XRP price has breached an ambiguous pattern favoring the bulls but spends moving sideways. This lack of volatility is what’s causing the remittance token to remain mum. However, a resurgence of investor interest and inflow of capital could catalyze an exponential move.

XRP price awaits volatility

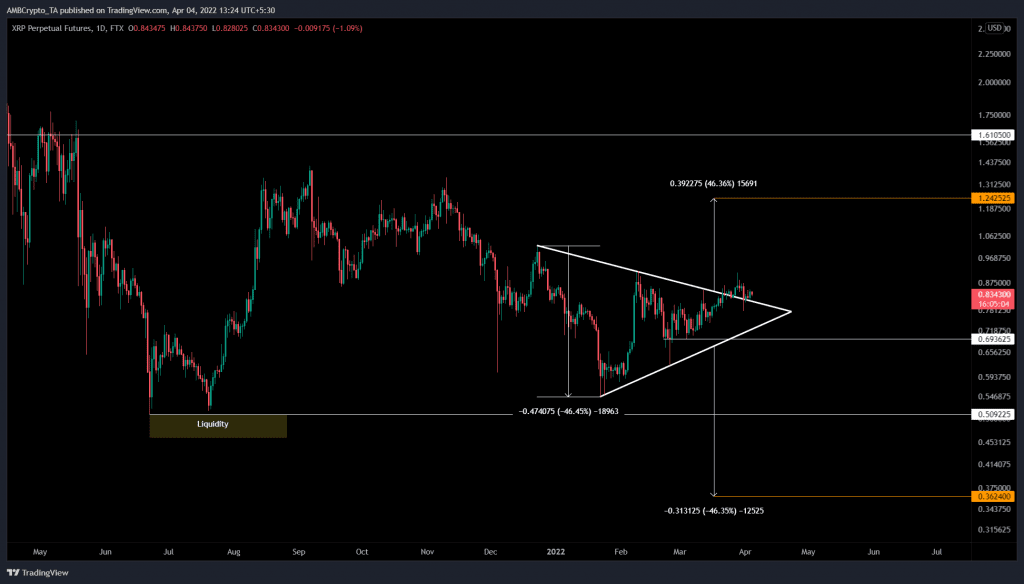

XRP price action since 21 December, 2021, set up three lower lows and two higher lows. Connecting these distinctive swing points using trend lines results in a symmetrical triangle formation.

This technical pattern shows no directional bias until the asset breaks out of it and forecasts a 46% upswing to $1.25. This target is obtained by adding the distance between the first swing high and low to the breakout point at $0.84

On 23 March, Ripple breached the upper trend line, signaling a bullish breakout. Since then, the altcoin has been moving sideways without any hints of volatility. The theoretical forecasting method reveals that the XRP price is likely to revisit the $1.20 barrier.

However, for this move to occur, bulls need to hold above the upper trend line of the said pattern and slice through the $1 psychological level.

Dipping this crucial hurdle into a support level will pave the way for further gains. In some cases, the uptrend could extend to $1.61 if the buying pressure continues to build up. This move, however, would constitute a 95% gain from the current position at $0.82.

While the bullish thesis described from a technical standpoint is plausible, the supply distribution on-chain metric adds further credence to it. This index tracks the XRP wallets that are segregated based on the number of tokens it contains.

This on-chain index shows that whales holding more than 10,000,000 XRP tokens have been accumulating since 25 December. The number of wallets that fall into this category increased from 311 to 341 in the last three months or so.

A total of 30 new whales holding more than 10 million XRP tokens have joined the Ripple network. This index serves as a proxy of these investors’ intentions and bullish expectations of XRP price. Therefore, market participants can expect the Ripple price to see an explosive rally in the coming weeks.

While both the technical and on-chain metrics paint an optimistic outlook for XRP price, the high correlation of the remittance token with the big crypto could be the reason for its demise. Regardless of the bullish breakout, a fatal crash in Bitcoin price will translate to XRP price and its holders.

If the XRP price produces a decisive close below $0.69, it will create a lower low and end the bullish pennant formation.