Published 6 seconds ago

While the crypto market is still under bearish reign, the XRP price skyrocketed on September 22nd as the long-coming XRPvsSEC is nearing its end and the XRP side seems more optimistic. Thus, the trader’s confidence is turning to this altcoin, and the discount price attracts more buyers. However, the XRP price analysis the new buyers should wait for a possible pullback.

advertisement

Key points XRP price analysis:

- The gradual rise in volume activity indicates genuine recovery

- A higher price rejection candle suggests a minor correction in the XRP price

- The intraday trading volume in the XRP is $7.47 Billion, indicating an 82% gain.

Source- Tradingview

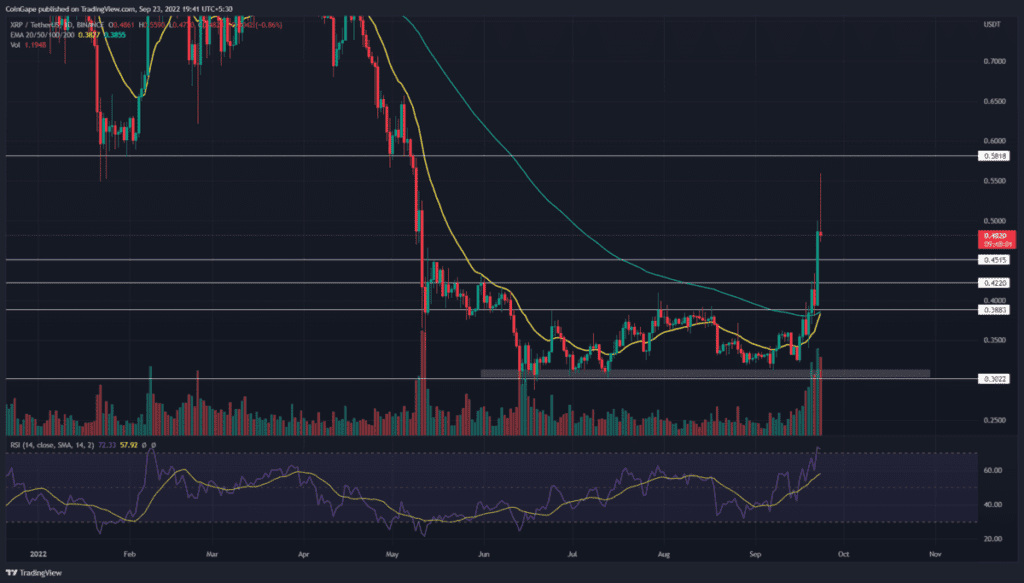

For the past three months, the XRP/USDT pair resonated in a range-bound rally stretched from the $0.388 to $0.3 barrier. The multiple retests to the bottom support reflect the strong buying activity at this range.

On September 7th, the XRP price rebounded from this support and initiated a new recovery rally. As a result, the XRP price surged 80% within three weeks and marked a record high of $0.5523. This bull-run was backed by the whale’s accumulation and improving traders’ sentiment for the XRPvsSEC case.

Trending Stories

On September 22nd, the coin buyers gave a massive breakout from the monthly resistance of $0.45. Earlier today, the buyers tried to follow up on this breakout, but the profit booking from short-term traders reverted the price immediately.

This long-wick rejection accepted supply pressure and a need for a minor pullback before prices resume their prior recovery.

If this theory worked out, the possible retracement would likely retest the $0.45, $0.422, or $0.388 level as a potential support to encourage further rallies. Moreover, the technical chart also reversals a rounding bottom pattern, which in theory sets a significant growth for the asset.

Conversely, a daily candle closing below $0.388 will undermine the bullish theory.

Technical Indicator

EMAs: the rising prices have reclaimed the crucial EMAs(20, 50, 100, and 200), which could assist buyers in extending the ongoing rally. Moreover, the 20-and-100-day EMAs are on the verge of a bullish crossover, attracting additional buyers.

advertisement

Relative Strength Index: concerning the sudden jump in XRP price, the daily-RSI slope spike into the overbought region bolsters the pullback analysis.

- Resistance levels: $0.425 and $0.45

- Support levels: $0.39 and $0.31

Share this article on:

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.