Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject

The idea of foraying into a crypto because it costs a fraction of a dollar is tempting. Alas, it’s not always a smart decision. Then again, the way the market is doing, it’s doubtful that most financial decisions will be smart. In any case, it’s worth looking at VeChain. Why? Well, just in case. Also, over the past few days, there’s some optimism going around as well. Especially on the back of Bitcoin and other major cryptos recovering on the price charts.

In this article, we will analyze what drives the price of VET and what factors affect the altcoin’s price.

About the platform

In 2015, Sunny Lu, the Chief Information Officer of Louis Vuitton China, founded VeChain. It was founded with an aim to disrupt conventional business models and revolutionize the way companies around the world manage their supply chains.

The company boasts partnerships with luxury brands like Louis Vuitton, BMW, big-four auditing firm PriceWaterhouseCoopers (PwC) and Walmart. Most recently, VeChain entered a multi-year deal with the UFC. The deal is valued at $100 million.

VeChain works on a consensus protocol that is different from the traditional proof-of-work and proof-of-stake protocols. VeChain uses a proof-of-authority consensus model. This protocol requires relatively low computational power and is more about integrity and quality. This consensus model is rather centralized, when compared to traditional ones.

VeChain is a blockchain platform that seeks to disrupt the logistics industry by reimagining how businesses around the world manage their supply chain. The relatively nascent firm has become an industry leading name by focusing on collaborations with established companies around the world.

VeChain has announced a slew of partnerships since the beginning of 2022, tapping into various sectors, demonstrating the power of blockchain and the crucial role it will play in the future. The firm behind VET, a token that is ranked 33 on CoinMarketCap, has diversified its clientele by collaborating with names from retail, luxury, fintech and even entertainment industries.

Most recently, VeChain announced a partnership with UCO Network, a public blockchain protocol that operates in the Biofuel space. This partnership will introduce VeChain to ESG issues, furthering its sustainability narrative. Other notable ventures include a technical partnership between Amazon Web Services (AWS) and VeCarbon, a subsidiary of the VeChain Foundation.

Although VeChain is based out of Singapore, a significant portion of its team and connections are based in China. Almost half of VeChain’s partners are Chinese companies. Such is the customer concentration in China that more than half of the demand for VTHO is coming from a single customer – Walmart China. This so-called Chinese label may not be in their best interest, however, given the Chinese government’s crackdown on cryptocurrencies and frequent trade wars with the west. These factors cast a shadow on the project’s overall sustainability.

Following its rebranding as VeChain Thor and the subsequent launch of its own mainnet in 2018, VeChain pivoted to retail-facing products like decentralized applications (dApps) and e-NFTs. This move may not have been in their best interest. Data from DappRadar shows negligible activity on VeChain dApps, despite the company waiving off gas fees for dApps. These ventures could serve as a distraction, especially amid increased competition from industry giants like IBM and SAP who have started offering enterprise-facing blockchain products.

