XRP price is looking for a platform to rest after its recent downtrend. This short-term correction is a result of the recent breakout and due to its correlation with Bitcoin. Regardless of the recent downswing, Ripple is worth taking another look as two on-chain metrics suggest a bright future ahead for the altcoin.

Technicals and on-chain metrics align

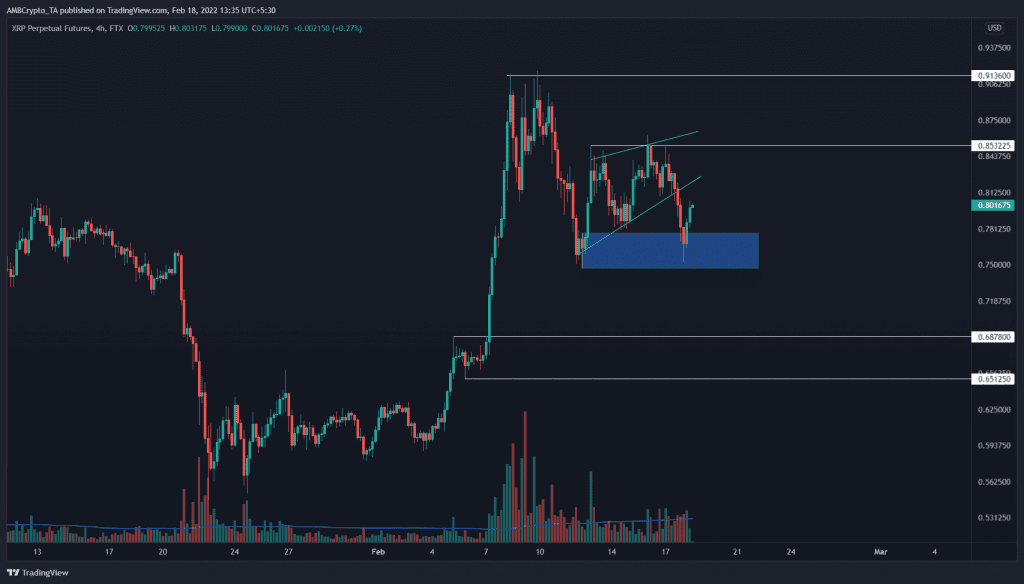

XRP price seems to be stabilizing on the four-hour demand zone extending from $0.746 to $0.777 after a breakout from a rising wedge pattern on 17 February. This retracement is now due for recovery as indicated by technicals and on-chain metrics.

A relief rally is likely to propel XRP by nearly 10% to $0.853 from a conservative standpoint. If the buying pressure continues to build up, the remittance token could retest the $0.913 resistance barrier.

While the technicals are mildly bullish on XRP price, on-chain indicators are suggesting that the token is ready to pop.

The one-hour active address metric shows a massive rise from 4,621 to 19,629 over the last 24 hours. This uptick indicates an increase in investors’ interest for XRP at the current price levels. More often than not, this spike precedes a price pump. Thus, suggesting that the altcoin is ready to move higher.

On 12 February, the number of one-hour active addresses increased from 5,076 to 23,569. Interestingly, the price of XRP rallied by roughly 14% over the next 24 hours.

Backing this claim is the recent divergence between the price and the on-chain volume for XRP. From 16 to 18 February, the total on-chain volume for XRP rose from 1.95 billion to 2.95 billion, representing a 51% uptick.

However, the price dropped by nearly 12% in the same period, signaling a divergence. This technical formation forecasts a bullish outlook for XRP. And, indicates a clear interest among on-chain participants at the current price levels.

Despite the bullish on-chain indications, a potential increase in selling pressure might push XRP price to produce a four-hour candlestick close below $0.746. This development will skew the odds in the bears’ favor and invalidate the bullish thesis.

In this situation, market participants can expect the remittance token to crash 8% and tag the $0.687 support level. While this move is slightly bearish from a short-term perspective, it does not ruin the long-term bullish outlook. Therefore, a resurgence of buying pressure around $0.687 to $0.651 will play a pivotal role in triggering another run-up for XRP.