Data from DeFi Llama records a massive increase in the total value locked (TVL) of FluidTokens, a Cardano-based lending protocol. This blockchain deployed its smart contract capabilities in late 2021 and has been experiencing a spike in ecosystem growth as more projects are launched on mainnet.

Related Reading | When Will The Extended Stretch Of Extreme Fear In Crypto End?

According to DeFi Llama, the Cardano-based lending and borrowing platform has seen a 20% increase in its TVL for the past week and a 56,600% increase in its TVL during the past hour. FluidTokens managed to take the 7th position in terms of TVL with $24,200.

This is far below the number one protocol in terms of TVL, WingRiders, which records $50 million, and the second protocol in the ranking, Minswap, which records $37 million. However, FluidTokens has been live for over a month and has been consolidating important partnerships which suggests the trend could extend.

Via Twitter, the team behind the project announced a partnership with Eternl, a Cardano light wallet provider. The collaboration will allow users to access FluidTokens products “from any device”.

In addition, the platform has been enabling liquidity for other Cardano projects. The platform will allow users to trade with Yummi Universe non-fungible tokens (NFTs), a popular project on this blockchain, and allow users to access a new use case: using their digital assets to obtain liquidity.

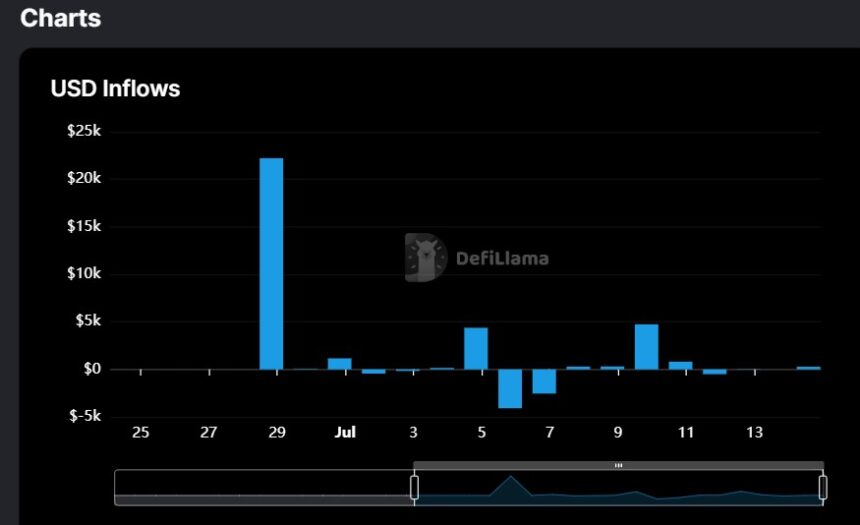

Further data provided by DeFi Llama record a spike in token inflows and USD Inflows for FluidTokens over the past week. This spike in protocol activity could be related to the partnerships and collaboration announced during June and July.

In the coming months, the protocol will enable a staking functionality for its native token FLUID and will consolidate sponsorships of DAO investment funds. By the end of the year, the platform will deploy additional functionalities to incentivize user activity further.

Cardano Follows General Market Trend

The Cardano ecosystem has been expanding at a fast pace and has generated a lot of attention due to its “Vasil” Hard Fork Combinator (HFC) event. At the time of writing, ADA’s price trades at $0.44 with a 4% profit in the last 24 hours and a 4% loss over the past week.

The upcoming HFC “Vasil” will implement network updates and improvements to the Cardano blockchain. This should contribute to ADA’s price and bring bullish momentum to the cryptocurrency.

Cardano has been trending to the downside more aggressively than other cryptocurrencies in the top 10 by market cap. This is probably motivated by the general risk-off sentiment across the crypto market.

Related Reading | Bitcoin Price Spends Four Weeks At 2017 Peak Prices, What Comes Next?

Data from Material Indicators records significant resistance for ADA’s price as it climbs from its current levels. There are over $2 million in asks orders poised to operate as major resistance. If the cryptocurrency can surpass this level, it will find resistance at around $0.50.