What is bitcoin mining?

Bitcoin mining is the pillar that keeps the Bitcoin system upright, functioning, and thriving. It is based on a type of governance mechanism called a distributed proof-of-work (PoW), designed to incentivize participation and facilitate Bitcoin’s network growth, security, and decentralization.

Bitcoin issuance is identified as mining because it recalls mining gold and other minerals, even though there’s no digging deep underground or in caves. In short, bitcoin mining can be explained as the process that enters new bitcoin into circulation and adds new transactions to the Bitcoin timechain (also called a blockchain).

These two apparently simple performances are possible due to a robust system of computation operating in conformity with the rigorous Bitcoin protocol and governance to create the solid, decentralized, and innovative monetary system we know today.

This article explains how such a technological and economic structure works while trying to debunk misconceptions around its energy consumption with accurate data and solid reasoning. Don’t forget to scroll through the FAQ section to explore the highlights of Bitcoin mining.

The solution to transaction fraud

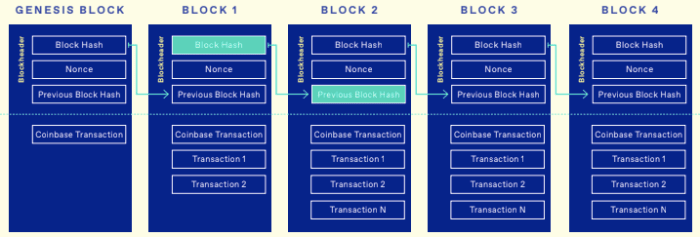

Bitcoin mining creates new blocks and adds them to the ledger adhering to predefined rules. The network’s participant nodes must agree that users, identified publicly by cryptographic addresses, are the legitimate owners of bitcoin balances.

Miners perform a coordination function for the Bitcoin network that, in traditional payment systems, is executed by a trusted intermediary, like a bank or any other financial institution.

To eliminate the reliance on a trusted third party, Bitcoin needs to prevent funds from being double-spent or spent by anyone other than its owner.

The use of digital signatures, a cryptographic invention of the 1970s, prevents unauthorized users from spending other people’s money. A private-public key pair is a strong proof of ownership that allows only the private key holder to spend or move bitcoins.

However, digital signatures alone do not ensure that the bitcoin received as payment have not also been spent somewhere else (the double-spending problem).

To resolve this issue, Satoshi used Adam Back’s hash-based PoW to allow transactions to be ordered chronologically into blocks and the network to achieve agreement on the ledger’s current state by pursuing the longest chain of blocks.

This mechanism secures the blockchain from attacks since transactions only become reversible if a malicious actor redoes all the preceding blocks’ PoW. Given that new blocks are constantly added to the chain, it is virtually impossible for such actors to catch up.

How does bitcoin mining work

Mining requires a massive effort translated into an enormous amount of computation using systems similar to data centers. Application-specific integrated circuit (ASIC) computers are employed to provide the computational power to miners, who compete to be the first to append the next block to the blockchain, issuing new coins and making the cryptocurrency’s network trustworthy.

Mining creates trust by ensuring that transactions are confirmed only when enough computational power has been committed to the block that contains them. The more blocks are generated in the chain, the more trust is created.

Miners add a variable amount of transactions which are bundled in a block. There’s no set number of transactions included in a block because it depends on their stored data so that each block can contain from one single transaction to several thousand. The amount of bitcoin to be issued is fixed and diminishes with time through the halvening (aka halving) event occurring every four years.

Why mine Bitcoin

Just like gold or any other mineral requires hard physical work to be mined and entered into circulation, Bitcoin requires hard computational work to be issued . This computational effort is a necessary step to ensure its security.

Why and how? Being digital data in the timechain, Bitcoin is exposed to copying, counterfeiting, and double-spending. The computational hard work required to mine Bitcoin is so costly and resource-intensive that malicious actors have a better incentive to spend such resources to mine Bitcoin rather than trying to compromise it.

Moreover, mining is the necessary process required to issue new bitcoin. If mining ceased, there would still be millions of bitcoin in circulation, and the network would still be functioning. However, the financial incentive rewarded to miners enables fulfilling a system that would otherwise appear as an unfinished business.

A little history of bitcoin mining

Bitcoin relies on the peer-to-peer network of tens of thousands of nodes (computers) to function, the mining and user nodes. These nodes are the foundation of a payment network that moves trillions of dollars worldwide each year without coordination from a central entity.

