Bitcoin’s price may be recovering as the king coin turned the 45k resistance into a support level, but now it’s time to get serious again, and set our gaze a little higher. What do the metrics want to tell us about the state of the investment environment?

The price of fame

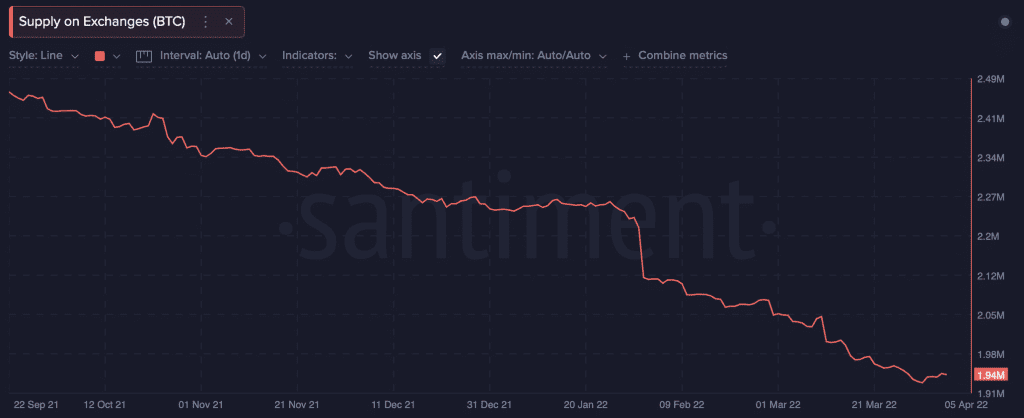

At press time, Bitcoin was switching wallets at $46,726.30, after rising by 1.08% in the past 24 hours. However, the king coin has fallen by 2.56% in the past week. The coin is still selling at a discount when compared to its ATH and many know it well, with Bitcoin largely leaving the exchanges. That said, a very slight uptick in BTC coming to the exchanges was noted before press time.

Source: Santiment

But the verdict is clear. Bitcoin is not the main attraction for now, but rather Ether and other coins or tokens. The volume of Bitcoin traded in the first quarter of 2022 is down by more than 25% when compared to 2021. Glassnode’s co-founders theorized that investors are choosing to invest in alts like Ether instead.

#Bitcoin traded volume down -26% in Q1 2022 as per Q1 2021.

Q1 2021 $BTC return: +103%

Q1 2022 #BTC return: -1.46%More money is spreading to #Ethereum and altcoins. Read more here 👉 https://t.co/puXlRHCMaK pic.twitter.com/Oe8zgdEDZV

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 4, 2022

On that note, it’s a good idea to remember that Adjusted Price DAA Divergence for Bitcoin had just started to flash a small red bar as it dipped into negative territory. This is a warning of possible selling action in the future.

Source: Santiment

While speaking of unusual movements, Bitcoin’s stock-to-flow ratio, which indicates the scarcity of the asset, saw a dramatic spike from slightly above 50 to 109. The last time this took place was around 27 June 2021, when S2F ratio went above 140. To refresh your memory, a higher ratio means greater scarcity, which represents greater value to buyers. As crypto analysts fret about a potential supply shock, this metric appears to echo their fears.

Source: Santiment

Be mine-ful of your manners

While Bitcoin’s price may be recovering, the mining scene is a completely different ball game. With 19 million BTC mined as of 1 April 2022, the race is only likely to get even hotter.

To that end, mining giant Marathon Digital Holdings published its Q1 report for the year. At press time, the company was reportedly holding about 9,374 Bitcoin, with 1,258.6 BTC obtained in the last year.

Marathon’s press release noted,

“On April 1, 2022, the fair market value of one bitcoin was approximately $45,539, implying that the approximate fair market value of Marathon’s current bitcoin holdings is approximately $427.7 million.”