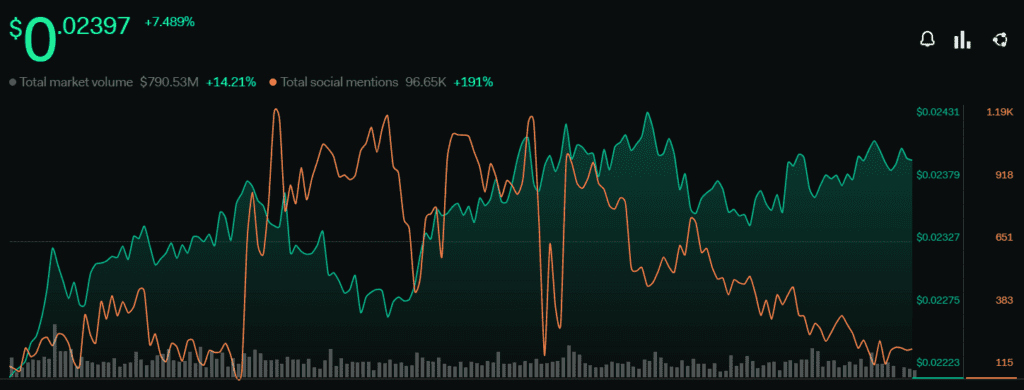

VeChain [VET] lately managed to make its investors happy as the price of VET surged by nearly 8% over the last week. At press time, VET was trading at $0.02396 with a market capitalization of $1,737,838,130.

Though much of the credit goes to the current bullish crypto market, several developments on the VeChain ecosystem may have contributed to this price surge.

____________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for VeChain [VET] for 2023-24

____________________________________________________________________________________

For instance, the NFT supporting the first Inventory Monetization transaction was minted on the VeChainThor network. A statement was released by Supply@ME and VeChain about the same. This development is expected to improve cash flow and access to working capital for the automobile manufacturing industries in the US, Italy, and Africa.

October was an amazing month! Technically the most important brick was laid with our #WebHooks that allows bi-directional #Blockchain communication with every backend. But there was more …

Here’s our reflection on October:https://t.co/RfiW5UNncW#VeChain #VeFam 🎃 pic.twitter.com/GevQyKC58v

— vechain.energy (@VeChainEnergy) October 31, 2022

However, as we enter the final months of 2022, what lies ahead for VeChain investors? A look at VeChain’s metrics provided some clarity to the scenario.

Investors should consider this

Though VET’s ecosystem was quite heated because of the aforementioned developments, LunarCrush’s data revealed a different scenario. VeChain’s social mentions reduced considerably over the past few days. This indicated that the network was growing less popular in the crypto community.

A look at DefiLlama’s chart pointed out that despite marking a slight uptick, VET’s TVL was considerably down as compared to the last week. This could be considered as a negative signal. However, the rest of the metrics looked quite promising as they were all in VET’s favor.