When Satoshi Nakamoto launched Bitcoin in 2009, there was little dissimilarity between running a Bitcoin node and mining bitcoins. Therefore, node operators and miners were identified as the same actors in the network since many users who ran nodes on their computers could also mine bitcoin profitably on those same processors.

Bitcoin mining was a sort of a DIY job, distant from the mining industry it has grown into in more recent years, flourishing alongside the price of bitcoin and the incentive to mine.

One of the most significant differences between Bitcoin and most other cryptocurrencies is the absence of pre-mined bitcoins (coins issued before the project’s launch). Indeed, Satoshi launched the network before mining bitcoin so that he could not have any advantage over anyone who wanted to participate in the system.

Once the network was launched on Jan. 3, 2009, he mined the first block, identified as the Genesis block or block 0, containing 50 bitcoins. As the only miner on the Bitcoin network at the time, Satoshi created blocks using an average personal computer.

From CPU to ASIC mining

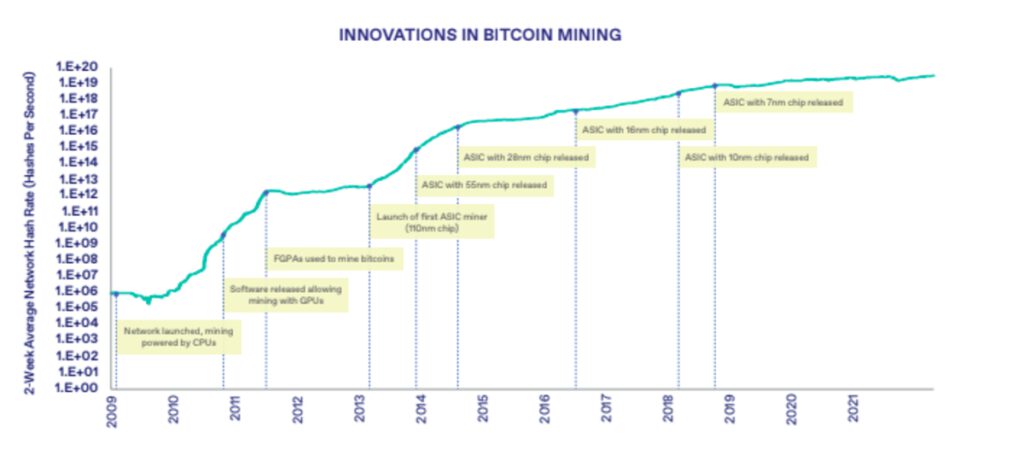

The Bitcoin network’s hardware experienced rapid technological evolution in only ten years. The mining equipment required to generate new bitcoin and add new transactions on the blockchain plays a fundamental role in the network’s success because it determines whether or not it is profitable for miners to run such a business.

In the early life of Bitcoin, node operators and miners performed very similar operations using similar hardware called central processing units (CPUs). The genesis block was almost certainly mined by a computer using its CPU.

CPUs control how computers’ commands are processed and executed, and due to the lack of miners’ competition during Bitcoin’s early days, the little computational power required to create new blocks and earn mining rewards could be easily performed on CPU devices.

Source: Glassnode

Once bitcoin started to gain value in 2011, hitting $1 first and then $30 per coin, competition to mine bitcoin became more intense, and graphics processing unit (GPU) mining was adopted. Initially built for gaming applications, GPUs are designed for doing many mathematical calculations simultaneously and are much faster than CPUs.

In 2012, field programmable gate arrays (FPGA), an intermediate step between a fast programmable processor and a dedicated ASIC, were used until ASICs emerged and dominated bitcoin mining until now.

Application-specific integrated circuits (ASICs) started being used in 2013 for bitcoin mining. They are custom built for a particular application, and in Bitcoin, these chips are customized only to perform SHA-256 hashing. They are orders of magnitude faster than GPUs. Today, ASIC mining is the only economically feasible bitcoin mining technique.

The mining process

Mining consists of the following steps, which are performed in a continuous loop:

- Picking and bundling transactions that were broadcast on the peer-to-peer network into a block.

- Selecting the most recent block on the longest path in the blockchain and inserting a hash of its header into the new block;

- Trying to solve the Proof of Work (PoW) problem for the new block and simultaneously watching for new blocks coming from other nodes.

