Place/Date: – March 7th, 2022 at 12:01 am UTC · 3 min read

Source: Huobi

There are many derivatives exchanges to choose from: Binance, OKX, FTX, Bybit, etc. Each has its advantages, whether it be liquidity, fees, product options, user interface, etc. But where do traders go if they just want the best fees? Huobi Global.

Huobi Global recently announced a trading fee rebate campaign for USDT-margined futures last week, offering maker fee rebates (as high as 0.015%) and 0.02% taker fees for all traders.

Basically these rebates mean that the exchange is giving you cash back, based on the trading fees incurred. Normally, only the traders who trade large volumes can get such high rebates. So what’s the catch?

Let’s assume that Sarah placed a limit order (as a maker) to open a long BTC/USDT futures position on Huobi Futures.

What she did was put up an initial 5,000 USDT as the order amount and leveraged the position by 10x. At a rebate rate of -0.005%, she received rebates of 2.5 USDT, instead of being charged a fee like at the other exchanges.

When the price of the BTC rose to her expected point, Sarah closed this position as a taker. Huobi charges taker fees of 0.03%, so her taker fee was 15 USDT (5000*10*0.03%); Hence, Sarah’s net transaction fees summed up to 12.5 USDT (15-2.5).

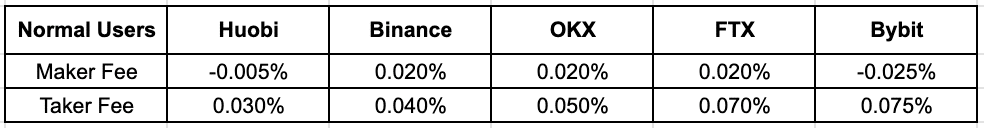

If you took a look at some of the other exchanges and compared the fees for everyday users (not just vip traders).

Here’s what you’ll find:

Binance: 10 USDT in maker fees + 20 USDT in taker fees = 30 USDT in total fees

OKX: 10 USDT in maker fees + 25 USDT in taker fees = 35 USDT in total fees

FTX: 10 USDT in maker fees + 35 USDT in taker fees = 45 USDT in total fees

Bybit: 12.5 USDT in maker fee rebates + 37.5 USDT in taker fees = 25 USDT in total fees

The above data assumes savings off of trading volumes of just 100,000 USDT. It doesn’t seem like a lot at first, but for traders who lever up and trade 1 million or even 10 million USDT, it can add up to alot.

Aside from these low fees, Huobi Futures is popular among crypto traders because it has a wide variety of derivatives, including futures, options, and swaps.

For example, it just launched USDT-margined futures in December, and offers options on Dogecoin, in addition to Bitcoin and Ethereum. This means that you don’t have to split your trades across too many platforms.

Huobi Futures also stands out for its robust risk control systems, which help assess risk when investors take highly leveraged positions and protect them from instant liquidation.

Subscribe to our telegram channel. Join