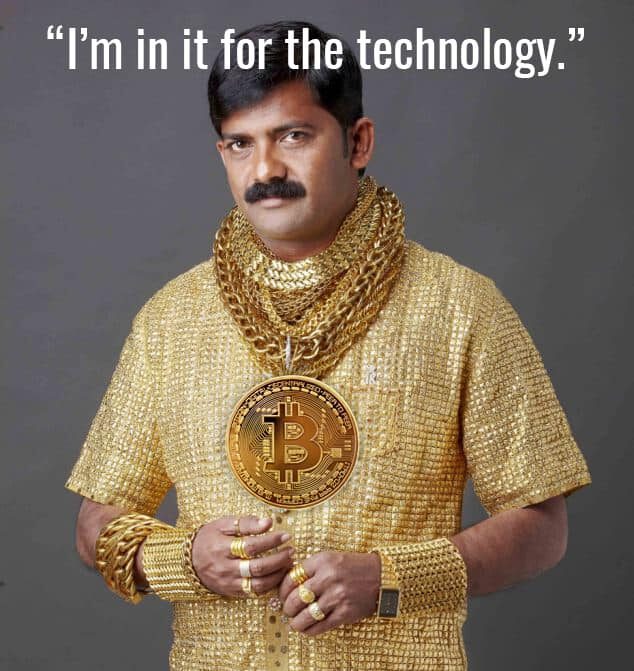

Chain-specific gatekeeping that only advantages the earliest whales has long troubled cryptocurrency (more recently DeFi) and reminded us all that blockchain “BUIDLers” might not really be in it for the tech.

It’s been over 13 years since Satoshi announced the arrival of Bitcoin. It appeared to be a viable alternative to the traditional financial systems, with equal parts tech and ideology. Fast forward to today. Unfortunately, many newer DeFi oriented projects in the space have also become just as biased towards early adoption and loyalty as the traditional finance systems.

Cryptocurrency is already perceived to be volatile and risky, but as newcomers see that early buyers – who are privileged to participate in pre-sales and seed rounds – can handle rising gas/utility fees without trouble, the perception grows worse. It drives a greater psychological wedge between those who can participate easily and those who will never be able to participate at all because of the rising barrier to entry.

The problem of rising fees on layer one chains isn’t easily resolved, but communication between different blockchains at least makes it possible. By bridging various smart contract enabled chains, investors’ access to a broad range of asset classes is enhanced and they are enabled to work with investments that scale linearly in both directions – up and down. With a core value of truly democratizing finance and not merely talking about doing so, Comdex’s launch within the IBC ecosystem was imperative.

TF is IBC?

Our friends at the Akash Network created a beautiful summary:

IBC is a critical element to the Cosmos framework connecting sovereign blockchains. This creates tremendous value to the network, beyond the obvious ability to swap tokens and information. Paired with the Tendermint BFT engine, Cosmos SDK, and other tools, developers can scale blockchains with speed, security and interoperability within or outside of the Cosmos network. This kind of versatility can be a powerful incentive for new or existing blockchains to build with or connect to Cosmos via the IBC protocol thereby growing the value of the Cosmos network, in addition to its capability and utility.

IBC presents a new future of fundraising – a more scalable and equitable method for dispersing assets. Comdex’s choice to start on IBC enables more diverse investor participation. The breakdown of price and scale barriers make it possible for investors who never dreamed they’d be able to participate in the exchange of commodities like gold and oil to do so.

Through this secure and fair distribution protocol, Comdex moves one step closer to achieving its goal of global accessibility in finance.

“But can we really forget about Ethereum?”

The short answer is we don’t have to! Ethereum’s place in DeFi’s past, present, and future is secure. Large-scale investors don’t concern themselves over high gas fees, but those of us who lack the ability to move markets do, which is why alternative chains like Cosmos and the IBC network are imperative.

Demonstrating the lack of necessity to choose between chains, EVM-focused Miss Natoshi recently tweeted about the many advantages that IBC enables. As development continues and bidirectional swaps between EVM and IBC become easier, the barriers that stand between hungry investors – who have been chomping at the bit to sink their teeth into commodities and those commodities themselves, are lowered.

Hands Up!

So the question: “Who’s down with IBC?” is asking who is interested in greater access, higher throughput (shared across more chains), lower fees, and a more fair distribution of the world’s wealth. Again, unless you’re among the 1% who control a vast majority, or just a really mean person who wants to see other people pay high fees, your answer is probably “Yeah, you know me!”

For those who’d like to participate in the future of synthetics and commodities, Comdex’s LBP is running on Osmosis from now through December 6th. Read more about how you can participate here.