On 1 April 2022, the Bitcoin network reached a milestone after records showed that 19 million Bitcoin got minted. However, with nineteen million Bitcoin in circulation, two million Bitcoin remain out of the circulation circle. Following this, BTC’s network hashrate reciprocated the bullishness as it reached an ATH.

Re-enacting this scenario

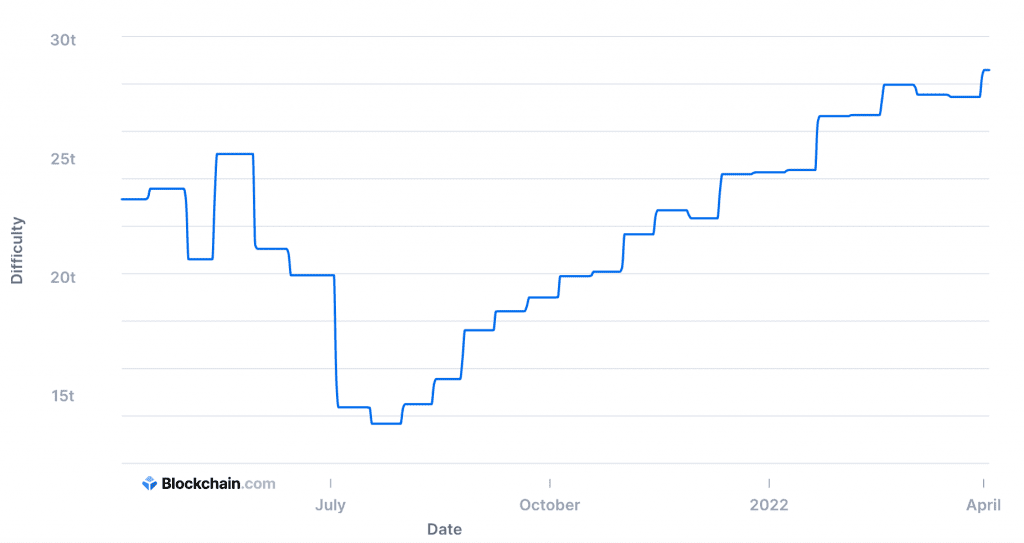

Soon after SBI Crypto mined the 19 millionth Bitcoin, the mining difficulty of the digital asset reached a new all-time high of 28.587 trillion. According to data from Blockchain.com, this surge marked a significant increase since February.

Source: Blockchain.com

The difficulty is a measure of how difficult it is to mine a Bitcoin block. A high difficulty means that it would take more computing power to mine the same number of blocks, making the network more secure against attacks. Now, this indicator is directly related to the total estimated mining power estimated in the Total Hash Rate (TH/s).

Although Bitcoin’s mining difficulty rose, the network hash rate didn’t see a similar increase. Bitcoin’s hash rate stood below the 200 mark- 196.07 (TH/s) at press time.

Source: Blockchain.com

The hash rate level had dropped from its previous ATH of 248.11 TH/s reached on 13 February. Note that, the period between each block reward is usually around 10 minutes, and the difficulty adjustment algorithm (DAA) adjusts every two weeks.

The only way is up

With a higher hash rate, the DAA adjusts mining difficulty to match the rate and make it more difficult for miners to find a block. Just 2 million BTC left to mine as rewards and an influx of Bitcoin miners worldwide, the BTC network would only grow stronger.

In fact, as difficulty inevitably goes up and supply dries- BTC accumulation would only get difficult.

That’s 16949.1525424 BTC per year if the emission rate didn’t decrease over time. That means only 16,949 people per year can buy one whole Bitcoin each from mining. And it’s worse than that, as difficulty inevitably goes up and supply dries up by design. Bitcoin today is CHEAP. https://t.co/rZ90H5r7EO

— Beautyon (@Beautyon_) April 2, 2022

Now, let’s talk profit. Mining firms indeed benefited from this development. Foundry topped the miners chart in the past three days, with 18.93% of the computing power. F2Pool and Poolin followed with 15.53% and 13.3% of the network computing power.