BSCDaily hosts Waterfall Defi: #Defi #Waterfall Defi #BSCDaily #BSC

BSC_Daily Admin: Hello and welcome, how are you today?

Tom: Thank you and BSC Daily team for having me here, super excited!!

BSC_Daily Admin: Happy to hear! Ready to start our AMA?

Tom: Ya ready!

Q1: Now to start the AMA, please tell the community what Waterfall is all about & story behind?

Tom: So Waterfall DeFi is a yield aggregator protocol that aims to bring true risk tranching to the DeFi landscape.

We are built on BSC initially, and would develop portfolios that include different farms. Instead of just offering a yield aggregation product, we actually would slice the portfolio into different “tranches” – essentially each tranche represents a risk/reward combo that would allow the users to select.

The senior tranche would receive a reduced yield return, in exchange for first lost protection. Junior tranche would receive a much higher, leveraged yield return, but their capital is used to cover any losses suffered from the portfolio.

For example – a portfolio with 10% expected yield, after we slice it into 2 tranches, the senior tranche will receive 5% return, while the rest will flow to the junior tranche. So in a perfect world, the junior tranche will get 15%.

The senior tranche is essentially using their future return to buy protection against any capital lost.

So in this example – if the farm underperform and the return is only 3% – senior will still get their 5% (as they are being paid out first), while junior might see a 2% lost in their capital.

Like I mentioned earlier, we are launching first on BSC, with the first portfolio focusing on 3 BUSD farms. Going forward, once we are more matured and the community is more educated to the product, we will be pushing out not just safe, sustainable return package with major farms and high TVL, but also risky leveraged products and new farms with high APY.

Goal is to create different types of investment options and risk factors that users can select based on their preference!

Waterfall is a pretty well-known terminology in TradFi to describe risk traching products. Let’s try to visualize this, imagine every risk tranching product as a series of waterfalls.

The senior tranches are the beginnings of the stream, starting at the mountain tops and taking their fixed percentage yield while the junior tranches will receive the remaining runoff. When the market is doing well, yield increases; like a rainstorm overflowing the river banks the junior tranches receive a higher cut as senior tranches are only entitled to their fixed percentage yield.

Vice versa, when the market is in decline, yield decreases, like a drought where senior tranches remain entitled to their fixed cut as junior tranches are left with only droplets.

Q2: Can you tell us a bit about the team and their experience with crypto projects?

Tom: I am Tom, the Project Lead of Waterfall DeFi, the risk tranching protocol offering structured risk products to the DeFi space…I started off my crypto journey back in 2017, my buddy was at MIT Lab and was using the lab to mine ETH, so I kinda joined on his bandwagon, and have been on and off since then.

Gradually during last year’s DeFi summer I decided to put more attention into the space, looking into yield farms and applications of derivatives, and finally earlier this year decided to go all in, and take on the Project Lead role for Waterfall DeFi.

Before going full time in crypto I was working in management consulting, operations and strategic planning, having worked at McKinsey & Co, before moving to a food delivery tech unicorn Deliveroo. As the Project Lead in Waterfall DeFi I am basically in charge of handling everything and making sure Waterfall gets to become one of the projects that stands out across the space and offers what the DeFi community needs especially in terms of risk management options in yield farming.

Our team is comprised of professionals with years of experience from both TradFi, consulting, fast-growth tech and Crypto/Defi markets. We strive to deliver the best risk tranching product in this ever-changing industry.

With the spirit of decentralization, our team is formed by nerds all over the world.

Apart from me, here are two other key members of the team

Founder: 0xWaterfall

10+ years of experience in Tier 1 Investment Bank specializing in Cross Asset Structured Products. 4+ years in crypto trading. Will be responsible for all aspects of the project.

Product Lead: 0xNiagara

Master of Finance and an Electronics Engineer. 10+ years experience in structured derivatives and fixed income trading. 5+ years in crypto derivatives trading. Defi OG (YFI farmer). Will be responsible for designing product strategy.

Q3: Can you walk us through the uniqueness of Waterfall?

Tom: Yaa sure! In fact we are the first true risk tranching protocol on BSC, and probably on the other chains as well in the future!

