Will it or won’t it? That is the question many crypto-investors have as they wait with bated breath for Bitcoin to either cross $40,000 again or drop back to its $35,000 lows. However, not all investors are equal and there are some factors to keep in mind.

Whales are counting sheep?

Bitcoin whales with a balance of between 100 and 100,000 BTCs have not significantly risen or fallen this month. Curiously, this was in spite of drastic price changes.

In fact, one crypto-analyst suggested that the whales might be waiting for a sale so as to snap up the king coin at an even lower price. In light of Bitcoin falling below $34,000 in late January, this might not be a far-fetched idea.

The number of whales on the network with 100 to 100,000 $BTC has remained flat since Feb 1. These wealthy market participants do not appear interested in buying #BTC at the current price levels and could be expecting to buy #Bitcoin at a discount. pic.twitter.com/HqGTzD9guP

— Ali Martinez (@ali_charts) February 20, 2022

If that wasn’t enough, the analyst also noted that the number of new addresses entering the Bitcoin network has been moving sideways for the most part. The analyst linked this to a “lack of interest in the spot markets.”

#Bitcoin | The lack of interest in the spot markets can be seen in the # of new daily $BTC addresses joining the network, which has remained stagnant at an average of 400,000.

A spike in this on-chain metric can signal the continuation of #BTC uptrend. pic.twitter.com/jWNkzJjPEj

— Ali Martinez (@ali_charts) February 20, 2022

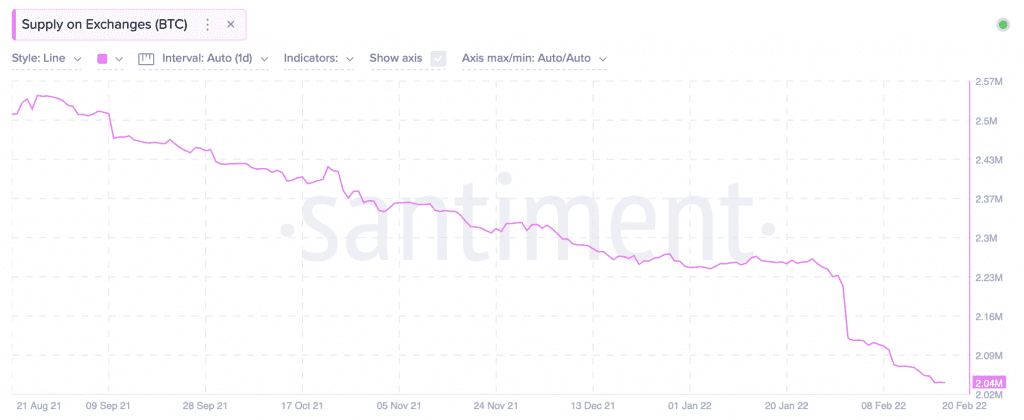

A look at exchange supply, however, provides a much clearer picture of what investors might be doing. While the number of Bitcoin on exchanges has been on a steady downward trend thanks to the king coin’s popularity, the end of January 2022 brought an especially sharp drop. This was likely due to many buying the dip.

However, there have been about 2.04 million BTCs on exchanges since 18 February.

Source: Sanbase

But, how are investors feeling about this lull in activity after weeks of dramatic changes, crashes, and price movements? Well, weighted sentiment has turned negative again. What’s more, on 19 February, it hit a level of -1.33, not seen since the fall of 2021.

While this may look dire, it’s important to remember that negative sentiments have the potential to trigger a price rally.

At press time, Bitcoin’s price had dropped below the $39,000 mark yet again.

Source: Sanbase

A change of scenery?

It might look like Bitcoin whales and investors are feeling listless, but that might not be the case worldwide. In Canada, where the government is trying to cut off crypto-funding to the Freedom Convoy protestors, interest in Bitcoin is rising.

In fact, Purpose – a Canadian Bitcoin Spot ETF – recorded formidable inflows of more than 1,000 BTC in a single day.

The Canadian Purpose #Bitcoin spot ETF just saw one of its biggest inflows ever on Friday! 🇨🇦Adding almost 1.2k $BTC in one day. Only surpassed by inflows on one of its first trading days on Feb 22, 2021. AUM now at a new ATH with 32.26k bitcoin! 🚀 pic.twitter.com/DOO3OtocQ3

— Jan Wüstenfeld (@JanWues) February 19, 2022