Past trend of the Bitcoin long-term holder SOPR (EMA 30) may suggest that BTC holders may face more pain in the coming months.

Bitcoin Long-Term Holder SOPR Has Dropped Below “One” Recently

As explained by an analyst in a CryptoQuant post, BTC investors may be in for a frustrating few months if history is anything to go by.

The “spent output profit ratio” (or SOPR in short) is an indicator that tells us whether Bitcoin investors are selling at a profit or at a loss right now.

The metric works by going through the transaction history of each coin being sold on the chain, to see what price it was last moved at.

If the previous selling price of any coin was less than the current value of BTC, then the coin has just been sold for a profit.

On the other hand, the past value being more than the latest price of the crypto would imply the coin has moved at a loss.

When the value of the SOPR is greater than one, it means the overall Bitcoin market is selling at a profit right now.

Related Reading | Bitcoin Coinbase Premium Gap Approaches Zero, Selloff Ending?

On the other hand, values of the indicator less than one imply investors as a whole are realizing some loss at the moment.

Now, the “long-term holder” (LTH) group includes any Bitcoin investor who has been holding their coins since at least 155 days ago without moving or selling.

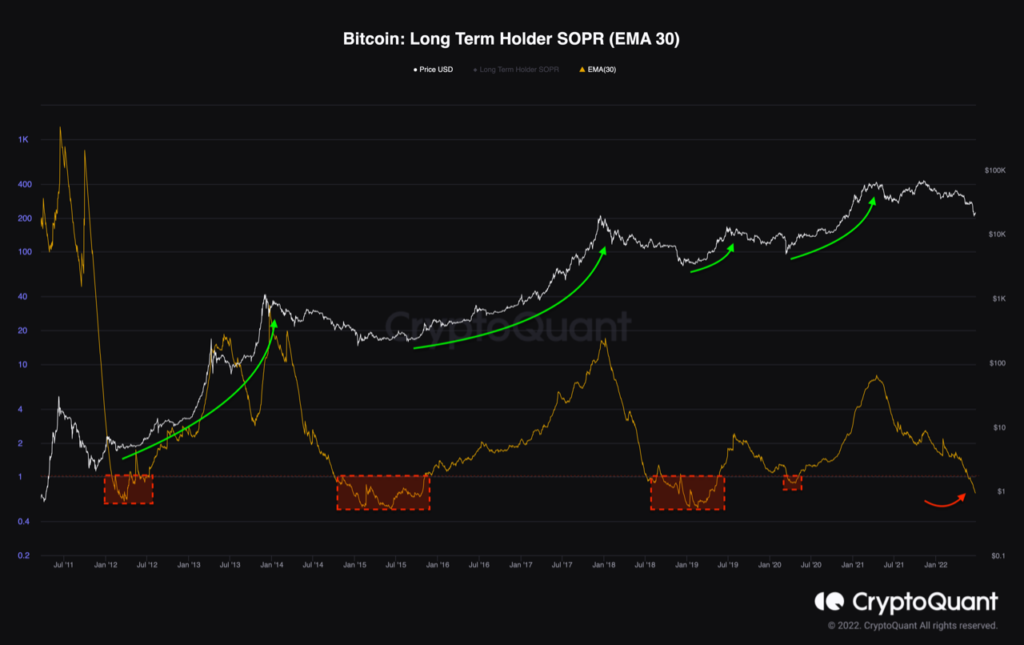

The below chart shows the trend in the SOPR over the history of the crypto specifically for these LTHs.

Looks like the 30-day exponential-MA value of the indicator has gone down recently | Source: CryptoQuant

In the above graph, the quant has highlighted all the regions of relevant trend for the Bitcoin long-term holder SOPR.

It seems like during past bottoms, the indicator’s EMA-30 value has gone below one and trended sideways there for a while (except for the COVID-19 crash, where the metric didn’t stay in the zone for too long).

Related Reading | Bitcoin Whale Presence On Derivatives Still High, More Volatility Ahead?

Recently, the LTH SOPR’s value has once again gone below one, suggesting long-term holders are realizing losses right now.

The analyst notes that while such capitulation events have historically lead to bottom formations, it may still be a while, even months, before a low is actually found.

BTC Price

At the time of writing, Bitcoin’s price floats around $21.4k, up 11% in the past week. Here is a chart that shows the trend in the value of the coin over the last five days:

The price of the coin seems to have surged up over the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com