In the traditional market, a significant portion of the financial products is fixed rather than variable. On the other hand, DeFi lending protocols are currently 100% under the variable rate regime, which lacks the environment for DeFi to cross over with the traditional market. And bring the money into this open, permissionless financial world on the blockchain.

Under the variable-rate regime, the introduction of risk-related products to the DeFi space will bring further development in the already growing sector, and structured products are the next big thing to emerge on the DeFi horizon.

Structured products (options, futures, etc.) allow users to better control their investment portfolio, finesse their risk tolerance, and min./max. their trading strategy to further leverage their positions.

Among structured products, the concept of risk tranching is particularly well positioned in the current DeFi market — relatively simple to grasp, it introduces a fixed income product that provides attractive yield options to investors with different risk appetites. In the DeFi space where everyone is seeking a good yield — especially if they’re in a bear market — attractive rates offered by risk tranching products is a strong option for anyone looking to delve deeper into the DeFi community.

So… we know that there are a few similar concepted protocols in the space now, and Waterfall is a bit different from them due to the following features:

1. Diversification

Our portfolio strategies package multiple DeFi assets and yield farms to ensure risk and return diversification.

In the future, we aim to include more diversified assets to ensure an abundance of options for the community.

2. Clear tranche differentiation

A TVL limit is set initially for each tranches in the initial launch to ensure clear tranche differentiation.

Going forward will lift the limit but will introduce dynamic reward to incentive optimal user behavior.

3. Three tranche approach

We launched our first product, the BUSD Falls, with a three-tranche product, expanding the optionalities for the community.

4. Fixed income product

Fixed income products are available through our tranches by locking up the user deposit for a fixed period of time (seven days) during the deployment period.

A comparison matrix showing the key differentiators between us and other risk restructuring projects across the DeFi ecosystem!

Q4: Kindly share with us about Tranching & Key advantages.

Tom: Think tranching of this: Alice and Bob are two big whales. They both love yield farming and enjoy the high APY offered in the DeFi space. Alice is very aggressive with her capital: she likes putting her money into the latest yield farms that offer crazy high APY. Bob is conservative with his capital: he prefers having a guaranteed return of yield that endows him a stream of fixed cash flows over time.

The thing about yield farms is even DeFi’s biggest farms contain a certain risk of a full loss of capital due to protocol attacks, and the returns in yield farms often vary so that a guaranteed and predictable return is difficult to achieve.

To solve this, we ask Alice and Bob to bundle their capital together as a whole and deploy into farms, so they are now a farming fund which Alice and Bob have 50% of ownership to the fund respectively. Suppose the predicted APY is 20%, Alice and Bob should be splitting the yield half-half, getting half of the yield each.

However, as Alice is looking for high yield and doesn’t really care about risks, while Bob is looking for low risk and predictable return, Alice and Bob can negotiate a deal: As the yield starts getting farmed, say 20%, Bob will receive a fixed amount of yield first, say 8%, and the rest of the yield, 12%, goes to Alice. This doesn’t seem fair right? Both contributed the same amount of capital however Bob is getting less yield than what he deserves. However, imagine now the yield farms perform poorly and the yield generated is only 15%. Bob will still get his fixed payment: 8%, while Alice’s only getting 7%.

Now you see the idea: Bob is sacrificing his some of his fair share (8% vs 12% under 20% APY situation) plus potential extra yield gains (8% vs 16% under 24% APY situation) to Alice in exchange for maintaining the stability of his yield returns, and hence Bob transferred his portion of yield volatility risk to Alice, which Alice accepts taking on the extra risk in exchange for higher returns under situations when yield is equal to or better than expected.

If Alice did not enter such agreement, her share of yield will be split equally, getting only 10% instead of 12%.

Tranches, as a concept came from TradFi, can be viewed as categories of risk and rewards in a pool of capital: a senior tranche in Waterfall DeFi is the fixed yield return side with the highest priority to receiving interest payments (a pool of many Bobs);

while a junior tranche is the variable yield return side with the lowest priority to receiving interest payments (a pool of many Alices). Through tranching a pool of capital put into DeFi yield farms, users will have the autonomy to choose their desired balance of risk versus rewards, or essentially, insure their capital against yield volatility without upfront payment.

