Let Fidelity take the wheel and drive you through the wonderful world of volatility. Bitcoin critics wield one of the asset’s main characteristics as an unsolvable failure, but, is it? According to Fidelity, “bitcoin is fundamentally volatile.” That doesn’t deter it from fulfilling “its ultimate investment objective of preserving wealth over long time periods.”

Related Reading | Fidelity Says What We’ve Been Thinking: Countries & Central Banks Will Buy BTC

The company said all that in Fidelity ‘s latest edition of “The Research Round-Up.” In their longer explanation, they use oil and gold as examples to explain the whole volatility process. We’re in the summarizing business, though. Here at NewsBTC, we will distill their article, state the main points, and briefly comment on them.

Fidelity Explains Bitcoin’s Fixed Supply

-

“Bitcoin is unique in that it is a good whose supply is completely inelastic to changes in price. In other words, supply does not (and cannot) change in response to price.”

There will only ever be 21 million bitcoin and that’s that. With other goods, there’s a cycle. “Going back to economic principles, we know that when demand increases for a good, in the short-term the price will rise. However, the higher price then incentivizes suppliers to produce more. More supply will then bring down the price.” This doesn’t happen in bitcoin.

-

“With bitcoin, supply cannot change regardless of what price does. Therefore, any change in demand, short-term as well as long-term, will have to be reflected by changes in price.”

It’s only logical. The laws of supply and demand can only affect the price, and so they do. “There is no change in supply to dampen the effect of price moves, even over the longer-term.” Mix that with an ever-decreasing supply of new coins, due to the halvings, and you have a perfect recipe for what bitcoiners call “number go up technology.”

Fidelity summarizes the phenomenon with a quote from Parker Lewis:

“Bitcoin is valuable because it has a fixed supply and it is also volatile for the same reason.”

Those two characteristics come in a package.

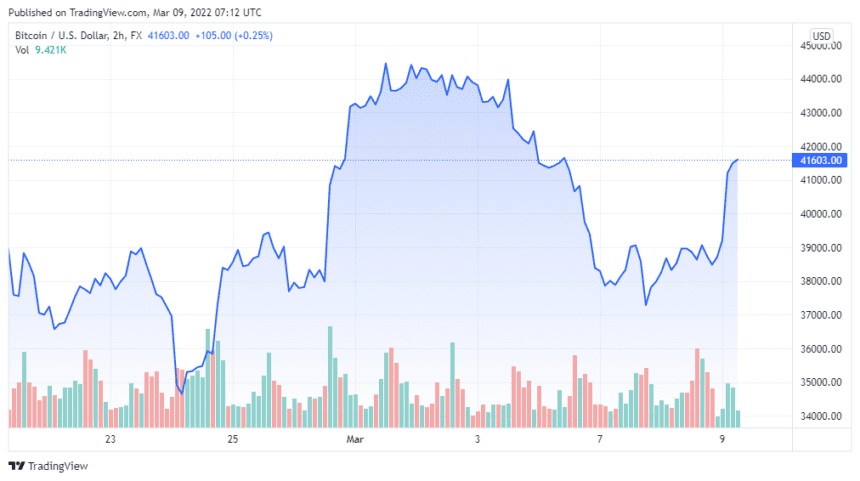

BTC price chart for 03/09/2022 on FX | Source: BTC/USD on TradingView.com

Bitcoin As A Store Of Value

-

“Something that has low volatility is not necessarily a good store of value in the long run, while something that has high volatility does not mean that it can’t be a good store of value in the long run.”

It’s easy to get scared by volatility. Investors, traders, and even true believers let their feeling get in the way and exit the market with every little bump in the road. However, there’s no one that has holded bitcoin for more than four years and is in the red. Literally no one.

Related Reading | Bitcoin Volatility Drops To 15 Month Low; What This Could Mean

Let’s get an obvious example from Fidelity, “The U.S. dollar is not volatile but has also not been a good store of value in terms of purchasing power, while bitcoin is considered very volatile, but has been a much better store of value over the past ten and even five years.”

-

“Volatility is a byproduct of price discovery, and there is no other way for price discovery to happen in a free market.”

Even though bitcoin is 13 years old, it’s still going through price discovery. How much is bitcoin really worth? We won’t know for years, even decades. “This process of individuals all coming to adopt bitcoin in different ways and timeframes necessarily must produce volatility,” completes Fidelity.

Fidelity Thinks Bitcoin’s Volatility Is Decreasing

-

“The limited historical evidence we do have so far appears to be showing volatility declining over the long-term.”

Bitcoin Volatility decreasing | Source: Fidelity

The graph clearly shows that volatility is slowly fading. This is only logical. Fidelity explains, “as gold went through a major price discovery process in the 70’s, which then resulted in amassing a larger base of investors, volatility naturally declined.” We’re still early, though. This is not financial advice, but, for now, you should learn how to ride volatility and use it in your favor.

Featured Image by Chris de Tempe on Unsplash | Charts by TradingView and Fidelity