Blockchain technologies emerged onto the scene more than a decade ago. As a revolutionary moment in the world of business, finance, and so much more, the arrival of cryptocurrency and blockchain technologies heralded a revolution. Now, large institutions to bankers to executives across different fields have made the switch to this fast-paced, yet niche market.

Crypto, still a bubble or…?

Well, that’s what critics used to censure the industry. Even though, crypto fell into this bubble game- institutional giants/individuals want to play as well.

Recent history, in fact, has seen professionals leave lucrative employment opportunities to join this $2T valued industry. According to a LinkedIn report, jobs postings with titles containing terms like “Bitcoin,” “Ethereum,” “Blockchain” and “cryptocurrency” grew by 395 per cent in the U.S from 2020 to 2021.

This marked a 98% increase in listings over the same time period, surpassing the wider tech industry.

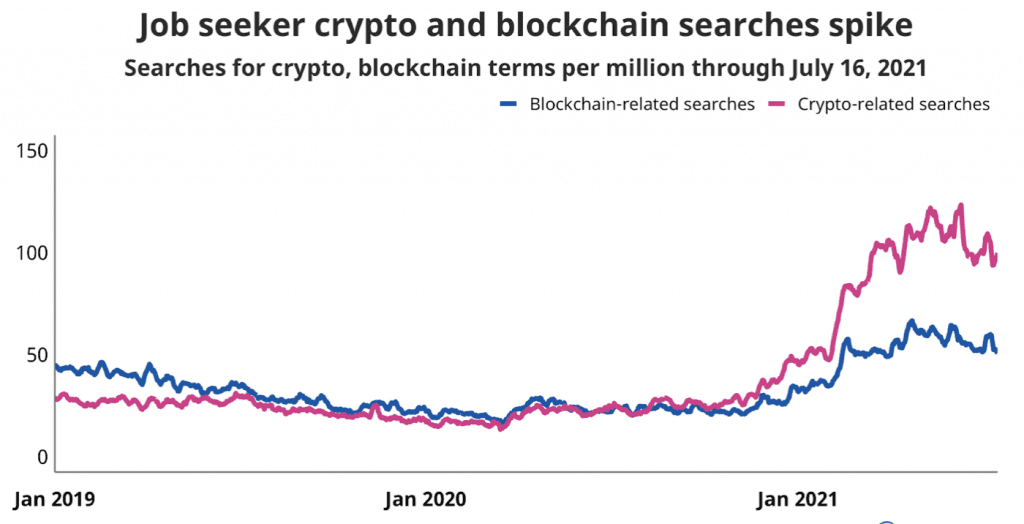

In the seven days ending 16 July 2021, the share of crypto-related searches catapulted by 300% from the comparable period ending 1 September 2020. It’s a similar story for blockchain-related searches, which shot up by 137% over the same timeframe.

Source: Indeed | Hiring labs

These postings varied from software and finance to other industries such as accounting and consulting, as well as the staffing and computer hardware sectors.

Neil Dundon, the founder of cryptocurrency-focused job agency Crypto Recruit, shared his position considering this immense demand for crypto-related jobs. The firm works with the largest projects in Layer 1 Blockchain to exchanges, Decentralised Finance (DeFi), NFT‘s, Blockchain Gaming and the metaverse.

Crypto Recruit specializes in placing quality talent into Blockchain and Crypto Projects globally. “We are the world’s first specialist in the industry,” Dundon claimed in a personal interview with AMBCrypto.

When asked about the current trend going forward in 2022, he added,

“Blockchain gaming and Metaverse projects, NFT’s and Defi are where the demand is. Huge amount of capital flowing into this space and therefore huge demand for all jobs – Engineers, Marketing, content, operations etc.”

But, why? Gaming, indeed, was the biggest segment of the entertainment industry, with nearly 3 billion regular participants. Sky Mavis, Axie Infinity’s developer, was the first to monetize NFTs in a gaming environment, but it won’t be the last. in fact, many investors have recognized the potential in crypto-gaming crossover.

As more brands leverage NFTs to build their communities in virtual worlds and as more consumers follow them in, technological and physical infrastructure moved into the foreground of the metaverse landscape. At the end of 2021, Intel had estimated that Web3 metaverse projects would eventually demand at least 1000x the computing power.

Any advice to beginners?

Beginner luck? No, definitely not. Might work once, but certainly not every single time.

Whether one has a finance background or not, intelligent investing is a crucial skill. Asset management and growth are fundamental to increasing wealth, and regardless of how much experience one may have, it’s never too late (or early) to start learning.

As cryptocurrency continues to solidify its role as the potential future of finance, here’s what one needs to know to get started as per the aforementioned executive.

Dundon asserted 3 points (in order) here,

a) Watch youtube videos to get high-level overview – everyone has time to do that. You need to be able to speak the language of crypto.

b) Next up, buy $100 worth of Crypto so you can say you have gone through the process (different exchanges such as Binance, Coinbase would help here).

c) Lastly, use a DEX – decentralised exchange, say Uniswap using Metamask.

He further added,

“If you do these 3 then you’ve given yourself a crash course in the subject matter. Landing a job then requires some research i.e where are your current skills most needed within Crypto”

Moving on, if one possesses the right skill, finding a job in the surging cryptocurrency field isn’t difficult. And, the plus side is that the salary bandwidth keeps increasing. Neil Dundon, in an interview with Yahoo Finance had stated,

“We have not recruited anything less than $100,000. But typically, even a year ago you might find some of these solidity developers would have been looking for $100,000. Right now, they are probably looking for $180,000 to $200,000.”

For instance, “If you want to make some money as a developer, learn how to code. We are talking anything from $150,000 to $250,000 for one of those developers at the moment.”

Forget stints on Wall Street.

Here’s how savvy undergraduates are getting the hottest jobs in crypto https://t.co/VegVsxvYOr pic.twitter.com/mCo380WEDY

— Bloomberg Quicktake (@Quicktake) February 5, 2022

Not just companies, but even countries have acknowledged the ongoing shift to the crypto-industry. Australia, then India are among those to recognise this exodus.

All good and no bad?

Regulation is among the most important factors affecting crypto-prices. The cryptocurrency’s rise has been arrested every time a government has cracked the policy whip, with countries taking varying approaches to Bitcoin regulation. For example, in November 2019, Bitcoin sank to a low when China accelerated a crackdown on cryptocurrency businesses, mirroring what happened when South Korea also made a move to regulate cryptocurrency trading back in 2017.

By their very nature, cryptocurrencies are freewheeling, not beholden to country borders or specific agencies within a government. But, this nature presents a problem to policymakers used to dealing with clear-cut definitions for assets.

Not just that, volatility or let’s say a dominant bear run could shift things or rather turn things south. In the 2018 bear market, several cryptocurrency companies laid off staff. Coinfloor, the exchange backed by TransferWise and UK’s oldest Bitcoin exchange terminated the services of at least 40 employees to offset the losses. Blockchain startup Steemit also laid off close to 70 percent of its staff, citing the prolonged bear market.

In a video address posted to YouTube, Steemit CEO and founder Ned Scott said,

“While we were building out our team over the last many months we have been relying on projections of basically a higher bottom for the market and since that’s no longer there, we’ve been forced to lay off more than 70 percent of our organization and begin a restructuring.”

Ergo, one needs to ask an important question before going skinny dipping into the crypto-pool. Are you ready to face the consequences? If yes, then surely enjoy the perks this space has to offer. However, keep in mind the cons as well.