Tron is set for a bullish week after its price bounced back from a bottom sloping trendline which functioned as support. After overcoming a near-term hurdle present at the 20-SMA (red), TRX would need to overcome some key swing highs to set a fresh local high at the 78.6% Fibonacci level.

At the time of writing, TRX traded at $0.105, up by 0.8% over the last 24 hours.

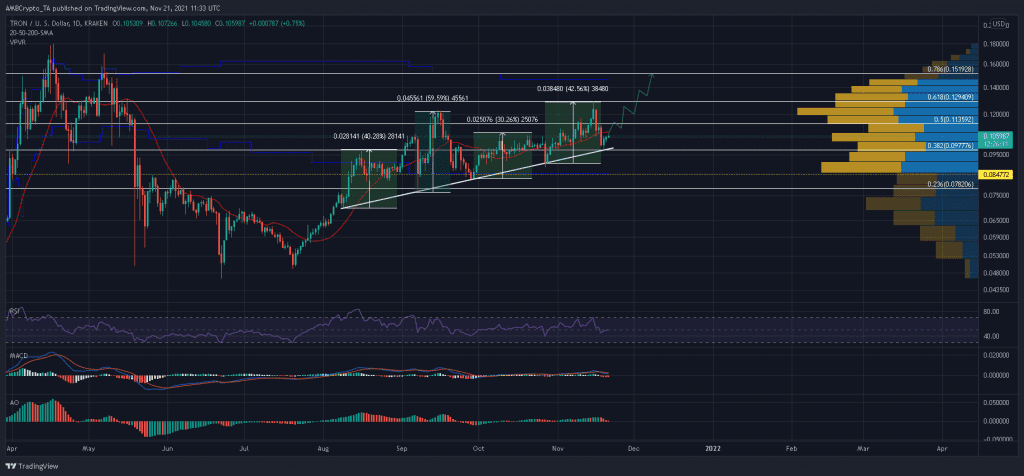

Tron Daily Chart

Since mid-August, Tron snapped four higher lows at $0.076, $0.092, $0.088 and $1.057 and has respected the boundaries of a bottom sloping trendline. In fact, TRX has set up bullish weeks of trade each time its price has bounced back from this trendline. Following a fifth retest, TRX eyed an extension of its present bull run.

Once the daily 20-SMA (red) is overturned, TRX would need to best 15 October’s swing high of $0.122 and 15 November’s swing high of $0.129 in order to set a peak at the 78.6% Fibonacci level. However, according to the Visible Range Profile, TRX could between the 61.8% and 78.6% Fibonacci levels for an extended period due to presence of some rigid supply and demand zones.

In order to maintain ground above its value high zone, TRX would need to add consistent buy volumes above $0.15. In case sellers overtake market control, TRX would call upon its defenses at the 38.2% Fibonacci level. On the downside, a move to $0.085 and value low area can be expected if the lower trendline is flipped bearish.

Reasoning

For the moment, TRX’s daily indicators maintained a neutral outlook. The RSI and MACD held around their respective mid-lines while the Awesome Oscillator depicted the lack of market momentum on either side. Based on these readings, TRX could trade sideways, just below its 20-SMA (red) over the coming days. However, expect more favourable readings once TRX manages to close above its short-term MA.

Conclusion

TRX was in store for a bullish week after rebounding from its lower trendline. Once sell pressure at the 20-SMA (red) is bested, Tron could form a new peak at the 78.6% Fibonacci level provided certain swing highs are overcome with strong buy volumes.