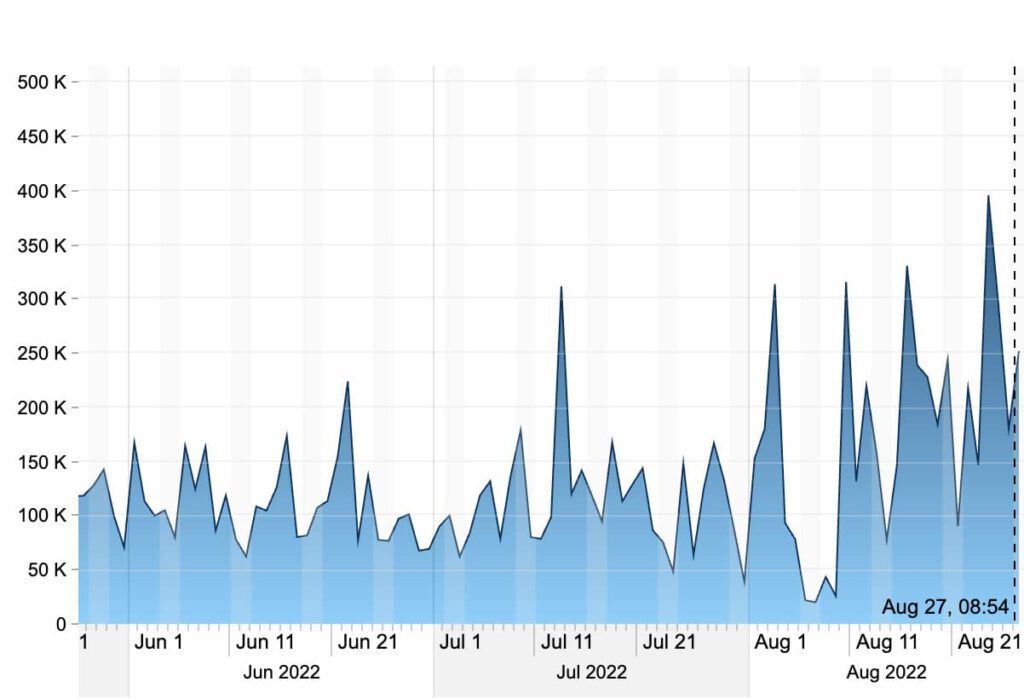

Source: VeChainstats

In fact, data from VeChain Stats revealed a troubling decline in its mainnet activity.

Although there has been a visible spike in activity since the beginning of August, one cannot ignore the difference compared to last year where the network was seeing over 2 million clauses a week. Unlike many other cryptocurrencies, VeChain’s price and its mainnet activity started declining since the beginning of 2022. The market wide sell-off following the collapse of Terra did impact VeChain’s mainnet activity, but as the chart indicates, it has pretty much recovered to pre-bear market levels.

Additionally, data procured by SeeVeChain suggested that VeChain Thor transactions have been on a steady decline too. The daily burn rate of VETHO, the token required for facilitating VET transactions, can be seen consistently falling – A sign of diminishing VET transactions.

However, since the beginning of August, the daily burn rate has been setting higher highs, while moving in a sideways direction. This may suggest recovery and stabilization to some extent.

Source: See VeChain

VeChain was in the news back in May 2022, when it offered Terra LUNA developers grants of upto $30,000 to migrate their layer 1 chains to VeChain following the collapse of terra.

There was a brief rebound in VET’s price towards the end of the first quarter of 2022. The token surged all the way to $0.089 following the announcement of VeChain’s partnership with Draper University which entailed a fellowship and a Web3 accelerator program. However, May’s market-wide crash sent VET’s price tumbling down to $0.024. The price failed to recover from the bearish trend, despite news of a new partnership with Amazon Web Services and the Q1 financial report from the VeChain Foundation which showed a healthy balance sheet.

In 2020, PwC estimated that blockchain technologies could boost the global GDP by $1.76 trillion by 2030 through improved tracking and tracing. PwC’s economic analysis and industry research showed that tracking and tracing of products and services has an economic potential of $962 billion. Investors will be eager to see how PwC’s blockchain partner VeChain benefits from this.

Global market intelligence firm IDC released a report in 2020. According to the same, 10% of the supply chain transactions in Chinese markets will use blockchain by 2025. This could work out in favor of VeChain, with it being the leading blockchain firm catering to supply chain solutions and given its significant presence in China. James Wester, research director at Worldwide Blockchain Strategies IDC noted,

“This is an important time in the blockchain market as enterprises across markets and industries continue to increase their investment in the technology. The pandemic highlighted the need for more resilient, more transparent supply chains”

According to a report published by ResearchandMarkets.com, the global supply chain management market size is projected to hit $42.46 billion by 2027, with a Compound Annual Growth Rate (CAGR) of 10.4% from 2021 to 2027. Experts have indicated major opportunities for integration of blockchain technology in supply chain management software in the projected period. As the leading blockchain firm catering to supply chain management, VeChain could stand to gain from this.

It was reported in July that VeChain will be rolling out a solution for luxury brands that often find their cheap knock-offs being illegally sold in the primary and secondary market. VeChain will implant its proprietary chipset in luxury products which will help manufacturers keep track of their inventory and monitor sales in real time on the blockchain. In addition to that, customers will be able to verify the authenticity of their purchased product using a mobile application. The application would also provide additional info such as carbon emission associated with their purchase and the story behind their product.

A paper published by The Institution of Engineering and Technology, outlined blockchain applications for the healthcare industry. The paper explained how start-up companies in this industry were exploring the use of blockchain technology for clinical data management. The paper went on to cite the example of the Mediterranean Hospital in Cyprus, which leveraged E-HCert, a data management application based on VeChain Thor.

On 10 August, VeChain and OrionOne, a global logistics tech firm, announced an integration partnership. The joint venture aims to combine the VeChain ToolChain with Orion’s best-in-class logistics platform to offer clients an efficient and effective pathway to leverage blockchain technology in their business without spending a ton on network infrastructure. Tommy Stephenson, CEO of OrionOne, while speaking on this new partnership remarked, “When it comes to blockchain and supply chain, there’s only one game in town, and that’s VeChain. No other entity can compete with their low-cost, rapid deployment, and ease of use.”

