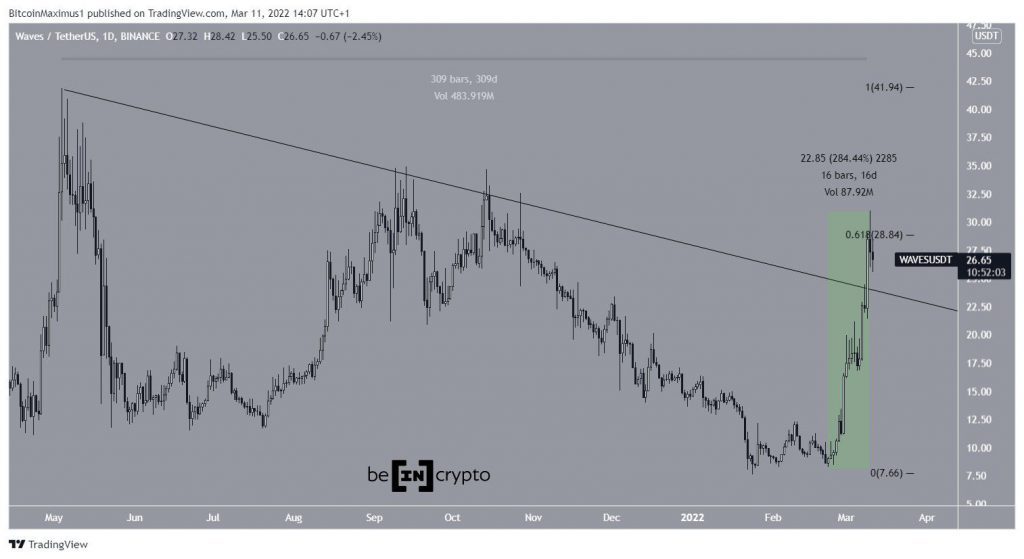

Waves (WAVES) has broken out from a long-term descending resistance line, suggesting that it has begun a new upward movement.

WAVES had been decreasing alongside a descending resistance line since hitting an all-time high of $41.86 on May 4. The downward movement has led to a low of $7.56 on Jan 24.

On Feb 22, WAVES initiated a rapid upward movement and increased by 284% in 16 days. This created a high of $31 on March 10 and caused a breakdown from the descending resistance line. Prior to the breakout, the line had held in place for 309 days.

However, the price was rejected by the 0.618 Fib retracement resistance level at $28.90 and has fallen slightly since.

Short-term WAVES movement

On Feb 28 (shown in green), WAVES broke out from an ascending parallel channel which had previously been in place since Jan 24. This is a sign that the upward movement is impulsive, which means that the underlying trend is bullish.

However, both the MACD and RSI have generated bearish divergences (green lines). Therefore, it is possible that a downward movement will follow.

If that occurs, the closest support levels would be at $19.60 and $22.30. Which are the 0.382 and 0.5 Fib retracement support levels, respectively.

Cryptocurrency trader @TheEuroSniper tweeted a chart of WAVES, stating that the price could fall to the low $20s.

If the bearish divergences play out, it is possible that the price will fall to this level.

Wave count analysis

The decrease since the May 4 all-time high resembles an A-B-C corrective structure in which waves A:C have had a nearly 1:1 ratio.

The rate of increase of the ensuing upward movement and the breakout from the long-term descending resistance line support this possibility.

Therefore, despite the likelihood of a short-term pullback, it is possible that WAVES has begun a new upward movement that will take it to another all-time high price.

BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.