Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Ethereum Classic [ETC] witnessed a death cross on its EMAs, can the buyers stop the bleeding?

- The altcoin saw an uptrend in its social volumes while the long/short ratio affirmed a bearish edge.

Ethereum Classic [ETC] buyers revved up their efforts to shift the broader momentum in their favor from the $21 baseline. But the sellers popped in at the $26.5-resistance to undermine the buying potential.

Here’s AMBCrypto’s price prediction for Ethereum Classic [ETC] for 2023-24

The resulting bearish pull’s bearish engulfing candlestick orchestrated a streak of red candles in the four-hour timeframe. The altcoin’s volatile decline can plateau in the high liquidity region.

At press time, the altcoin was trading at $23.26, down by nearly 7.27% in the last 24 hours.

Will the bears continue to press for more?

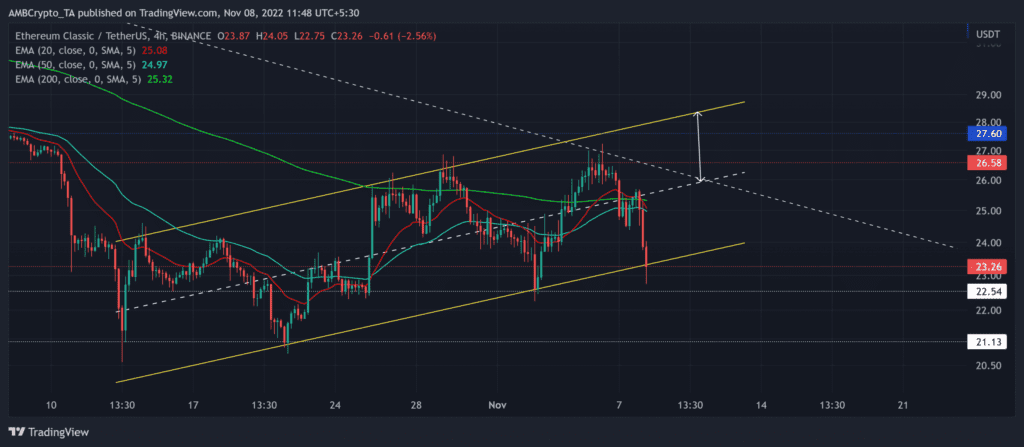

From a relatively long-term viewpoint, ETC has been in a decline phase, as evidenced by its two-month trendline resistance (white, dashed). The coin lost nearly half its value after its mid-September reversal from the trendline resistance.

While the $21-$22 range exhibited its inclinations to offer reliable support, ETC marked an ascending channel (yellow) growth.

Over the last few days, ETC broke into high volatility after observing a strong rejection of higher prices from the $26.5 ceiling. Thus, the sellers re-emerged to induce a close below the 20/5/200 EMA on the chart.

Going forward, a sustained close below the up-channel can position the coin for a continued downside in the coming sessions. A close below the $22.54 support could enhance the downside chances.

The first major support level, in this case, would lie in the $21 region, followed by the $19.5 baseline. A likely bearish crossover of the 20 EMA with the 50 EMA would further reaffirm the bearish edge.

In case the broader sentiment rekindles the buying pressure, any immediate recoveries would likely slam into the $26 ceiling before the upper trendline of the up-channel.

While it may be a long shot given the press time conditions, a close above these barriers would confirm a strong bearish invalidation.