The new block is added to the local blockchain and broadcast to the peer-to-peer network if a solution is found to the Proof of Work problem.

Source: https://drive.google.com/file/d/1_R1hO8719NLSqUpwPha6Ohs98YTi1fU0/view

The proof-of-work problem

Proof of work is the core of the Bitcoin network. Without it, each network participant could modify the blockchain to their benefit. Without a centralized authority to resolve disputes, PoW guarantees that the network continues to function correctly.

The proof of work mechanism fulfills two purposes: it ensures that each participant shares the same copy of the blockchain and that funds are not spent more than once, a known issue for payment networks without central coordinating entities.

Bitcoin’s PoW algorithm adopts hash functions, one-way mathematical operations that transform a string of data into a fixed-length number called a hash. Even the minor change to the data, like a comma, results in the complete modification of the hash.

Bitcoin relies on SHA-256, which outputs a value that is 256 bits long and was created by the National Security Agency in 2001. For this reason, it is also considered very secure.

Miners search for acceptable blocks typically using the following procedure performed continuously:

- Increment (add 1 to) an arbitrary number in the block header called a nonce;

- Take the hash of the resulting block header;

- Check if the block header’s hash is less than a predetermined target value when expressed as a number.

If the block header’s hash is not less than the target value, the block will be rejected by the network. Finding a block with a sufficiently small hash value is the PoW problem.

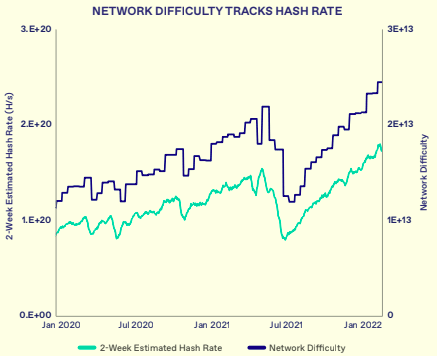

The difficulty adjustment feature

Bitcoin’s difficulty adjustment and reward halvings are the foundation of Bitcoin’s programmatic supply system. On average, the Bitcoin network is designed to create one block every ten minutes. Satoshi specifically chose this feature as a tradeoff between fast confirmation time and the amount of work wasted due to chain splits and invalid blocks.

This is handled through difficulty adjustments, periodically adjusting the hash target value for blocks. As more miners join, the rate of block creation will go up. As the rate of block creation goes up, the mining difficulty rises to compensate, pushing the block creation rate back down to its designed 10-minute average.

Source: Glassnode

In practice, for every 2,016 blocks (typically generated every two weeks, with each block taking ∼10 minutes to confirm), Bitcoin nodes calculate a new difficulty accordingly, based on the time it took to mine the last 2,016 blocks.

The genesis block only had a difficulty of 1, which means it was likely mined instantly. Comparatively, the block mining difficulty is now at 30 trillion and growing. This measure indicates that it requires the highly specialized ASICS mining hardware to perform, on average, over 30 trillion hashes before finding a valid block to remain competitive.

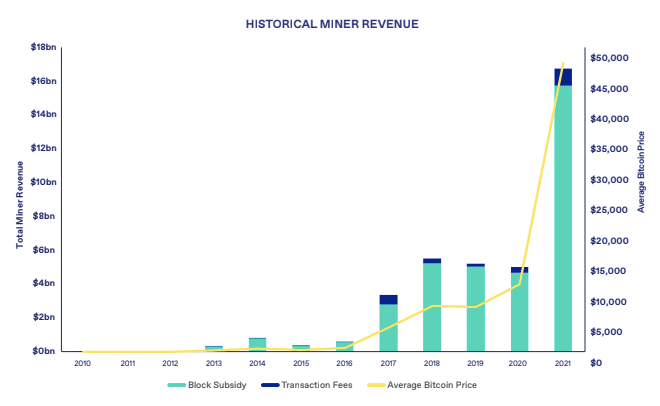

Mining Reward

Solving the PoW problem requires a lot of computing power that costs a lot of money. To encourage participants to invest their resources in mining, Bitcoin provides two rewards for each successfully mined block: a block reward (subsidy) and transaction fees.

Based on Bitcoin’s algorithm, the block reward halves every 210,000 blocks (approximately every four years) and is presently fixed at 6.25 bitcoin per block.