Q5: Let’s dive into your token. Tokenomics & use cases? Where and how can the community buy your token?

Tom: Our project is fully committed into making the protocol as decentralized as possible. Even our team members are formed across the world of yield farming strategists and DeFi OGs.

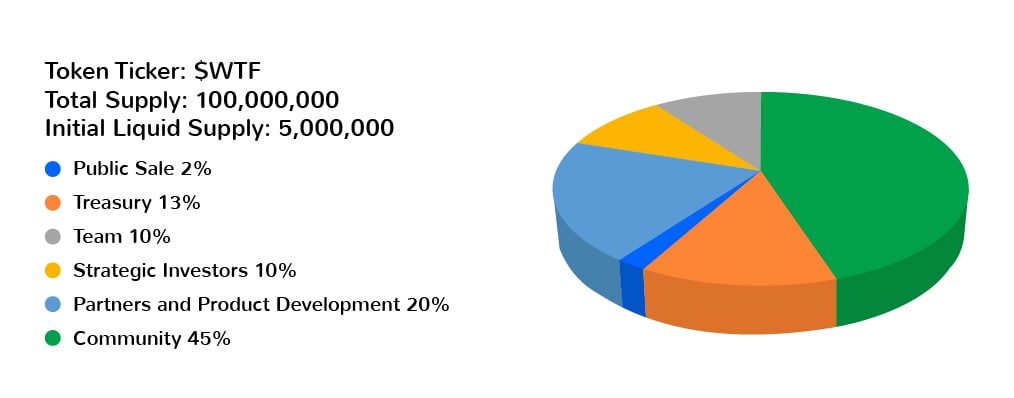

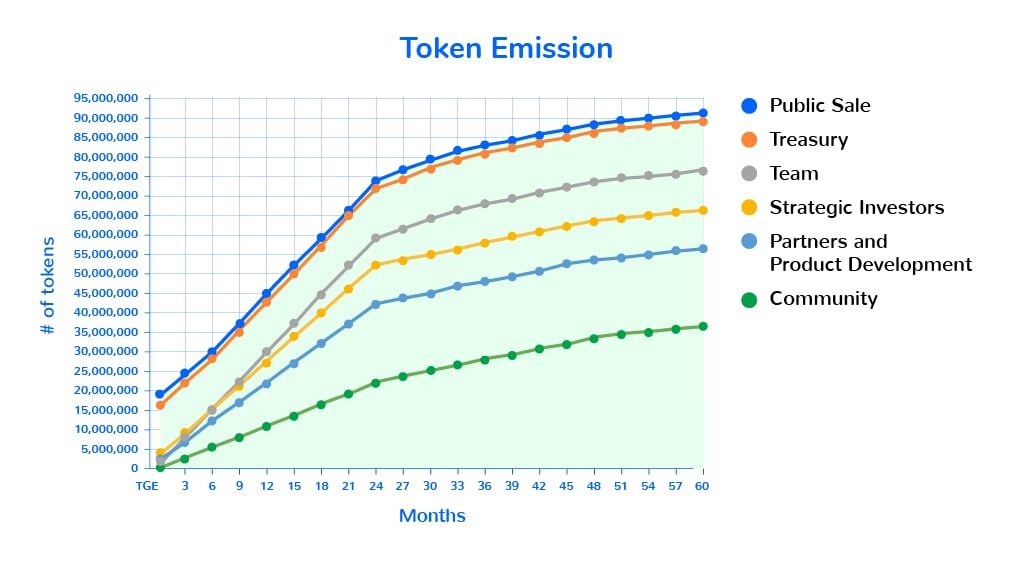

As in our tokenomics, we have committed 60% of the tokens allocated to our community, via user incentives like staking, liquidity provisioning, public sale and our treasury — the usage will be decided in our future DAO.

For more information about our tokenomics, can refer to this article: https://medium.com/waterfall-defi/waterfall-defi-token-metrics-aead80c89627

There are three major use cases for our tokens:

1. You can stake our token to earn the governance token, which in terms would allow you to vote on upcoming protocol decisions such as approving new portfolio strategy

2. Holders of our governance token would have the right to earn a portion of the transaction fee we charged from users

3. Going forward, users with our governance token can propose their own risk tranching products and earn structuring fees

Q6: Let’s talk about marketing plan, partnerships & influencers that you are collaborating with.

