Avalanche [AVAX], just like Cardano and Solana, witnessed steady growth alongside an increased interest in the NFT market. According to a tweet posted by analytics firm Messari on 5 November, Avalanche‘s NFTs performed well in Q3.

.@avalancheavax NFT Summer Q3?

NFT sales rebounded at the beginning of Q3.

Average daily sales were $25,000 in June, followed by an average of $70,000 in July.

This rebound represents a 180% increase off the lows at the end of Q2. pic.twitter.com/CW45eVwGVB

— Messari (@MessariCrypto) November 5, 2022

____________________________________________________________________________________________

Here’s AMBCrypto’s Price Prediction for Avalanche for 2022-2023.

____________________________________________________________________________________________

The report by Messari stated that Avalanche’s NFT sales improved by 180% in the last quarter. However, despite this growth, the current condition of its NFT market was far from noteworthy.

A change of pace

According to data provided by AVAX NFT STATS, the number of Avalanche NFT sales depreciated by 28% over the past seven days. Correspondently, its NFT market capitalization also decreased by 1.47%.

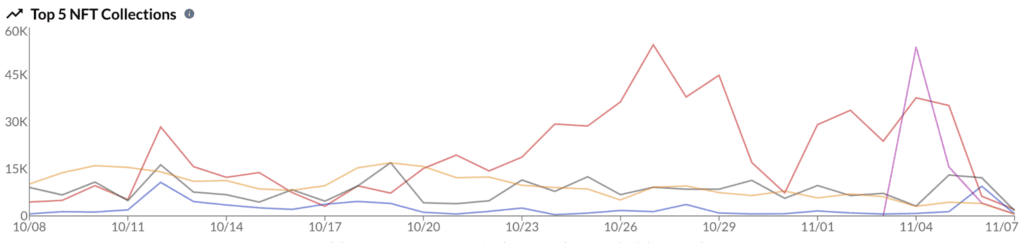

The top five collections on AVAX NFT’s market also witnessed depreciation in volume, despite witnessing some growth towards the end of October. The same can be witnessed in the chart given below.

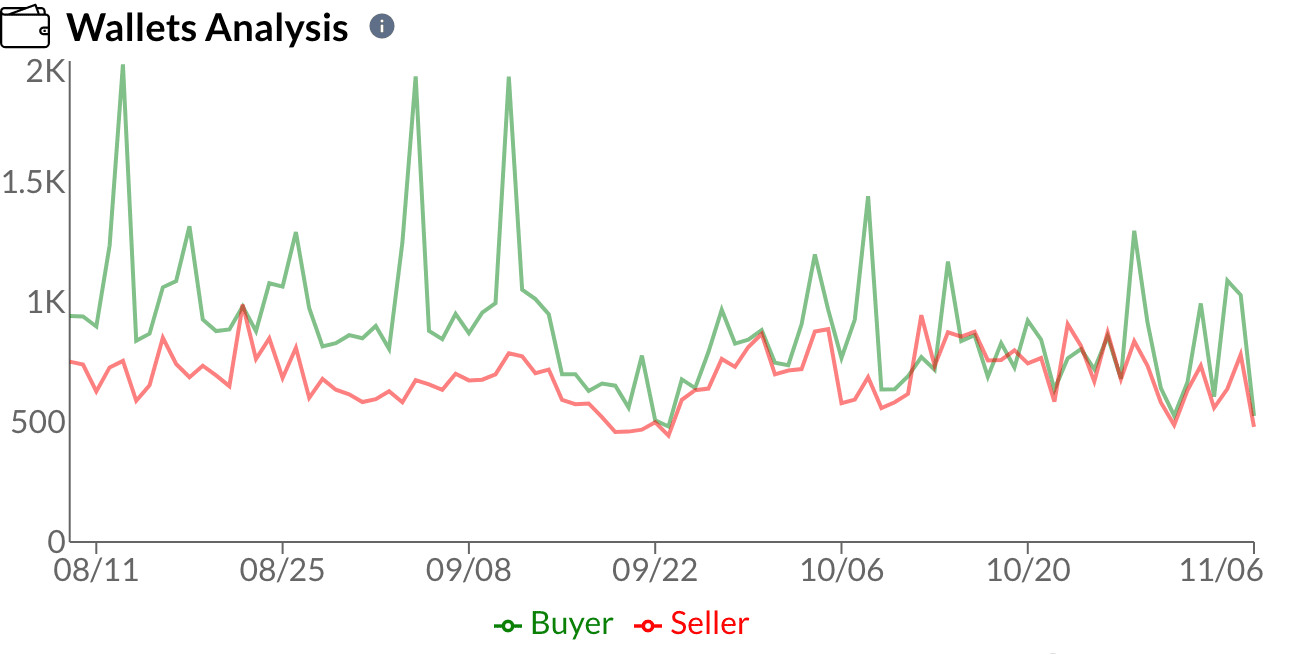

Furthermore, the number of buyers and sellers also decreased over the past few months. Thus, signaling a waning interest in Avalanche NFTs.