Reward halvings ensure that the production of bitcoin is steady over the intermediate term but exhausts itself entirely over the long term, guaranteeing that the amount of bitcoin supply is ultimately capped.

For this reason, bitcoin is often considered to be the world’s “hardest asset.” Even the gold supply has grown at 1% – 2% per annum since 1900, and there’s no assurance that its growth rate might increase or decrease, unlike Bitcoin’s immutable programmatic supply.

Eventually, the reward will drop entirely when the limit of 21 million bitcoins is reached by the year 2140. After that, block mining will be rewarded solely by transaction fees paid by Bitcoin users as an incentive for miners to include their transactions in blocks.

Source: NYDIG, Glassnode

HOW TO START MINING

There are two options available to get involved in bitcoin mining. You can either mine at home or outsource your mining to a company. Both options have benefits and drawbacks, and whichever option you choose, it’s equally important that you familiarize yourself with Bitcoin mining as rigorously as possible.

MINING AT HOME

While bitcoin mining is dominated by heavily financed companies with large warehouses full of equipment, it’s still possible for individuals to mine successfully at home. That being said, mining is a specialized industry that requires sufficient know-how, affordable ASICs, a cooling system, a low-cost & stable source of electricity, plus a reliable internet.

Therefore, before committing to mining at home, make sure you’ve taken into account all the advantages and drawbacks to avoid costly mistakes.

If you can tick all the necessary boxes, you can consider mining bitcoin at home – KYC free. As you know by now, Bitcoin mining requires a lot of energy, which generates a lot of excess heat. This heat can, in turn, be used to heat your home, which is a great secondary benefit – if you can harness it.

Read More >> Guide to mining Bitcoin at home

When we think about mining bitcoin at home, there are two methods to choose from – Solo Mining and Pooled Mining.

SOLO MINING

Solo mining or DIY mining is when participants use their specialized mining hardware to search for blocks alone without joining a mining pool. In contrast with pooled miners who contribute their computational powers and resources to mine Bitcoin, solo miners are self-sufficient; they don’t rely on any other party to mine.

Solo miners are paid only when they personally find a block, receiving the total amount of the reward plus any transaction fees. This outcome is no easy feat these days, as the odds are stacked against it.

This type of mining was efficient only when the mining difficulty was low enough that finding new blocks was relatively easy. More recently, though, the self-mining trend has been making the news when, in Jan. 2022, one solo miner had found a valid block against all odds with only 120 TH and earned roughly $265K worth of bitcoin at the time.

Nowadays, solo or DIY mining is generally considered not profitable to mine bitcoin as it is nearly impossible to earn the block reward. Still, it helps with daily expenses when using the ASICs machines to heat your home, for instance. Moreover, solo mining is the best way to engage with non-KYC Bitcoin.

If you are set up as a solo miner, and you’re having little success, you could consider joining a mining pool.

POOLED MINING

Pooled mining is a way for individual miners to combine their hash power to mine as if they are one big miner.

Mining pools are decentralized groups organized and operated by third parties to coordinate hash power from miners around the world and then share any resulting bitcoin in proportion to the hash power contributed to the pool. With pooled mining, miners can earn a relatively steady income instead of hoping to make a huge payday someday.

Choosing a Bitcoin pool can be difficult for miners. Many options are available, and the pricing has historically been quite opaque. The best advice for selecting a mining pool is to try multiple options and do some of your own testing.

Some examples of Mining Pools:

- Luxor

- Foundry

- Slush Pool

- Poolin

- Mara Pool

- F2Pool

Read More >> Guide to Pooled Mining

MINING WITH A BITCOIN MINING COMPANY

Large Bitcoin mining operations are generally the most successful and profitable. Your small home setup is likely no match against these sophisticated operators. These companies have much greater resources available to them than home miners – so you might consider investing in or buying hashing power from these specialized companies dedicated to Bitcoin mining.

There are generally three options to mine with a company:

- Buy mining equipment from them and host it in their facility.

- Buy a percentage of their available hash power.

- Invest in the company.

There are trade-offs, however, as you will likely need to provide KYC information and will be charged service fees. Furthermore, you have no control over the company’s direction, which makes you vulnerable to poor decision-making on their part – potentially putting your investment at risk. So before you consider investing in a mining company, you must do your research to weigh up your options.