On 19 August, the VeChain Foundation announced via twitter that the VeChainThor public testnet had been successfully updated to accommodate VIP-220, also known as the Finality with One Bit (FOB). The update implements a finality gadget which allows the network to run dual modes of consensus, the Nakamoto and Byzantine Fault Tolerance (BFT) consensus, at the same time. This move saved VeChain the trouble of completely replacing their proof-of-authority consensus mechanism. A finality gadget helps blockchains execute transactions optimistically and only commit them after they have been sufficiently validated.

Developers have clarified that FOB has an edge over the existing finality gadgets which follow the view based model of Byzantine Fault Tolerance (BFT) Algorithms, because nodes in FOB are less likely to be affected by network failure.

The update will also help VeChain reduce the complexity of their current proof-of-work consensus protocol, thus minimizing the potential risks caused by unknown implementation bugs, in addition to sustaining the usability and robustness of the network.

Earlier in June, VeChain had described block finality as “an indispensable property for a modern blockchain system because it provides an absolute security guarantee for blocks that satisfy certain conditions.”

The VeChain Foundation informed its community on Twitter that from 5 September onwards, the network will be suspending $VEN TO $VET token swaps. The function is expected to resume after the Ethereum network stabilizes following the much-anticipated merge slated for mid-September.

Earlier this month, VeChain announced that it had entered into a strategic partnership with TruTrace Technologies, a blockchain development company catering to the legal cannabis, food, apparel and pharmaceutical industries. The partnership aims to integrate complementary technologies, and offer TruTrace’s clients enhanced traceability by leveraging VeChain’s seamless infrastructure.

Source: VET/USD, TradingView

The price of VET has been on a downtrend since April this year. It is clear from the VET/USD chart that ever since VET dropped below $0.039 in May this year, it has faced major resistance at the $0.034-level. The crypto moved sideways in a ranging pattern between mid-June and July with key support at the $0.021-level. Towards the beginning of August, the pair finally broke the three-week long resistance at the $0.027-level and rallied 24% all the way up to $0.034 by 13 August.

The price has since, however, dipped back down to $0.024, which may also emerge as a new support level, although one can only be sure after a couple more retests. It is unlikely that the price of VET will go back to what it was trading for before the market wide sell-off in May.

VeChain Tokenomics

Token minting predates VeChain’s rebranding, thus, figures have been converted from VEN to VET.

VeChain initially minted 100 billion VET which was distributed in the following manner –

- 22 billion VET were retained by the VeChain Foundation

- 5 billion VET were given to project team members

- 23 billion VET went towards enterprise investors

- 9 billion VET went towards private investors

- 27.7 billion VET were sold in the crowdsale

- 13.3 billion VET were burned by the VeChain Foundation as part of the token sale refund process

VET Price Prediction for 2025

Crypto-experts at Changelly have projected VET to be worth at least $0.10 in 2025. They believe the maximum it could go to is $0.12.

Data gathered by Nasdaq suggests that the average projection for VET in 2025 is $0.22.

According to data published on Medium, however, the average projection for VET in 2025 is $0.09.

VET Price Prediction for 2030

Changelly’s crypto experts have concluded from their analysis that VET should be worth at least $0.64 in 2030. The projection included a maximum price of $0.79.

Data gathered by Currency.com suggests that the average price of VET in 2030 should be $0.38.

The experts at Medium predict VET to be worth an ambitious $1.79 by the end of the decade. Considering the current price, that would amount to a whopping 6200% profit.

Conclusion

It is important to note that increased adoption of VeChain doesn’t necessarily translate to increased demand for VET since the token is primarily used for staking and governance.

VeChain is arguably the only blockchain in the supply chain vertical that has survived the test of time. Rival tokens like Waltonchain and Wabi have seen their market capitalization and volume dramatically diminish over the past few months.

The ongoing supply chain crisis would have been a very good opportunity for VeChain to demonstrate its capabilities but companies all over the world have been resorting to conventional systems rather than exploring an innovative blockchain solution like VeChain. That being said, the supply chain tracking industry is ripe for disruption and VeChain is in a position to dominate the space in the near future.

Critics have speculated that while VeChain’s blockchain may prove useful, the specific nature of its native token’s utility i.e. pertaining to the business world, may become a hindrance in its growth.

VeChain needs to focus on what it’s good at – Enterprise-facing blockchain solutions for logistics and supply chains.

The major factors that will influence VET’s price in the coming years are –

- Increase in demand for VET through growth in dApp activity

- Development of VeChain cross-chain

- Stable economic environment in China

- New partnerships with companies in the supply chain industry.

- Development of new use cases for VET

In other news, the Fear and Greed Index improved briefly in early August, before slumping back again as the market fell.