Key Takeaways

- Ethereum has successfully shipped the Merge after years of anticipation, but ETH is down. The number two crypto has lost 25% of its market value over the past week.

- Though the Merge brought several notable upgrades, it will likely take time for the market to digest the event.

- The weak macro environment has been a major factor weighing down ETH and other crypto assets this year.

Share this article

Ethereum made history when it completed “the Merge” from Proof-of-Stake last week, but ETH has suffered a sharp drawdown since the update shipped.

Ethereum Hit in Post-Merge Selloffs

Crypto traders are rushing to sell their Ethereum following last week’s highly anticipated “Merge” event.

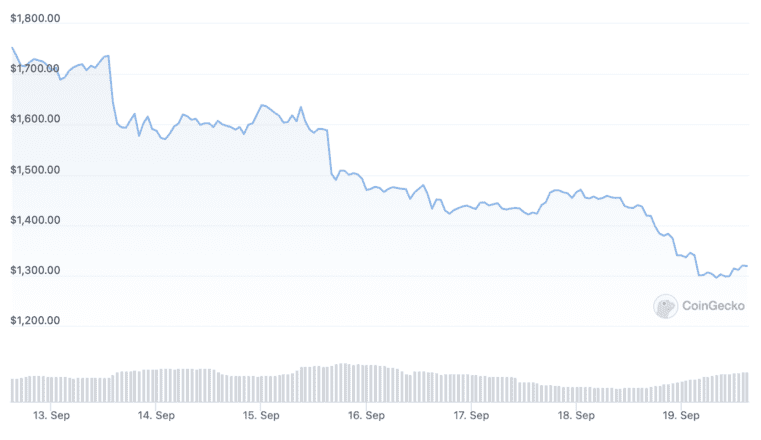

The world’s second-biggest blockchain has recorded heavy losses since it transitioned to a Proof-of-Stake consensus mechanism early Thursday. ETH was trading just above $1,606 when the Merge shipped but has since declined by about 17.8%, trading at $1,320 at press time.

ETH showed weakness in the lead-up to the event, taking a hit Wednesday as the U.S. Consumer Price Index registered a higher-than-expected 8.3% inflation rate. According to CoinGecko data, it’s down 25.1% over the past week.

The Ethereum selloff comes as most major crypto assets suffer from market volatility. September has historically been a weak month for crypto prices, and the recent market action has added to the pain for crypto hopefuls following months of selloffs. Bitcoin broke below $19,000 Monday, currently trading at $18,684. Ethereum-related tokens like Ethereum Classic and Lido have also slid on the downturn, respectively shaving 12.6% and 9% off their market values over the past 24 hours. ETHW, the native token for the Proof-of-Work Ethereum chain launched following the Merge, has plummeted to $5.49 after topping $50 on some exchanges ahead of the event.

While ETH holders had placed hopes on the Merge serving as a catalyst for bullish price action for Ethereum’s native asset, the event appears to have suffered from the “sell the news” effect. “Buy the rumor, sell the news” is a popular turn of phrase in financial markets. It refers to the practice of buying an asset ahead of a major event in anticipation of a price rise before selling the asset after the fact. Coinbase going public on the Nasdaq was another example of a “sell the news” event; many market participants hoped that the U.S. exchange’s listing would propel Bitcoin to $100,000 following the event, but the top crypto peaked at $64,000 on the day then lost over 50% of its market value in the space of six weeks.

Changes to Ethereum

Anticipation for the Merge was high, partly because it was years in the making and partly because it was such a major technological feat. Discussed by Ethereum co-founder Vitalik Buterin since the blockchain’s inception, the transition from Proof-of-Work to Proof-of-Stake frequently drew comparisons to an airplane changing its engine mid-flight.

When the Merge completed, Ethereum introduced several important changes. First, and without a doubt Ethereum’s most significant step in preparing for mainstream adoption to date, the blockchain slashed its energy consumption by around 99.95% by ditching Proof-of-Work miners. Several mainstream news outlets, including The Guardian, The Independent, and Financial Times, reported on the Merge as it shipped last week, leading with discussions over the blockchain’s improved carbon footprint.

Additionally, Ethereum slashed its ETH issuance by around 90% with the move to Proof-of-Stake since it no longer needs to pay miners. According to ultrasound.money data, the circulating ETH supply has increased by about 3,000 ETH since the Merge, down from the 53,000 ETH it would have paid out under Proof-of-Work. The reduction in issuance was widely hailed as a bullish catalyst for ETH, with the likes of Arthur Hayes describing the Merge trade as “a no-brainer” based on the fundamental switch.

ETH holders can earn yields of around 4% by staking their assets to secure the network, and with the move to a more ESG-friendly consensus mechanism, the possibility of institutional investors deploying capital in ETH fueled a narrative that the Merge would help the asset surge.

A Delayed Reaction

While Ethereum has introduced several improvements, there are several factors that could explain why ETH has not responded in the way its biggest fans had hoped. The reduction in ETH supply is happening gradually over time. It’s likely that the market will need time to process the impact of such a major change, similar to how Bitcoin only tends to appreciate in value months after its “halving” events. With the supply cut, ETH could theoretically become a deflationary asset, or “ultrasound” as it’s been dubbed in the Ethereum community, but market participants may be waiting to see how the change plays out before buying into ETH.

Similarly, while Ethereum has earned green credentials with the switch, it could take some time for hedge funds and other big players to invest in ETH (institutions and traditional finance firms tend to move slower than crypto-native investors). It’s also unlikely that the Merge will transform the mainstream perception toward crypto and its climate cost. The entire asset class became the subject of scrutiny in 2021 over the environmental impact of Proof-of-Work mining and the climate issue has arguably been a significant barrier in preventing mass adoption. While Ethereum has cut its energy consumption, the world’s biggest cryptocurrency still uses Proof-of-Work and likely will for many years to come. Even if would-be investors are aware that Ethereum uses Proof-of-Stake, they may still have an aversion to crypto due to Bitcoin’s energy usage. Similar to the ETH issuance cut, it could be months or years until the energy consumption reduction improves Ethereum’s appeal among institutional and retail investors alike.

The Macro Picture

Besides the Ethereum Merge itself, the broader crypto market and its place in the current macroeconomic climate can go some way to explaining why ETH is down. Like Ethereum, Bitcoin is over 70% short of its November 2021 high, leading an almost-year-long slump in the crypto market. Cryptocurrencies have traded in close correlation with traditional equities in 2022, suffering sharp losses at the mercy of the Federal Reserve and its ongoing economic tightening policy. In response to soaring inflation, the Fed has hiked interest rates throughout the year, and risk-on assets have suffered as a result. Fed chair Jerome Powell’s latest indications of further “pain” ahead suggest that more hikes could be coming, particularly after the latest inflation data came in above estimates last week. The Fed has said it wants to bring inflation down to 2%; the U.S. central bank is expected to announce another rate hike of either 75 or 100 basis points this Wednesday.

Ahead of the Merge, Ethereum dominated the market. Hype for the event hit a fever pitch, particularly after EthereumPoW’s plans to fork the chain came to fruition in August. However, now that the event has passed, traders need a new narrative to get behind. With the Merge completing amid a period of macroeconomic uncertainty and no bullish catalysts on the horizon, it’s no wonder Ethereum’s biggest update ever turned into a “sell the news” event. At least Ethereum’s fundamentals have improved for when market sentiment flips and interest in crypto returns—assuming it does at some point, of course.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.