Solana (SOL) has grabbed the attention away from Cardano (ADA) as one of the biggest competitors to Ethereum. Amid the staggering growth, the SOL cryptocurrency has emerged as the competitor to Ethereum (ETH) by grabbing a spot in the top five crypto list.

Solana (SOL) had a solid runup recently with the SOL price skyrocketing past $260. However, some of the fundamental factors show that buying Ethereum (ETH) at this point could be more rewarding to investors than buying Solana (SOL).

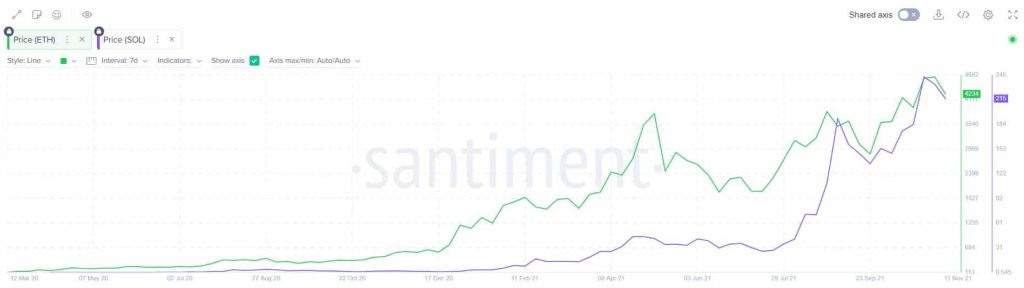

If we look at the last three months’ chart, the SOL price has closely followed that of ETH. But the former seems to have a much quicker runup.

However, if we look at the “revenue” i.e. the fees paid to protocol and miners/validators, Ethereum seems to beat Solana by a great margin. The cumulative revenue of Ethereum since that of inception is $8.8 billion while that of Solana is $16.4 million which is like 500 times different. However, it might not be fair to compare it considering that Ethereum is much older.

But if we also take a look at the weekly chart, Ethereum has $471 million in revenue while Solana has $1.6 million. Clearly, Ethereum is the winner by a huge margin.

Solana Seems Pricier on Marketcap/Revenue Multiples

Thus, on a multiples basis of market cap/revenue, SOL seems to be more expensive than Ethereum to buy at this stage. Solana (SOL) is currently trading at 1500x multiples while Ethereum (ETH) is trading around 25x multiples.

“The implies that SOL has significantly more rosy expectations embedded into the price, relative to where it currently is in terms of usage,” writes analyst Jefferey Zheng.

One area of concern is that Solana is quickly gaining traction with developer activity which has been on a decline for Ethereum. The high gas fee on Ethereum has served as a deterrent for new developers who are preferring Solana over Ethereum.