Bitcoin price fluctuations matter to miners more than they do to almost any other demographic of bitcoin investors because of the price’s effect on mining hardware markets. Regularly checking the price can often be counterproductive for long-term, diamond-handed HODLing, but the dollar value of bitcoin is important to any mining operation, especially for miners that are planning to acquire more hash rate.

A lower bitcoin price usually means slightly discounted prices on mining hardware for reasons explained in this article. With bitcoin still sitting nearly 40% off its latest all-time price high at the time of this writing, the prices for mining hardware have started to drop. This article explains the idiosyncrasies of the mining hardware market and its relationship to bitcoin, and it summarizes the mining market’s status quo amid a generally less frothy cryptocurrency market and the opportunities cheaper mining hardware could present.

Mining Hardware Market’s Relationship To The Bitcoin Price

Understanding how bitcoin’s price affects mining hardware prices isn’t complex. For one thing, since hash rate generally follows or lags behind bitcoin’s price movements, prices of ASICs — the source of hash rate — similarly lagging behind is not surprising. During downward price trends for bitcoin, the decision by some miners to unplug and even liquidate their hardware followed by the accumulation and deployment of new hardware during bullish periods tracks with (and somewhat intuitively explains) hash rate’s relationship to price.

In short, when the bitcoin price starts going up, sidelined miners are incentivized to plug in old machines and/or to buy new ones since the dollar value of the bitcoin they mine is higher. This price appreciation triggers higher demand for mining machines, which pushes hardware prices up, and eventually results in higher levels of network hash rate. When the bitcoin price starts going down, some miners become less profitable or altogether insolvent, which forces hardware liquidations, removes hash rate from the network and erodes some of the buyer demand for new machines that was present during the bullish period.

Mining hardware prices also tend to lag bitcoin because of their basic function as “money printers,” which makes their owners reluctant to hastily sell them. Between the operating costs, capital expenditures and overall bullish ideology required to start mining, this sector of the Bitcoin industry is by far the most heavily leveraged long out of any others. Thus, when the price goes up, miners are eager to buy more hash rate. And when the bitcoin price starts to dip, miners — even those with exceptionally thin profit margins — stop hashing and liquidate their hardware only when they have absolutely no alternative, which generally occurs sometime after bitcoin’s price has started to decline. In short, the internet money printers are valuable.

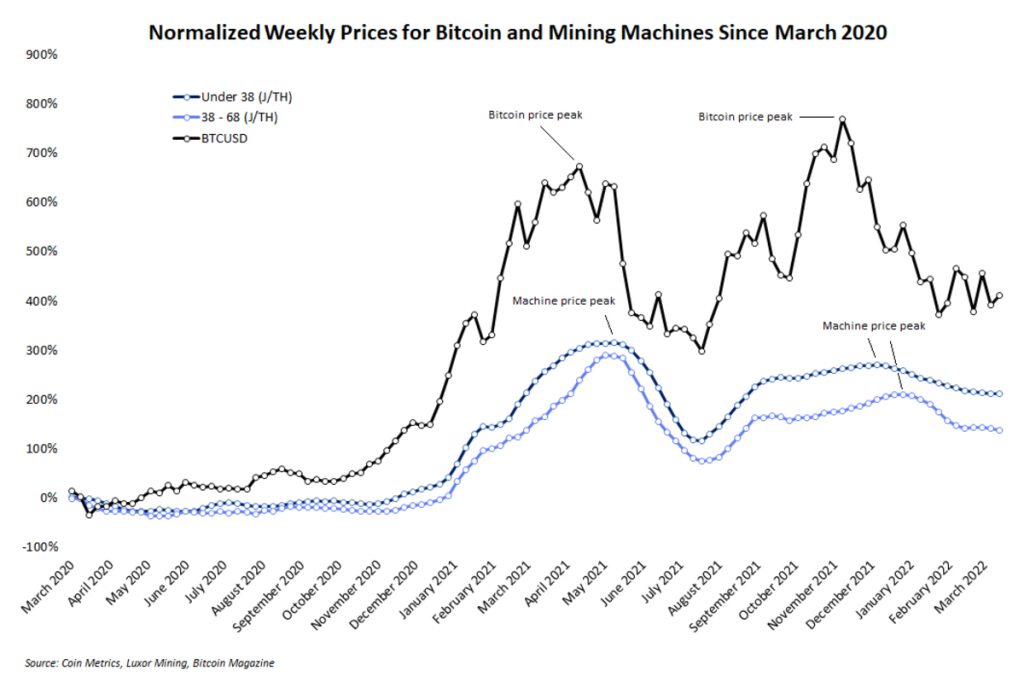

Observing the latest mining machine pricing trends compared to bitcoin’s price offers helpful insight into the relationship between the two data sets. The line chart below shows that even though price declines for bitcoin and mining machines have been roughly equal, the downward trends did not start at the same time.