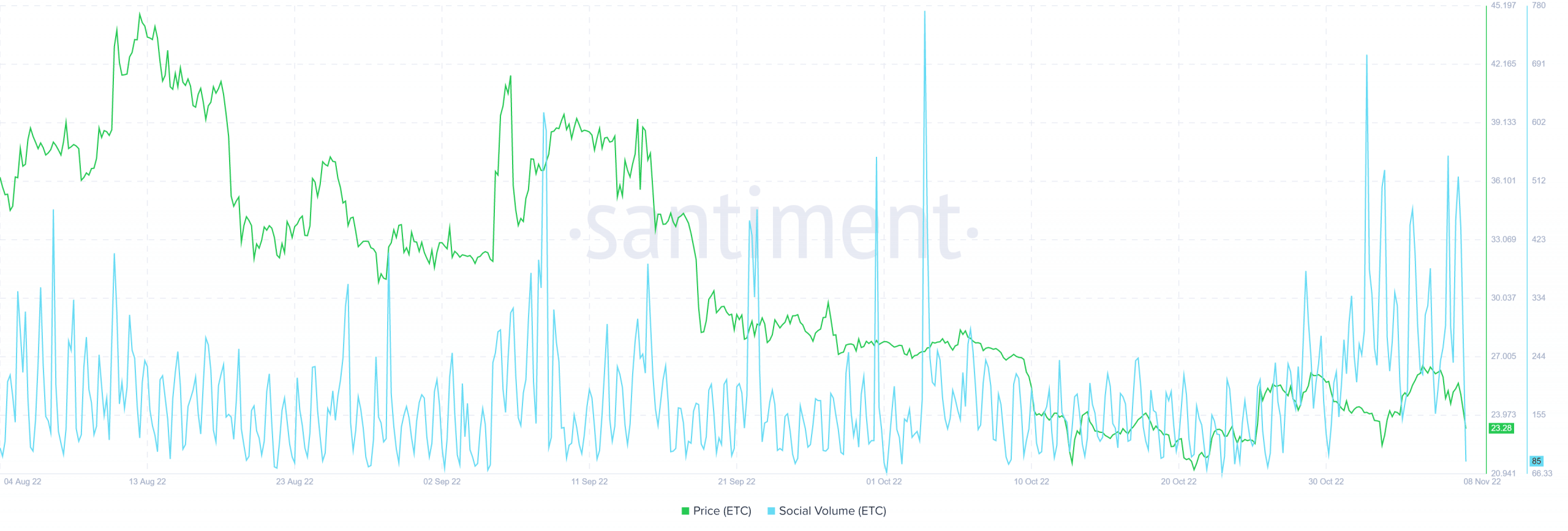

Improved social volumes, but is it enough?

Over the past month, ETC registered an uptick in its social volumes. Correspondingly the price action marked its uptrend by chalking out the up-channel on the four-hour chart. Continued growth on this end could aid the buyers in defending the immediate support zone.

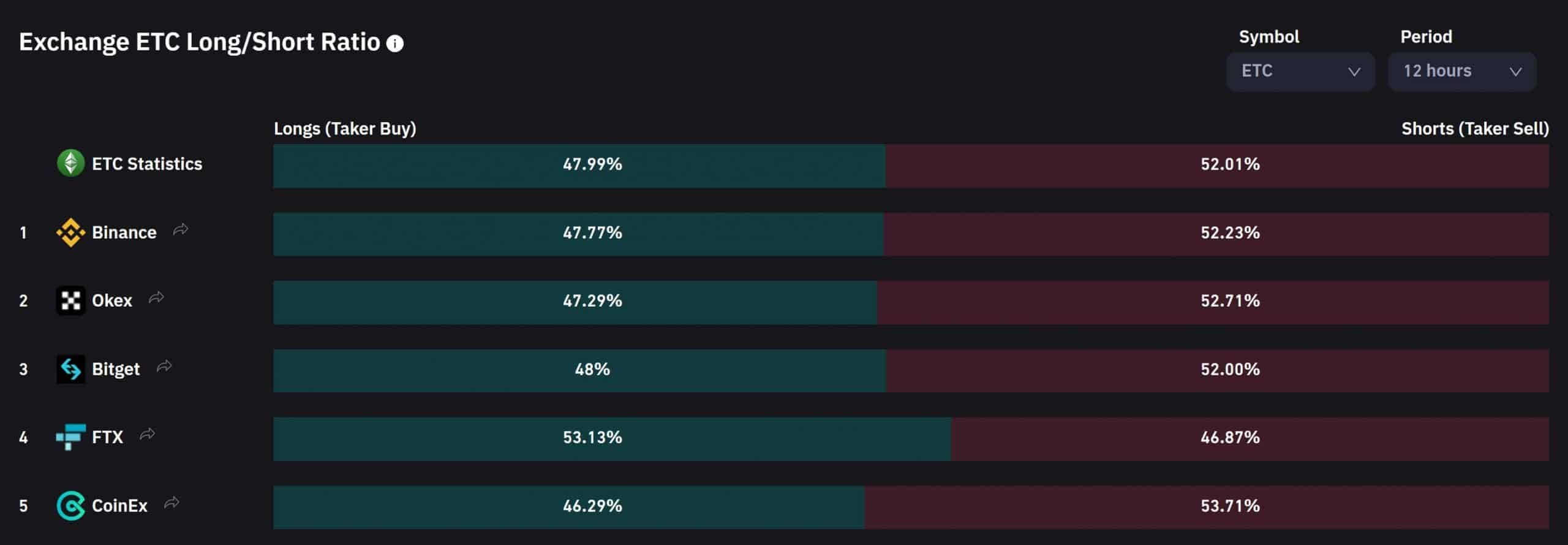

Nonetheless, an analysis of the long/short ratio over the last 12 hours revealed an edge for the sellers. But the targets would remain the same as discussed.

Finally, broader market sentiment and other on-chain developments could be vital in influencing future movements.