AVAX declines through-and-through

AVAX’s declining social mentions and engagements were also detrimental to its sales. According to data provided by LunarCrush, social engagements for Avalanche decreased by 10.55% over the last week, while social mentions declined by 23.58%.

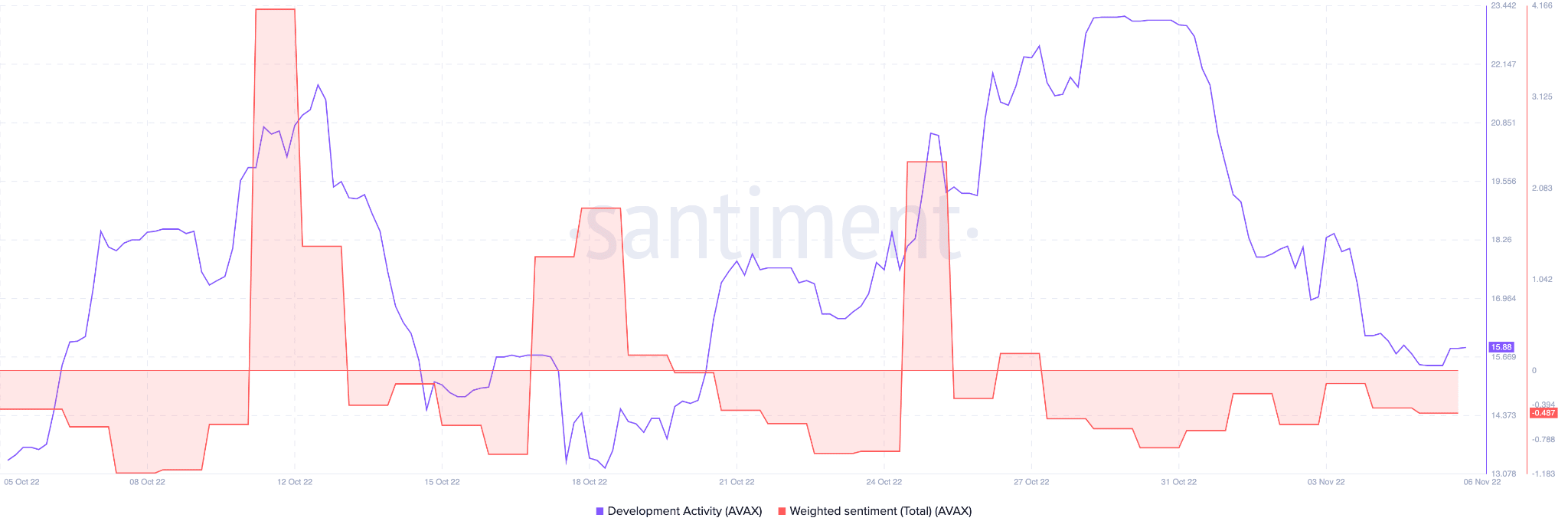

The weighted sentiment against Avalanche fell as well. This indicated that the crypto community had an overall negative outlook towards AVAX. Avalanche’s development activity took a plunge during the same period. This also showed that the development team at Avalanche had not been making consistent contributions to its GitHub.

This could imply that new updates and upgrades wouldn’t make it to the Avalanche Network in the near future.

Avalanche could not grow in the DeFi space as well. Its total value locked (TVL) depreciated from $1.62 billion to $1.32 billion over the course of 30 days, according to DeFiLama.

Furthermore, AVAX’s popular dApps also witnessed a decline in terms of unique active users. Over the past week, dApps such as Trader Joe and Benqi lost 24% and 67% of unique active users, respectively.

At the time of writing, Avalanche was trading at $19.50. Its price appreciated by 1.25% in the last 24 hours.