The normalized weekly prices of bitcoin and mining machines indicate that, though they correlate, changes don’t start at the same time.

Bitcoin’s first price peak was in April 2021, but machine prices didn’t follow its downward move until nearly a month later in mid-May 2021. Several months later, bitcoin peaked again in early November 2021, but machine prices didn’t start dropping mid-December 2021 and early January 2022.

The Current Mining Hardware Market

Like network hash rate and mining difficulty, the price of mining hardware also trends up or down with bitcoin. Thus, it’s not surprising that most pricing data from hardware resale markets show costs flattening or trending down. Later sections of this article explain this relationship, but for now, observe the latest pricing data visualized below.

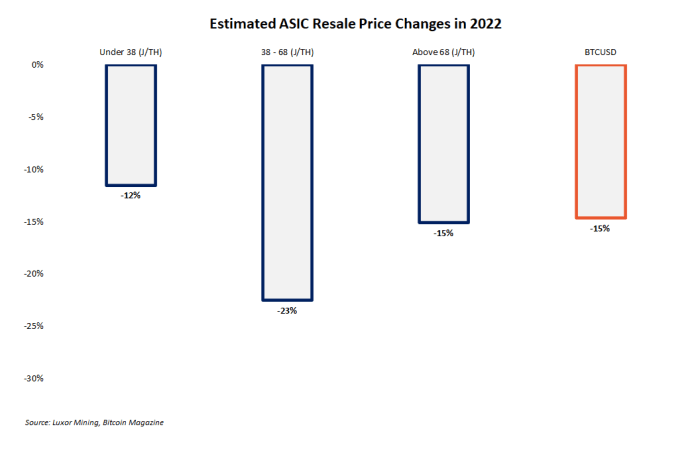

Year to date, bitcoin’s price has dropped roughly 14% at the time of writing, according to data from Coin Metrics. Over the same period, mining machines have similarly dropped by 12% to -23% depending on what level of machine efficiency is accounted for, according to pricing data aggregated by Luxor Mining.

The following bar chart visualizes machine resale price changes compared to bitcoin’s price in 2022. The data is sorted by hardware efficiency measured in joules per terahash (J/TH). Note that the data presented are not exact prices, but aggregate prices collected from a variety of independently operated resale markets. Since the start of the year, downward price movements for all categories of mining machines have roughly matched bitcoin’s price drop. The mid-tier efficiency machines have experienced the largest markdown in prices, with this category including models like the Whatsminer M30s and the Antminer S17.

Seeing machine prices fluctuate by double-digit percentages since the start of the year isn’t a big surprise considering bitcoin’s characteristic volatility over the same period and the 20% to 40% machine price increases recorded in Q3 2021.

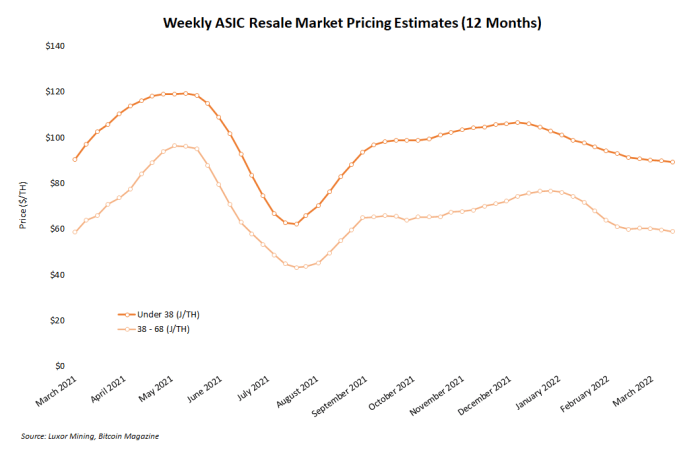

That volatility dissipated through. From Q4 2021 to date, mining machine prices experienced significantly smaller price changes. The line chart below visualizes weekly machine prices over the past 12 months for the top two tiers of machines sorted by efficiency — under 38 J/TH and 28 to 68 J/TH. Even though a downtrend since the holiday season is clear, machine prices are approaching the same levels they saw last year in March.

What’s Next For Mining Machine Prices?

Have ASIC miner prices bottomed? And if not, when will they?

The answer is: it depends on bitcoin’s price. At the time of writing, bitcoin is still trading around $40,000, and where it goes from here is anyone’s guess. Cryptocurrency traders and investors have widely disparate predictions for the bitcoin market through the rest of 2022 thanks to a variety of instability catalysts, including record monetary inflation, European conflict and lingering coronavirus variants. But no matter where bitcoin’s price goes, mining machine prices will almost certainly follow.

Just like when bitcoin goes on sale — meaning the price drops — discounted mining machine prices also present opportune buying conditions for miners. Bullish market conditions are always kind to paper gains on machine values for miners. And by the same principle, bearish conditions offer nice gifts in the form of discounted machines for miners looking to add more hash rate.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.