FTX Token [FTT] formed part of the token bought by the top 5000 Ethereum [ETH] whales according to a recent WhaleStats update. Based on data from the whale transactions tracker, FTT was a surprise addition to the lot.

JUST IN: #FTX Token @FTX_official now on top 10 purchased tokens among 5000 biggest #ETH whales in the last 24hrs 🐳

Peep the top 100 whales here: https://t.co/kOhHps9vr9

(and hodl $BBW to see data for the top 5000!)#FTX Token #whalestats #babywhale #BBW pic.twitter.com/ScWMZjPXZ8

— WhaleStats (tracking crypto whales) (@WhaleStats) October 21, 2022

Here’s AMBCrypto’s Price Prediction for FTT for 2022-2023

WhaleStats also reported that the top 100 ETH whales paid way more attention to FTT.

Even with the deep-pocket accumulation, FTT was not able to surpass its unimpressive recent performance.

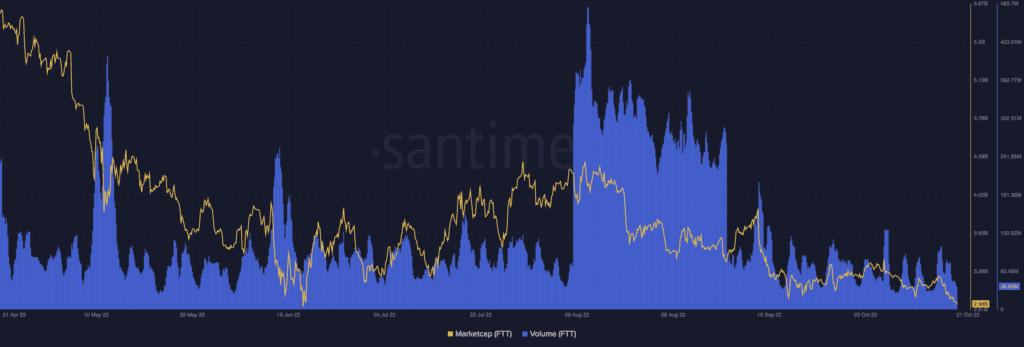

At press time, FTT’s market cap had decreased by 2.06% in the last 24 hours. Its trading volume had also decreased 24.12% within the same period to $36.63 million, according to Santiment.

This meant the whale buying and selling were not solid enough to neutralize the token dump in the wider crypto market.

Oh, these whales can’t move mountains

Additionally, it did not seem that the whale effect impacted much of the FTT ecosystem. This was because the transaction count which had failed to hit 1000 since 1 October decreased again.

According to Glassnode, FTT’s transaction count was 186 as of 20 October. This implied that the summed-up whale and retail daily confirmed transactions were still not worthwhile for the FTT network.

Per its social volume, FTT had not been able to see a spike in investors’ interest. Hence, discussions about FTT across the crypto community were not as much as investors might have anticipated.

So, it did not seem that the whale effect could shift the social volume downtrend. Santiment revealed that the social volume at press time was at a value of three.

However, the social volume was not the only one less affected by the renewed large-investor interest. According to Santiment, the FTT network growth was in the same spot.

With its value at 70, the on-chain platform showed that it was becoming increasingly difficult for a large number of investors to adopt FTT. So, it was likely that FTT might find it challenging to rise in price.

Will traders save the day?

Although the FTT price had not yielded profits for investors lately, it did not spur futures traders to sideline the token. According to Coinglass, the FTT funding rate was positive across the Bybit, Binance, and CoinEX exchanges. With this data, it meant that there was a good interest in the derivatives market.

At press time, about $44,000 worth of FTT had been liquidated in the last 24 hours. Coinglass data showed that a large percentage of these liquidations came from traders with long positions. With the current trend, it was possible that FTT shorts might profit better in the short term.