Tom: Ya sure on the marketing side we have been working with various marketing partners and VCs are also very helpful on connecting different opinion leaders across the circle…

We believe product and our community is the first priority and marketing comes along… that doesn’t mean we don’t have strong marketing partners, BSC Daily has been one of our partners that have been helping us to share our product’s news and vision to the community and circle you guys have!

Besides we also have different influential people in the space invested in us: CryptoDog, Boxmining are all our angel investors

here’s a thread of our friend CryptoDog introducing our project!

Hello 😊, join our announcement channel and international communities below:

Announcement Channel (https://t.me/waterfalldefi_announcements)

中文 Chinese 🇨🇳 (https://t.me/waterfalldefiCN)

Japanese 🇯🇵 (https://t.me/waterfalldefi_japan)

Korean 🇰🇷 (https://t.me/waterfalldefikor)

Portuguese 🇵🇹 (https://t.me/waterfalldefi_portuguese)

Spanish 🇪🇸 (https://t.me/waterfalldefi_spanish)

Turkish 🇹🇷 (https://t.me/waterfalldefi_Turkish)

Vietnamese 🇻🇳 (https://t.me/waterfalldefivn)

Besides, we also have other language’s channels, ran by our partners!

In the future as we release and build out more products, we will make sure our stuff is acknowledged by the DeFi space, no matter through marketing, or farming initiatives (we are having retroactive airdrops currently btw!)

Q7: What are the project goals? Can you share with us your roadmap in the next 6 months?

Tom: Expanding to Solana and other EVM-compatible chains is on the roadmap, EVM side is easier since most of the codebase can be reused, Solana we will expand our team with rust developers to do the work

In our opinion BSC is the second most mature DeFi space, with a lot of mature, high TVL farms right now, and the gas fees are negligible.

That being said, this is just the first step, and we are actively looking at expanding into other blockchains in the near future.

And here are our rough timeline:

2021 Q3 – initial funding, product development, initial marketing

2021 Q4 – public sales, test and v1 product launch, with BUSD stablecoin farm introduced

2022 Q1 – v2 product launch, introduce DAO, expand selection of DeFi assets in the portfolio, and user originated portfolio

2022 Q2 – v3 product launch, introduce variable and perpetual expiry tranches

In the meantime… We have also been exploring into other risk tranching opportunities, LP tranching is one of them!

Impermanent loss has been a big topic across the space, at which we must balance the cost and benefit of liquidity..

Therefore these days we have been modeling the concepts of LP tranching… which hopefully we could get them put into action soon!

Beyond that, in fact there’s a lot of risk that can be tranched, mitigated or transferred… beyond protocol security risks and IL risk… there’s also risk lies in such as Layer-1 chains staking systems… so we will also be looking into other options that we can tranche and restructure the risk-reward offered into different levels, and redistribute them to the right hands.

Q8: Where can we find out more about Waterfall on social media?

Tom: All here

Website: https://waterfalldefi.org/

Twitter: https://twitter.com/waterfalldefi

Telegram: https://t.me/waterfalldefi

Discord: https://discord.com/invite/gS9Gda4sez

Medium: https://medium.com/waterfall-defi/

BSC_Daily Admin: With this, we are now at the end of our AMA session with Waterfall DeFi.

Time for wrapping up, any last words you would like to say to our community?

Tom: Thank you so much for having me today, we are really grateful to be interacting with the BSC Daily community.

At Waterfall DeFi we keep building tirelessly to offer the DeFi community the autonomy of choosing between risk and rewards for everyone’s yield farming journey. We believe our tranched products will be one of a kind and it’s gonna be a great addition on top of the DeFi legos we have now…

be sure to follow @waterfalldefi_announcements and our group chat @waterfalldefi for the latest updates… until then stay safe and enjoy the Web3 revolution brothers and sisters!

BSC_Daily Admin: Thank you so much for spending time with our community & all the very best for Waterfall DeFi.