Some examples of mining companies:

- Iris Energy: Based in British Columbia, Canada, Iris Energy is a sustainable Bitcoin miner that owns and operates real assets, including data center infrastructure, powered by renewable energy.

- Core Scientific: Core Scientific is the largest bitcoin miner by hashrate or total computing power. They have locations in Texas, Georgia, North Carolina, Kentucky, and North Dakota.

- Riot Blockchain: Riot is one of North America’s largest U.S.-based publicly-traded Bitcoin miners, operating out of Whinestone and Cosicana plants in Texas.

- Blockstream: Blockstream Mining provides enterprise-class Bitcoin mining services to institutions and investors worldwide. They are co-founded by cryptographer Adam Back, whose prior work is instrumental in the creation of Bitcoin.

- Hut 8 Mining: Hut 8 are one of North America’s largest and most innovative digital asset miners, with one of the highest inventories of self-mined Bitcoin or publicly-traded company globally. They have mining sites in Southern Alberta and a third site in North Bay, Ontario, all in Canada.

FAQs

Is bitcoin mining legal?

Bitcoin mining is legal in most jurisdictions across the world. However, some countries have banned mining bitcoin due to its high-intensive electricity consumption. In some cases, the cryptocurrency is considered a threat to the government and its local currency control.

These countries include Algeria, Nepal, Russia, Bolivia, Egypt, Morocco, Ecuador, Pakistan, Bangladesh, China, Dominican Republic, North Macedonia, Qatar, and Vietnam.

Is Bitcoin mining taxable?

Bitcoin mining is considered a regular business and is, therefore, taxed as ordinary income. As a general rule, capital gains must also be paid if the mined bitcoin is sold over time with an increased value.

Is mining profitable?

Bitcoin mining is generally profitable, although its rewards largely depend on a series of factors, such as electricity costs, the price of ASIC mining devices, and cooling expenses. Also, a falling bitcoin price can lead to reduced miners’ margins.

How much do bitcoin miners make?

In dollar terms, miners gain the amount of bitcoin multiplied by the current price depending on the block reward. Considering an average price of $20,000 and a block reward of 6.25 bitcoin, in 2022, a miner would make $125,000 per block.

How hard is bitcoin mining?

It is increasingly hard to mine bitcoin, considering that upon its launch, Bitcoin’s mining difficulty was 1, while the current difficulty level is around 30 trillion. This figure means that ASICS mining hardware needs to perform, on average, over 30 trillion hashes before finding a valid block to remain competitive.

How long does it take to mine 1 bitcoin?

It takes on average 10 minutes to mine 1 bitcoin. However, currently, as that bitcoin is mined, so will another 5.25 BTC. This is because Bitcoin is mined as a new block is successfully added to the blockchain, which currently generates 6.25 BTC and takes on average 10 minutes. It might only be possible to mine close to one single bitcoin by block number 1,050,000 –– by 2028 –– when the block reward is expected to be about 1.56 BTC. Still, it will take on average 10 minutes to mine that block.

Debunking common misconceptions about Bitcoin energy usage

#1 “Bitcoin uses dirty, non-renewable energy.”

If truth be told, bitcoin mining offers a new market to the electricity industry that challenges the longstanding notion of energy generation from grid restrictions. This new opportunity reveals and incentivizes global renewables’ potential to achieve significant carbon-free power production.

Soon, bitcoin mining will be key to an abundant, clean energy future. Let’s explore how and why.

Solar and wind energy generation capacity is key to this reasoning because the Bitcoin network can act as a unique energy buyer of such renewables, facilitating the global transition to cleaner energy production and storage.

As solar and wind energy is becoming increasingly affordable, bitcoin miners are inclined to use it as they typically settle where electricity is cheaper to be more competitive and ensure their business remains profitable.

Solar and wind energy costs are now even cheaper than fossil fuels. Indeed, they are currently 3-4 cents /kWh and 2-5 cents / kWh, respectively, in contrast with fossil fuels such as coal or natural gas, whose costs are ~5-7 cents / kWh.

However, solar and wind energy intermittency is a significant drawback compared to natural gas or nuclear power. With the sun shining only during the day and the wind blowing unpredictably, their energy production can be either abundant or negligible.

Bitcoin mining is a viable technological solution providing increased transmission and energy storage capacity to overcome intermittency. The pathway to carbon-free energy generation has already been molded, with new mining facilities settling down where natural resources are widely available.

