On-chain data suggested that June was the worst month for Bitcoin [BTC] considering the performance of the king coin since 2011. It took a dip of 37.5% over the month in an already catastrophic Q2. Feds, inflation, and now recession rumors are circling around the crypto market. How will these talks affect the BTC performance in the coming weeks?

Despite the grievances during June, the month of July has bought some respite for Bitcoin. The entire crypto market is going through a so-called “mini rally”. Even so, Bitcoin managed to trade above $20,000, albeit briefly. It is currently trading just below the $19,900 mark with the bulls dictating an upward motion. The current surge of 3.96% on BTC prices has created a positive sentiment across the market.

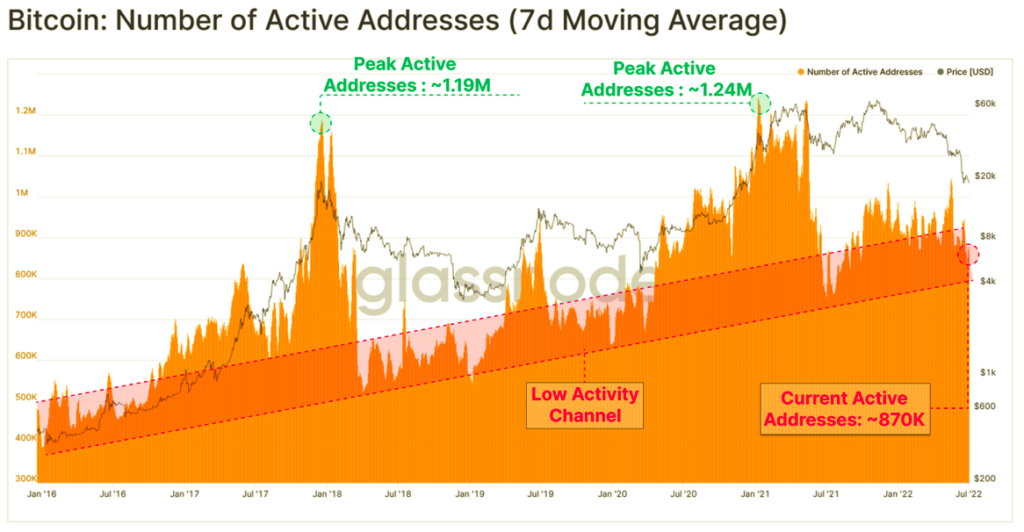

Meanwhile, Glassnode has released its weekly newsletter discussing important on-chain metrics. The report admits that,

“With US inflation estimates for June remaining elevated, and storm clouds of a potential recession looming, the market remains heavily risk off. This is evident in the on-chain performance and activity of Bitcoin, which has reduced modestly in recent weeks.”

The newsletter included the following data to support its claim.

Dive in to data!!

There has been a shift in active addresses on Bitcoin since its peak in November 2021. At the time, around 1.2 million addresses were active on the network. While the numbers have fallen to 870,000 as of 5 July, it has become difficult to retain the existing addresses given the grim scenario of the market.

The entities net growth metric has observed a downward trend which shows the difference between new and leaving entities on-chain. The growth rate saw a couple of spikes during the Luna collapse and again during the sell-off in late June. Furthermore, these numbers have plunged to the bear market levels of 2018 and 2019 after dropping to daily new 7,000 entities.

Contrary to the aforementioned data, there is an interesting development related to the Bitcoin supply on exchanges. Despite falling prices, there has been a rise in the number of exchange outflows in recent months. Since March 2020, over 750,000 BTC has been taken out of exchanges. However, in the past three months alone, 18.8% of the total or 142.5k BTC was seen in outflows. This is indicative of a growing community with strength in numbers.

Recent on-chain data was also suggestive that the worst might be over for Bitcoin. Furthermore, the crypto community has been euphoric since the revival of Bitcoin when it crossed $20k on 5 July. Crypto enthusiast, Lark Davis, was also seen sharing this joy with his one million followers.

Look… on the bright side we can all celebrate when #bitcoin gets back over $20,000 again!

— Lark Davis (@TheCryptoLark) July 5, 2022