The market-wide crash in the last week of November saw BTC drop to a 50-day low of $53.3K. Thereafter, the coin started to rebound amid an influx of bullish news from across the market. November, a month that was supposed to reap close to 40% gains for Bitcoin saw the coin dip by over 20% as anticipations of a Moonovember faded away.

Even so, the king coin made a monthly close above $60K reassuring the market of a decent run ahead.

Return of the bulls?

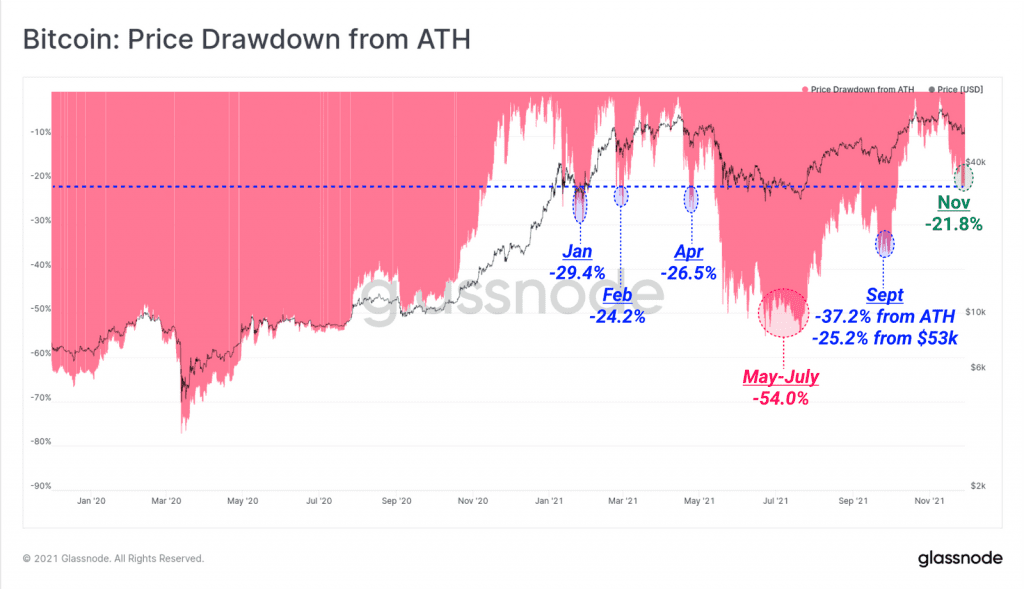

On November 29, Bitcoin’s price finally picked up noting close to 4% gains as the monthly candle closed above the $60K mark. While the larger market seemed to take a rather bearish tone over the last couple of weeks, data from Glassnode highlighted how Bitcoin’s 17% fall from ATH made the recent correction the shallowest of the year so far.

Source: Glassnode

That being said, in the options markets, nominal open interest throughout October and November has been between $12 billion and $14 billion. The total open interest over the last week dropped down to approximately $10 billion following the November 26 expiry of contracts.

The Futures open interest was also just below all-time-highs when denominated in BTC, reaching just above 400K BTC in total nominal value. By and large, open interest leverage in options and futures near ATH values, is a cause for some concern regarding heightened ‘flush out’ potential. While funding rates suggest an only slightly positive bias, making both a long- or short- squeeze plausible scenarios in the near term.

Market’s evolving?

A look at BTC’s liveliness compares Bitcoin activity, a rise in the same highlights spending behavior while a fall notes accumulation behavior. Liveliness Ribbon prints when the 30-day average of Liveliness is lower than the yearly average, which occurs in periods of heavy accumulation.

Interestingly, BTC’s Liveliness Ribbon has only printed five times in Bitcoin’s history, four of them near market lows, the fifth one was last week. The same demonstrates how stoic and steadfast the HODLers have remained.

This also makes a good case for BTC’s store-of-value properties which are emerging as the market evolves.

Thus while BTC’s long-term prospects in terms of market maturation look good, BTC’s short-term performance could still have some consolidation. December has generally been a good month for the top coin. However, a failed anticipation from November has left participants skeptical.

Notably, in December 2017 BTC made over 100% gains over the one-month period, while in 2020 it saw over 70% gains. Now, with November expectations having failed, whether December will pan out the way it did historically, remains to be seen.