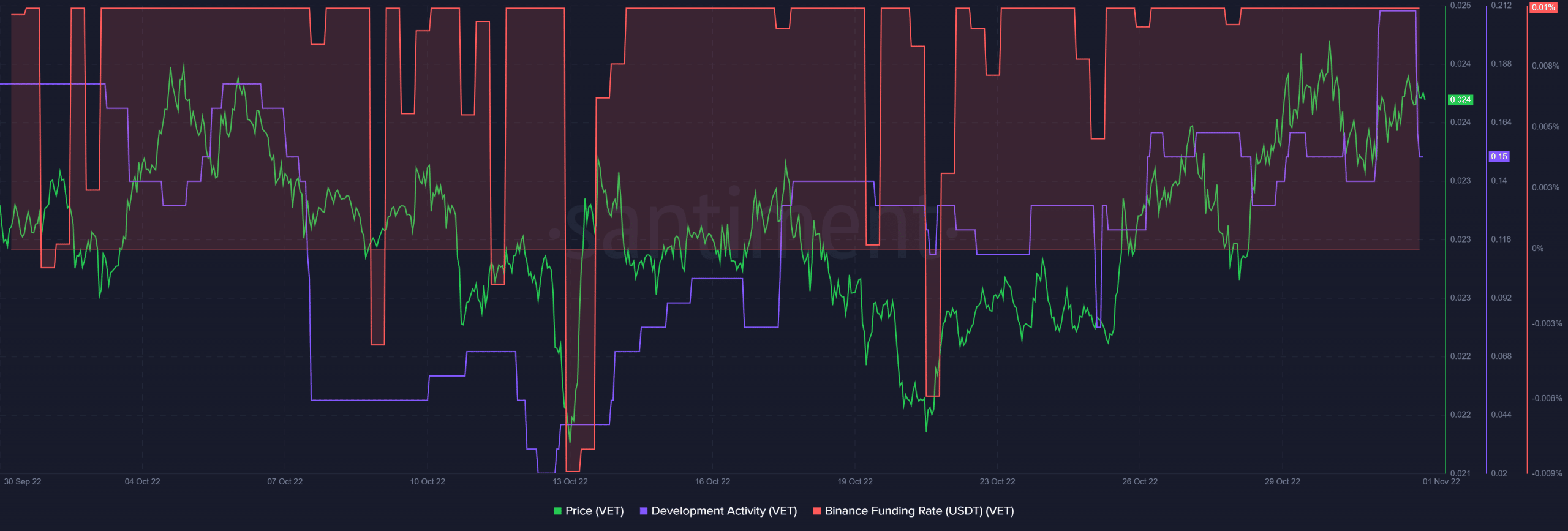

For instance, VET’s development activity increased sharply over the last week. Moreover, VeChain’s Binance funding rate was also consistently high. This indicated a rising interest from the derivatives market.

Good news incoming

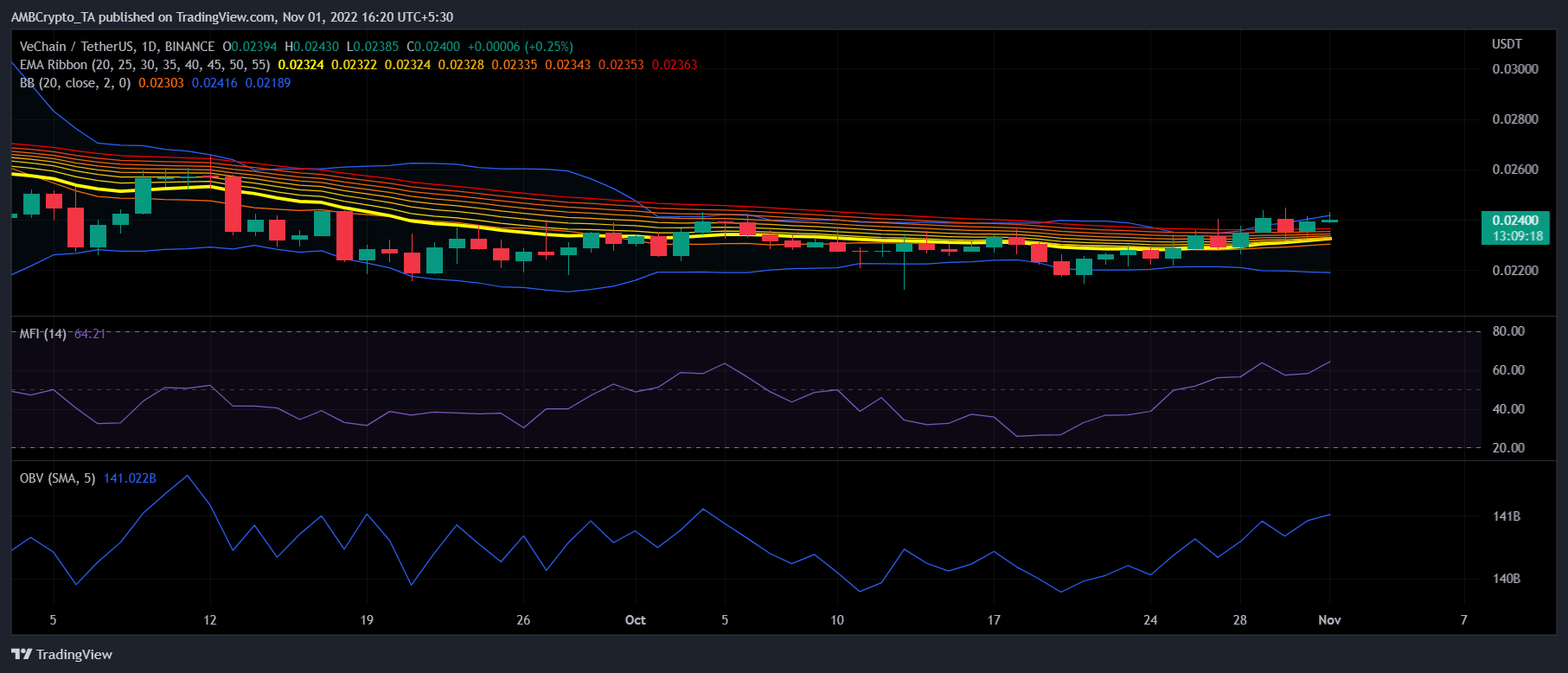

Like most other cryptocurrencies, indicators on VET’s daily chart suggested brighter days ahead. The Money Flow Index (MFI) and On Balance Volume (OBV) both registered upticks. This could be considered as a bullish sign.

Moreover, the Exponential Moving Average (EMA) Ribbon revealed that the bears’ advantage in the market might soon come to an end. The Bollinger Bands (BB) revealed that VET’s price was about to enter a high volatility zone. Therefore, considering all the on-chain metrics, developments, and market indicators, VET investors can sit back and relax as a continued price surge could be expected.