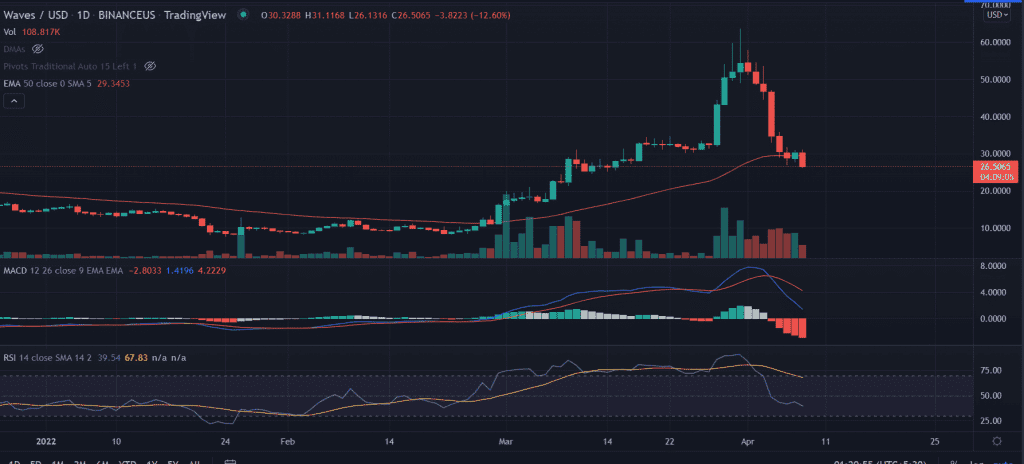

WAVES price downtrend shows an increase in the selling pressure that has pushed it past the immediate support level. The current movement could lead to a further crash if WAVES buyers sliced the vital support levels.

- WAVES price edges lower with significant losses on Friday.

- The price trades near critical support around $25.0, more downside if the level is broken.

- WAVES price lost nearly 45% since the beginning of the week.

WAVES price looks for downside continuation

WAVES price is currently hovering at $26.0 within a previous demand zone. The token dropped 45% since the beginning of the week. Now, if the price breaks the reliable support level it would trigger a fresh round of selling in the asset. In addition to that, the slippage of the 50-day EMA (Exponential Moving Average) at $29.46 hints at the brewing bearish sentiment further.

Since this area constitutes a demand zone and a support level, a breakdown of the former will indicate a rise in selling pressure and could trigger a further crash.

Investors would collect the liquidity near the demand zone extending from $20.0 to $17.06.

advertisement

On the flip side, if the WAVES buyers bind together then the price would have a good chance of recovery above $30.0. This would alleviate the prevailing bearish outlook. A consolidation above the session high could be key toward another run-up to $40.0. This would be a 53% price appreciation from the current level of $26.0.

In a highly optimistic scenario, WAVES price could extend the gains and retest the psychological $50.0 level.

Technical indicators:

MACD: The Moving Average Convergence Divergence slipped sharply below the mid-line with heavy selling pressure.

RSI: The daily Relative Strength Index approached the oversold zone. It reads at 39, still far from the extreme condition.