Ethereum [ETH], the king of altcoins has failed to register any significant improvement in the month of June. It is still stuck with the bears at the $1k level. Notably, this level was previously visited by the coin at a time when the market crash wiped out 46.4% of the ETH’s value. But with Q3 of 2022, circumstances might take a positive turn for ETH holders.

Ethereum needs a boost

Observing the entire Ethereum network, one can simply say that Ethereum needs a boost from its investors. Well, on the fundamental level, the network is making progress in all directions. Evidently, the arrival of ETH 2.0 and anticipation of ‘Merge’ has somewhat failed to accelerate ETH’s growth.

Thus, it’s important that the broader market cues turn positive at once since ETH is currently dependent on it. The bearishness prevalent in the market over the past couple of weeks has blocked Ethereum’s all attempts to rally. Consequently, investors have been forced to sell and prevent further losses.

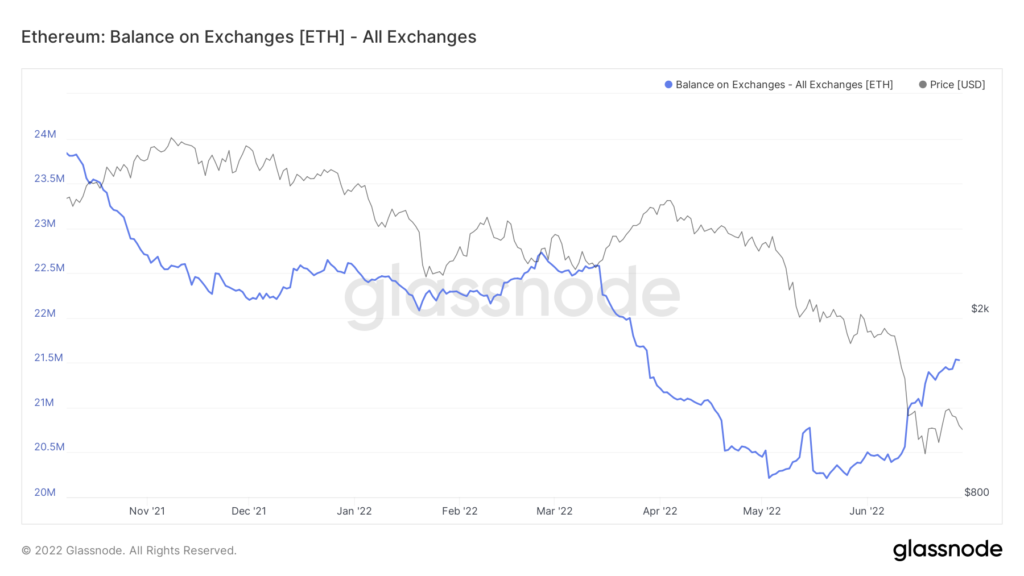

In the month of June alone, about 1.3 million ETH worth over $1.45 billion was sent back to exchanges, most of which was a part of panic selling that was triggered by the crash of 9 June.

Ethereum exchange balance | Source: Glassnode – AMBCrypto

However, most of this selling did not come from Ethereum’s loyalists, the long-term HODLers. Primarily, because the HODL waves made it evident that the one-month to three-month cohort took the charge of selling.

Their control over the supply reduced from 14% to a little over 9%, resulting in an increase in the domination of the HODLers who have held their supply for less than a month.

Ethereum HODL waves | Source: Glassnode – AMBCrypto

What is ETH looking for?

What Ethereum needs now is some patience from investors and a quick market-wide recovery. Patience because the investors need to hold off on moving their supply around until the mark price is at level with the buy price.

Doing the opposite of that may result in transactions that would be conducted at a loss, and such transactions combined have caused the spent output profit ratio to fall below 1.0.

Ethereum SOPR | Source: Glassnode – AMBCrypto

Trading at $1,092 at press time, ETH needed to retrace its steps back to pre-June levels at the least to correct this decline, which may take a while considering the alt’s price decline of 5.2% in the last 24 hours.