West Texas, for instance, provides an excess of wind and solar energy that has already prompted bitcoin miners to flock to that region to exploit the enormous opportunity.

Hydropower is another fundamental natural resource exploited by bitcoin miners where it is abundantly available. In Norway, for example, 100% of the country’s electricity is generated from renewable energy, setting up the perfect location for bitcoin miners who can enjoy cost-effective electricity fees and a climate properly fit for equipment cooling.

#2 “Bitcoin wastes energy.”

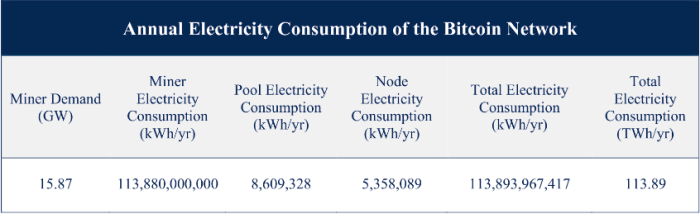

According to the Cambridge Center for Alternative Finance (CCAF), Bitcoin currently consumes roughly 87 Terawatt Hours per year which equals 0.55% of global electricity production, or the annual energy draw of small countries like Malaysia and Sweden.

While this could alarm Bitcoin’s detractors, overall attention should be directed to the carbon emission levels and not consumption. This is a critical distinction because Bitcoin could consume the entire globe’s electricity, but if it comes 100% from renewables, its impact on carbon emissions would be negligible.

Determining Bitcoin electricity consumption is straightforward to estimate, just by looking at its hashrate over the defined period.

On the other hand, the main issue is determining carbon emissions from bitcoin mining, and a few factors make this task harder to perform without knowing the exact energy mix utilized.

For various reasons, miners have a typical reticence in providing mining data. Due to Bitcoin nodes’ anonymity, we often do not even have data on miners’ existence in some regions of the world. When we do know, we can just guess their carbon impact based on the energy resources in that region.

Due to such inaccuracy of data, estimates for what percentage of bitcoin mining uses renewable energy could vary widely.

The Bitcoin mining council estimated that the global mining industry’s sustainable electricity mix was 59.5% in Q2 2022 and had increased by approximately 6% year-on-year from Q2 2021 to Q2 2022.

In 2019, Coinshare published a report suggesting that 73% of Bitcoin’s energy consumption was carbon neutral, primarily due to the abundance of hydropower in major mining hubs such as Southwest China and Scandinavia.

In 2020, the CCAF estimated that the figure was closer to 39%, suggesting that considering energy consumption alone is hardly a reliable method for determining Bitcoin’s carbon emissions.

What would be more beneficial to the debate is whether we consider mining bitcoin a worthwhile activity to utilize energy on or not. Here the gate is open to a broad and sometimes fierce discussion depending on the level of appreciation for the alternative monetary system that Bitcoin represents.

#3 “Bitcoin uses more energy than Visa per transaction.”

We already mentioned that it’s essential to consider the clear distinction between how energy to mine and use Bitcoin is issued and how Bitcoin actually consumes power.

Many Bitcoin detractors may be heard mentioning that Bitcoin’s per-transaction energy cost is very high, especially compared to other payment system transactions, for example.

In reality, they do not have a clue, and that’s only another way to attack Bitcoin. The vast majority of Bitcoin’s energy consumption happens during the mining process. Once coins have been issued, the energy required to validate transactions is minimal.

Many calculate Bitcoin’s total energy consumption to date by dividing it by the number of transactions. However, that doesn’t offer an accurate perspective since most of that energy was used to mine Bitcoins, not to support transactions.

We can go one step forward and claim that Bitcoin is a final “cash” settlement layer without needing a trusted party. Popular payments networks, like PayPal or Visa, do not provide instant irreversible settlements between banks.

All traditional retail payment systems are based upon a complex multiple-layered structure that might require as much as six months to finalize a transaction Besides being lengthy, how much energy is wasted during that long period? This is why the comparison cannot be regarded as valid.

The opportunity to turn Bitcoin mining from an “environmental disaster” narrative to a beneficial aid to cut CO2 emissions is real and already unfolding before our eyes.

New emerging methods and natural resources are continuously being explored, such as unlocking ocean energy to benefit as many as one billion people worldwide with 2 to 8 terawatts of continuous clean power.