The WAVES/USDT pair has been one of the top gainers of march 2022, registering a 230% gain since the beginning of the month. This exponential growth was backed by a series of positive news such as:

- The launch of a U.S-based venture, ‘Waves labs.’

- An announcement about the migration to Waves 2.0.

- Its partnership with Allbridge.

Key points:

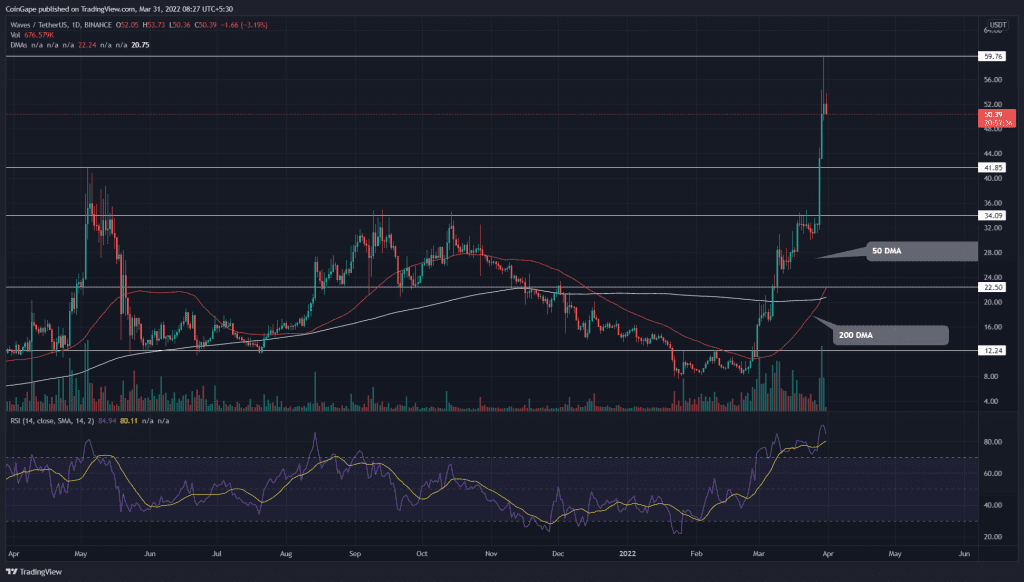

- The bullish rally triggers a golden crossover between the 50-and-200 DMA

- The intraday trading volume in the WAVES is $1.85 Million, indicating a 59% loss

Source- Tradingview

From mid-October 2021 to early February 2022, the WAVES price experienced a one-sided downfall2 which plunged the altcoin to the $8 mark. On February 7th, the coin breached the downtrend carrying resistance trendline, providing an early sign for reversal.

After its third retest to $8 support, the WAVES price rebounded and gave a bullish breakout from the $14.5 local resistance. The post-retest rally triggered a massive pump and drove altcoin high in the price chart.

The bull run sliced through some crucial resistance levels such as $22.5, $33.8, and the All-Time High resistance of $41.85. The buyers pushed the WAVES price to its new All-Time High at the $60 mark, which indicates a 270% gain from the beginning of the month.

However, on March 30th, the daily candle showed a long-tail rejection from the $60 mark, indicating the sellers are rejecting at a higher price. Today(March 31st), the altcoin is down by 4%, suggesting a possible retracement before the next leg-up.

The expected pullback could obtain support from the $44.85 or $33.8.

Technical indicator

The daily-RSI indicator slope spikes into the overbought region, bolstering a minor correction.

The important DMAs (20, 50, 100, and 200) are left behind by the fast-moving price. However, the coin price cannot stay far from its average for too long, and therefore a pullback is needed to maintain a healthy rally.